Trade Alert: Trimming some Google (PLUS Scary chart parallels)

A few thoughts on the markets and economy this morning.

Earnings, the economy, scary chart parallels:

- The sum of the topline beats for GM (quarterly sales of $33.62 billion – well beyond the $31.6 billion analysts had been looking for) , UTX (top-line actual of $15.1 billion outperformed the $14.9 billion analysts had been looking for), CAT (Sales reached $11.4 billion, far surpassing the $10.6 billion expected) MMM (of $8.2 billion vs $7.9 billion expected) SWBK ($3.3 billion vs $3.1 billion) in their respective earnings reports this morning is more than $3.5 billion. That’s a lot of upside amongst a handful of big industrial/auto sampling. The corporate economy is strong, the consumer is steady and the global economy is expanding.

- Here’s me on TV three years years ago explaining why we should expect that the corporate economy will strong, the consumer will be steady and the global economy will be expanding in the next three to five years.

- Mostly what’s changed in the last five years is that the markets are up a bunch, our Trading With Cody Revolution Investing stocks are up way more than the markets, everybody on TV these days talks about how the stock markets are up because the global economy is steadily strong (five years most pundits were still handwringing and worrying about the US and global economies), the permabears are mocked at The Money Show and on social media for being so wrong for so long.

- Steady as she goes for now. But let’s be vigilant, free-thinking, flexible, aware and prepared for the next time the corporate economy turns down, the consumer gets weak, employment tanks and the global economy craters. It will happen at some point and I’ll try to catch the next downturn like we did the last one, but I’ll try to keep us positioned for the upside while the risk/reward favors doing so. Remember my old “This won’t end well” series of articles I wrote for TheStreet.com back in 2007, the last time I turned from bull to bear? I’m not writing those articles again right now (yet?)…

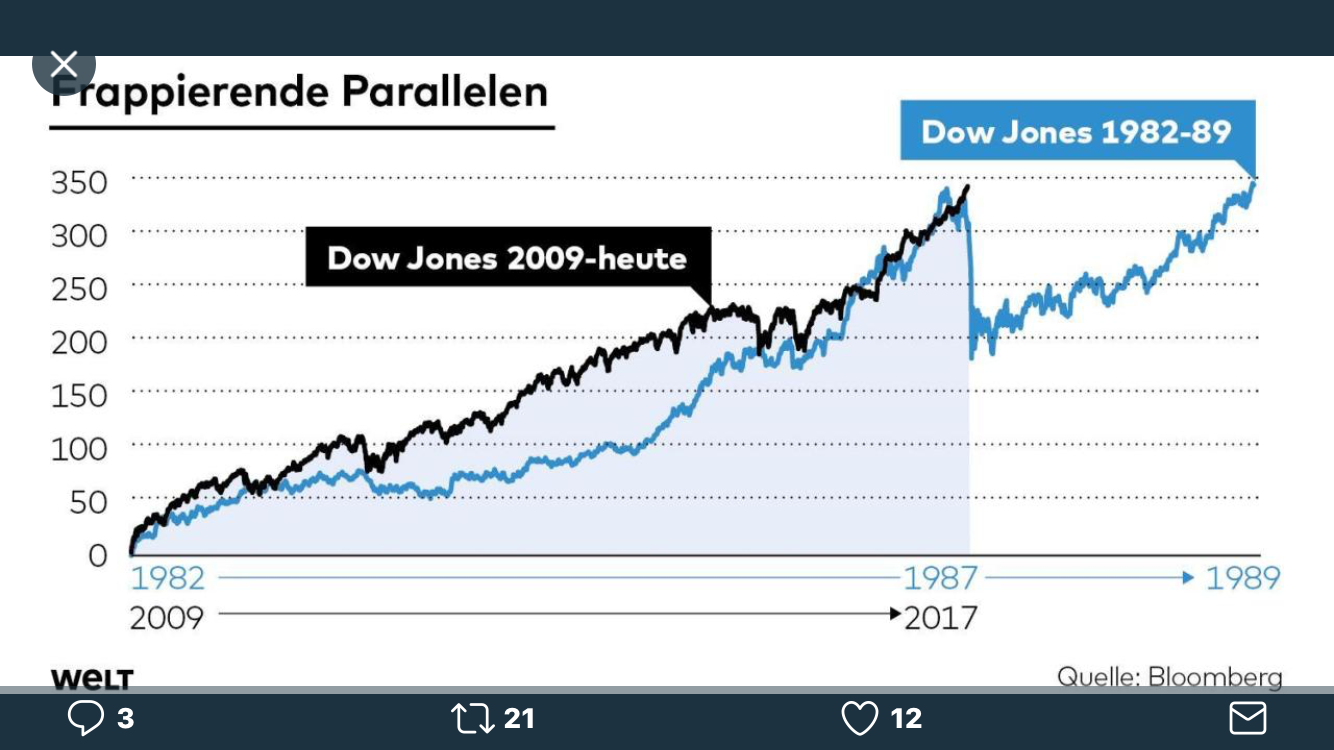

- Here’s a “scary chart parallel” someone sent me over the weekend.

- Here’s an article I wrote about a “scary chart parallel” back in 2014.

As I wrote aback then: “Very few investors, and even fewer analysts, have been able to navigate these past couple of bubbles and this ongoing cycle. Step back from the noise of predictions and doomsday speeches. Be prepared for bad times, but don’t go freak out until the analysis that predicted these last cycles, and their turns, tells you to.”

Trimming some my long-held Google.

- Here’s a screen of Google’s landing page on a computer. Google.com used to be just a search box trying to help you get the most relevant content on the Internet. This screenshot shows how Google wants you using YouTube and buying Google devices and not just searching.

- We should always remember, including with our huge Revolutionary Investment winners like Apple, Google, Amazon and Facebook, which have grown to become the most valuable companies in the world while we’ve owned them that “Empowering the end-user is the end-game of the Internet.”

- Google is up nearly 2000% from my original purchase price in the open market on the day the company came public and is up nearly 400% in the last five years since I left TV and started buying stocks again, the whole time being a Top 3 Biggest position in my personal portfolio. I’m not ready to turn bearish on Google or sell the whole shebang. But I’m going to trim 15% of my Google today to lock in some nice long-term profits and be disciplined and be vigilant. You know? Ok then.