Trade Alert: Trimming Some Exposure Into This Rally As The Volatility Continues

It’s that time in this bear market when I once again remind any of you that if you were losing sleep or in pain at the lows [checks calendar] four days ago that now is a good time to do some trimming. And if you have some stragglers in the portfolio that are down big and are probably not coming back anytime soon, you might consider selling it here as it’s probably bounced big this week too and this might be a last great time to sell it.

I’ll tell you that by far the hardest trade for me to make today is to do some trimming in the portfolio but that is indeed what I’m up to today. I found it easier to buy when our stocks hit our “Where I’d Buy More” price targets last week than I’m finding it to trim some of these names today. Discipline reigns though, especially as I am not convinced that we’ve seen the bottoms for the economy, earnings or for the broader stock markets. That said, some stocks have already bottommed.

Regardless, I took some profits by trimming 1/10 to 1/4 of the following names today ADBE, ENVX, SWAV, UBER. In the hedge fund, I also added some hedges back on using puts and/or shorts, including in AVGO, AMD, TAN, SMH, QQQ, ARKK.

This has been and probably will continue to be an historically volatile stock market and I’m just continuing to gently ebb and flow against the broader swings here.

I also thought it might be instructive for me to look at how much the “Where I’d Buy More” list has changed since I sent it to you last week.

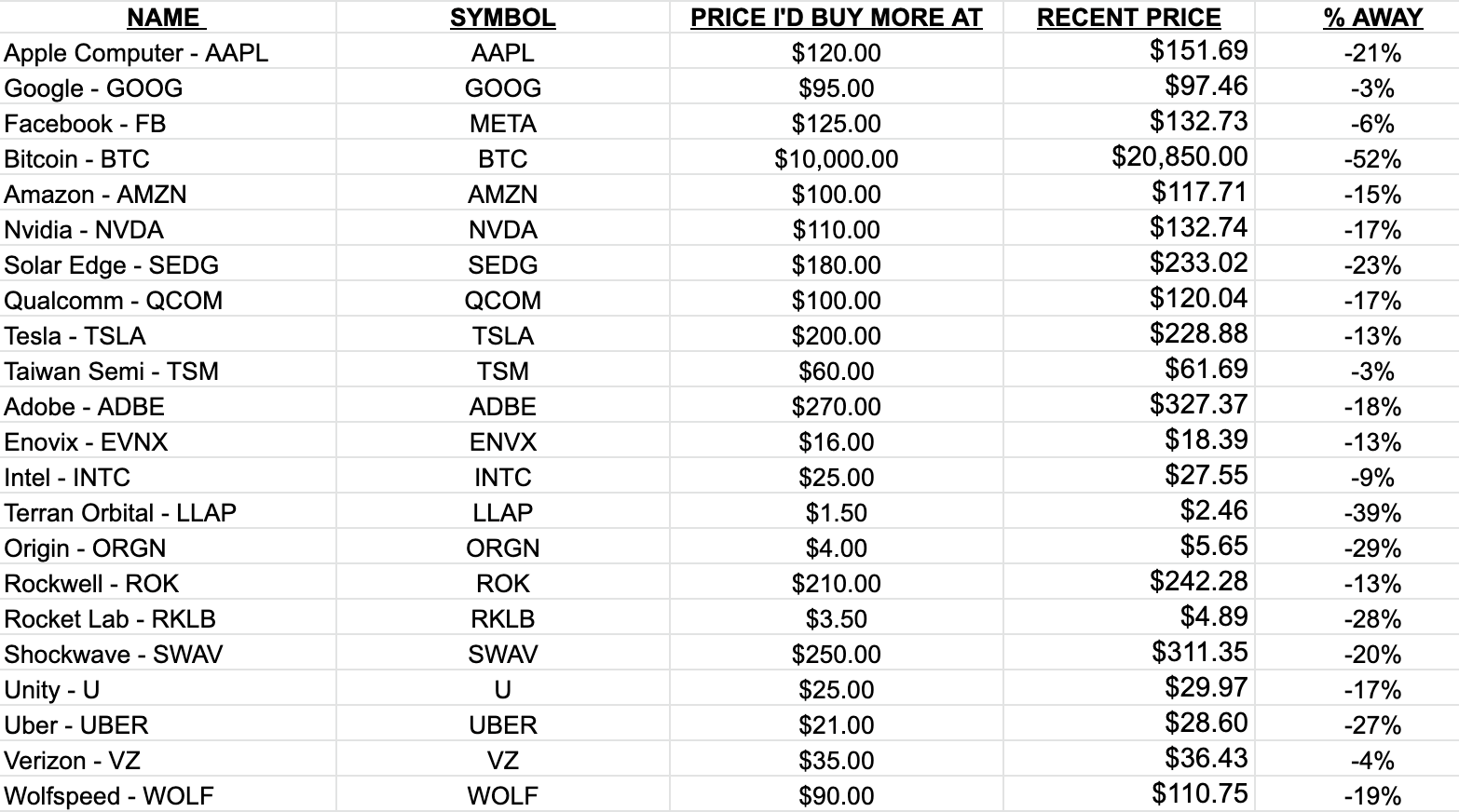

Here’s the list now:

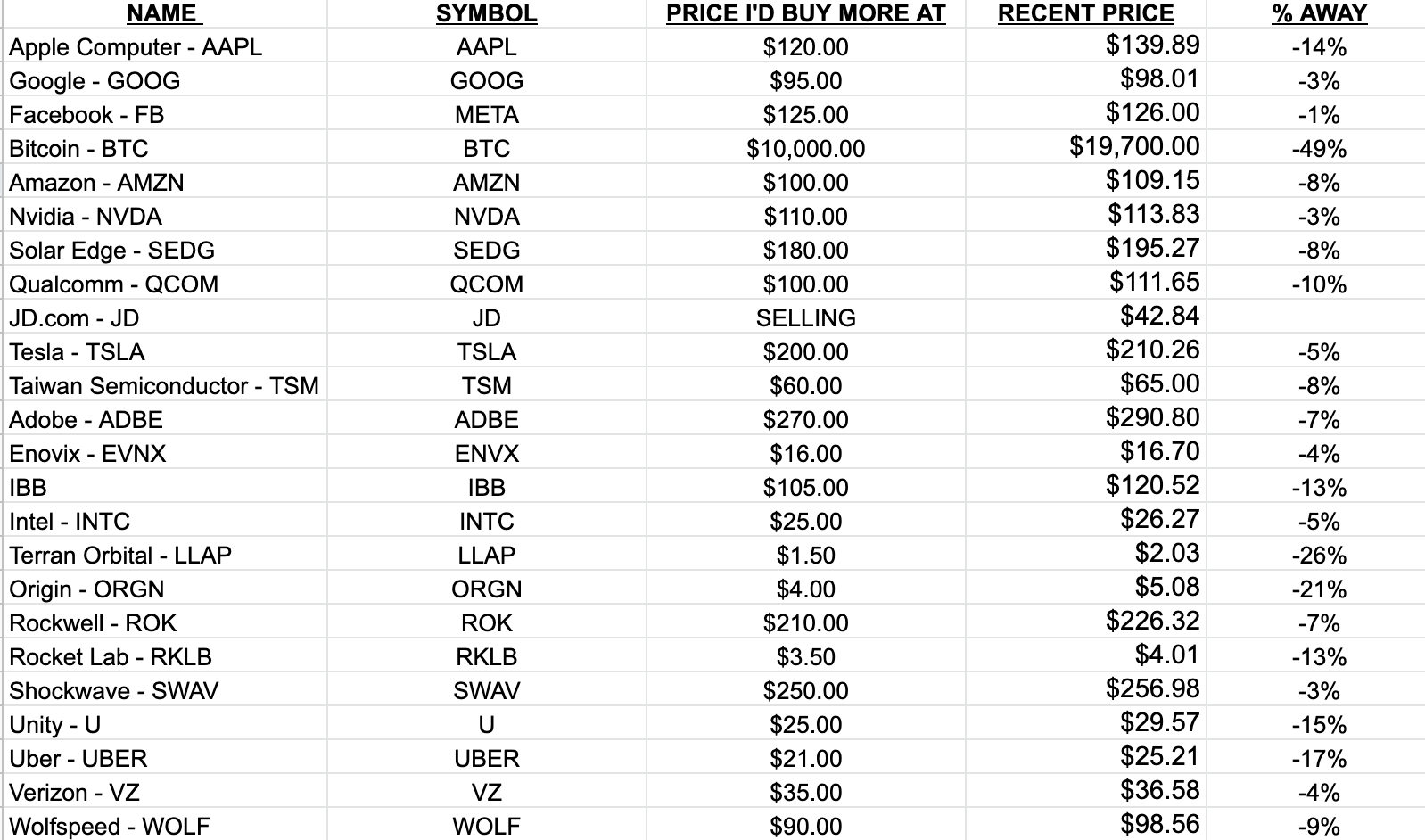

Here’s what it looked like when I sent to it you last week (I fixed META):

Several of those stocks did indeed hit the “Where I’d Buy More” price target, including TSLA, and each of them bounced big afterward, some up 20% or more in the last few days. I still have some pretty good long exposure in all of my favorite stocks but will let off the gas here a little bit into those big rally.

We’ll do this week’s Live Q&A Chat tomorrow (Thursday) morning at 8am ET in the chat room or hit reply on this email to send us your question.