Trade Alert: Trimming down our two biggest positions

Apple’s on a tear. FIO’s on a tear. Google’s been steadily rallying for a long time now. Lindsay too. Which means four out of our five largest positions have been rocking higher and propelling our portfolios to new places.

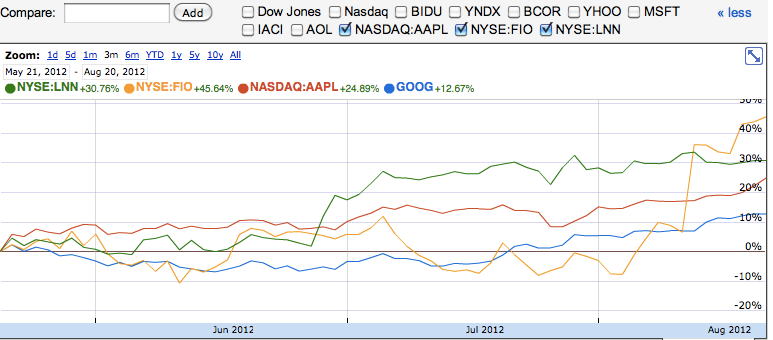

Here’s a chart of these four stocks over the last 90 days (which consists of about 65 trading days):

And guess what — having 15-45% gains over the last three months means that these stocks and many others in our long portfolio are probably starting to get a little bit ahead of themselves. Remember when we were buying Apple calls back when it was more than $100 lower than today’s quote? Same with Google.

I’m going to go ahead and sell down some of my Apple and my Google today. For Apple, I’ll trim by selling a little bit of the Apple common. I’m also going to sell up to about half of my Google calls, which will still leave it a top 3 position. Apple will remain my biggest position, but I’ll have locked in some very size-able gains from my most recent purchases on this one.

Facebook’s the big loser in the portfolio right now, but even that one I remain rather confident about if you’ve got a time horizon of at least a couple years out. I don’t know where it will bottom and as you guys have seen, I’m willing to be very patient before adding any more to it.

I know a lot of you are very happy about your portfolio’s performance of late. That’s the time to trim a little bit. Next time you want to puke and cry about your portfolio, that’ll be the time to get aggressively long again.

Little tweaks to the portfolio like this over time contribute to long-term outperformance.