Trade Alert: Two trades to avoid whistling past Turkey’s collapse

Is nobody here worried about Turkey currency crisis and the potential fallout/ramifications thereof? Stocks got hit on Friday but bounced back this morning before flattening again here now as I write this around 10am MT in Ruidoso NM.

Most of the headlines, punditry and commentary around this shockingly quick decline in Turkey’s currency are all about how the markets will continue to shrug off this and most any other geopolitical concerns. Long-time subscribers know that from 2011-2015, we used most any geopolitical-related market sell-off to buy more stocks and/or call options — to a lot of success, frankly.

But that was a different time, a different place in the cycle (both economic cycle and market cycle, both of which are long-in-the-tooth, if nothing else). And I often talk about how it’s usually the rate of decline not the long-term trend that disrupts markets currency markets, which can then disrupt stock markets and/or economies.

And while I don’t want to be contrarian for the sake of being contrarian, here a couple trades I am going to put on today, because I do think this Turkey crisis is alarming enough to warrant yet a bit more caution here.

I’m going to buy some GLD for a trade here. Gold has been demolished lately and I’m also likely to nibble some actual physical gold coins here soon too (I’ll send out a Trade Alert, as always, if I do). If you’d like to read more about my long-term outlook for gold (I expect it will go up 5-10-fold vs the US dollar in my lifetime, but not necessarily anytime soon) and why I only use GLD for a trade and never for an investment read this: Everything You Need to Know About Investing in Gold and Silver. (Read any and all of my investment books here.)

I’m also going to buy some another small tranche QQQ puts dated out into December with strike prices around $175 or a couple dollars lower or so.

To be clear, I’m not sounding the alarm or saying our Bubble-Blowing Bull Market that we’ve ridden to so many profits over the last eight years is over, but I am saying I think there’s some opportunity to take advantage of gold’s recent sell-off and to add some additional hedges to out overall portfolio while everybody’s whistling past Turkey’s economic collapse.

