Trade Alert: Update on the GTAT BK trade PLUS Everything You Should Know Heading Into This Busy Week

I only got filled on about 1/3 of how much I wanted to buy to even build up what would have been about a 1/3 first tranche of GTAT at around 90 cents, hoping I would build the rest near 80 cents or lower, but the stock didn’t fade lower into my bids. So now I’ve got a 1/9th-sized position of what would have been a tiny position even if it had been 9/9th-sized, if you follow what I mean. So I have a negligible exposure on this BK trade, but I’m already up nearly 50% on it, as GTAT now trades at $1.35-1.40 as I type. I’m going trim half of it, even though it’s almost meaningless to do so since I never got much of my GTAT orders filled. Discipline though, and a 50% move in an hour requires a trim.

Here’s what every serious investor and trader needs to know heading into this busy week of earnings, economic news and wild market moves.

Wow, I don’t recall the last time I saw a relatively-developed economy’s stock market spike 8% in a single day, but Brazil indeed has.

Sapphire crystal display and Apple supplier, GT Advanced Technologies files for bankruptcy this morning and the stock is already trading again. Looks like GTAT shareholders will get pretty much wiped out. Regardless, this was a strange filing and one that seems to have absolutely blindsided existing shareholders.

I’m not surprised by $GTAT‘s collapse. I wrote this 196 days ago here on Marketwatch: “I’d rather sell the news on GTAT up here. The stock is wildly overextended and it will take a lot of growth to justify the current levels already.” Wish I’d bought puts at some point.

Momo cuts both ways as outlined by the WSJ’s Simon Constable, even in the bubble-blowing bull market we’re living through right now. On the one hand, you’ve got tons of lost-momo stocks like FireEye FEYE, RocketFuel FUEL, and Digital Ally DGLY. On the other hand, you still have a ton of still very momo’d stocks like GoPro GPRO Tesla TSLA or Facebook FB.

Speaking of GoPro, did you realize that GoPro with its current $11 billion market cap is now worth 2/3 of what Sony’s own market cap is at $18 billion? I think we’ll look back in five years and Sony’s per share stock price might be closer to the $90 print that GoPro’s share’s currently go for and that GoPro’s own shares might be closer to the $18 print that Sony’s go for. At those levels, Sony would be worth $90 billion and GoPro would be worth $2 billion. We shall see.

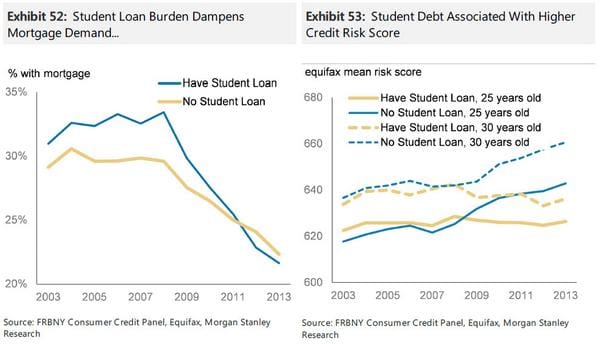

Our Chart(s) of the Day come from Jesse Colombo which shows his U.S. Higher Education Bubble update on how student loan burdens dampen mortgage demand.

I’ve no idea if TKMR has got any viable treatment for ebola in the works or not, but my gut tells me that this stock is up on hype similar to how $DGLY was up a few weeks ago on Ferguson/Wearable Cop-Camera hype.Be careful, be vigilant and keep to Revolution Investing.