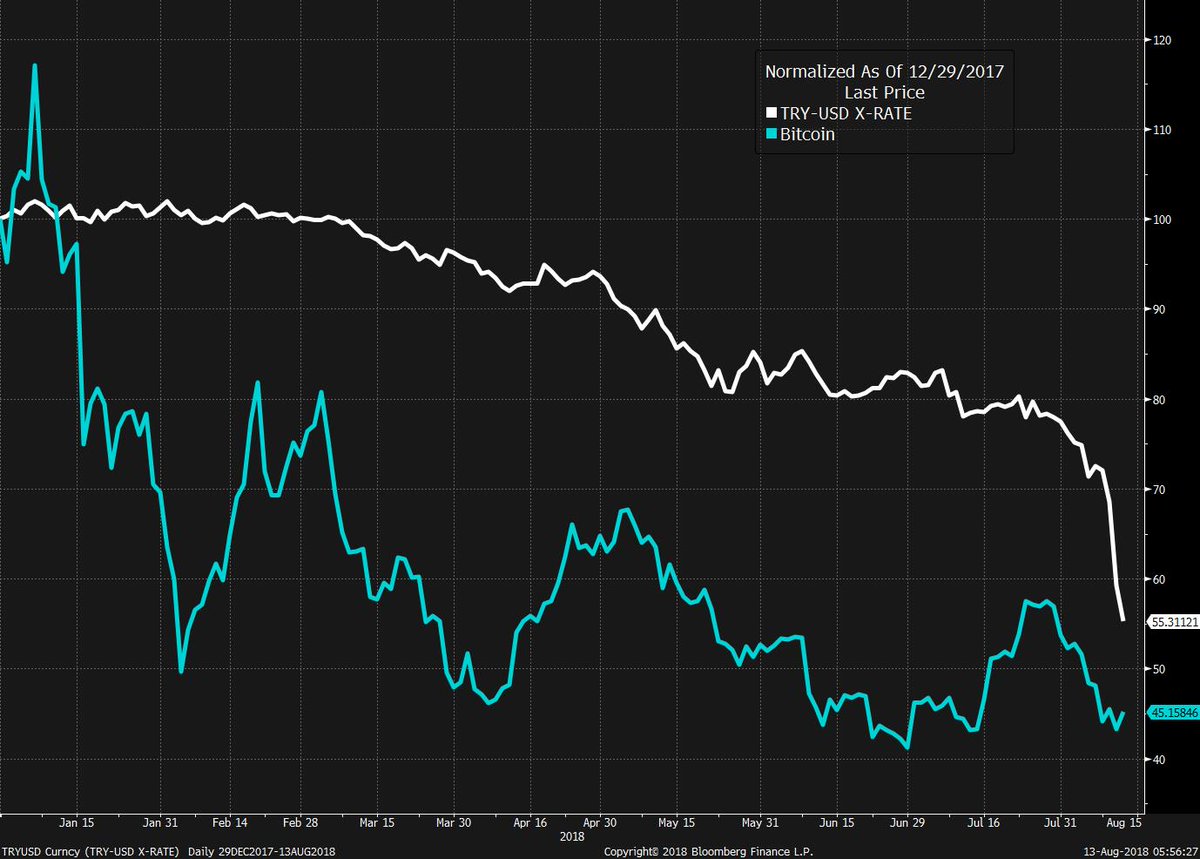

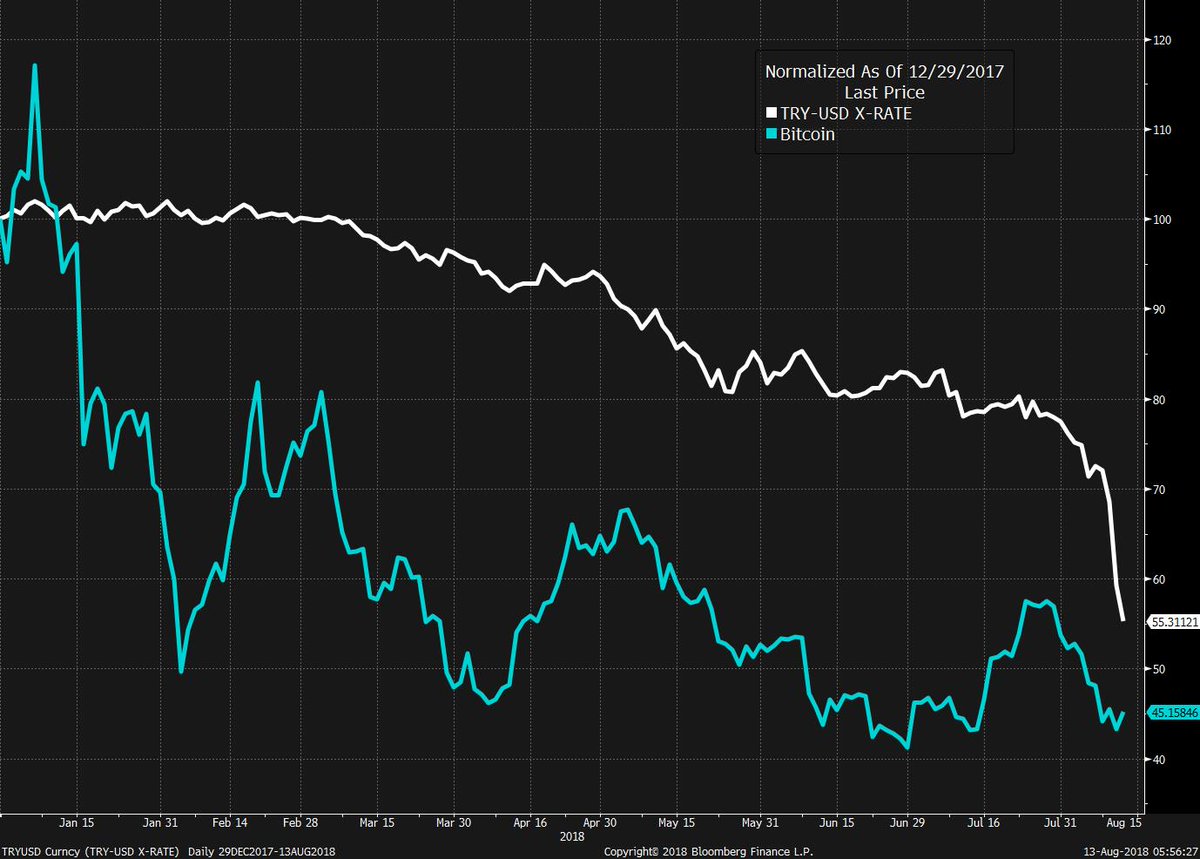

PS. From Joe Weisenthal (h/t Travis Leonard):

If someone in Turkey had bought Bitcoin at the beginning of the year, instead of holding their money in Lira… they’d have lost even more.