Trade Alert: What Could Go Wrong with a Relentless Rally, Daytraders Everywhere, Momo’s Highfiving?

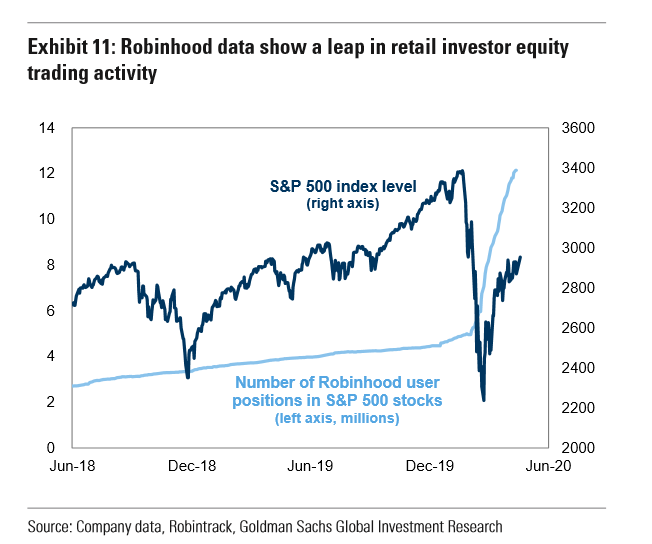

The relentless rally rollicks right on. Many of our stocks actually at or near new all-time highs. Meanwhile, the markets overbought, with small caps and penny stocks going vertical. Meanwhile, there are more retail investors jumping into the stock market pool than ever before. A few weeks ago in a Live Q&A Chat, we talked how millions of people around the United States who have been laid off, furloughed or otherwise at home have decided to bet some of their money on stocks. You can’t bet on sports right now. You can’t go to the casino. So play the stock market. And to make money quickly they think they need to be buying speculative small cap stuff and the fastest moving growth stocks.

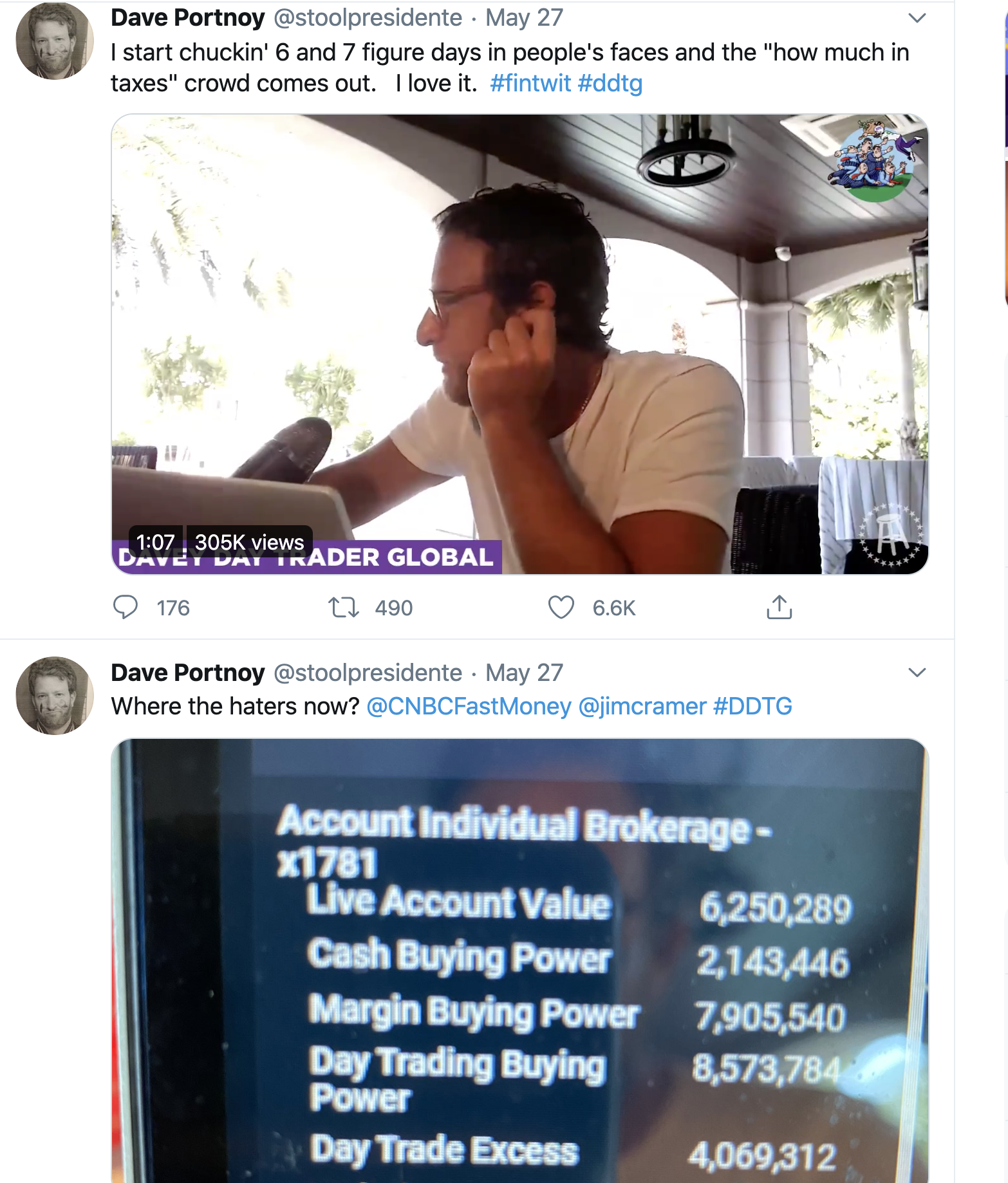

Meanwhile, the momentum junkies are highfiving and congratulating themselves on all the money they’ve been making and are doubled down in aggressiveness and many are using margin to juice their momentum gains even further. This Dave The Trader guy is pretty sure he’s got it figured out now, for example.

Meanwhile, I think the shorts and permabears have finally just about given up and are waiting for the markets to crack again before getting shorter again as you can see in the below chart that shows the the number of puts being bought vs the number of calls being bought is back down to pre-Coronavirus Crisis February levels.

Meanwhile, I don’t think the economy or corporate earnings are going to be nearly as good in 2021 as most people, and apparently the stock markets, seem to be expecting right now. Maybe 2022 will be the most amazing year of S&P 500 earnings and revenue growth in history and maybe the markets will look past all of 2020 and 2021’s problems and maybe all the Fed and Fiscal and Stimulus and Printing and Borrowing will keep asset prices inflated the whole time no matter what anyway.

But then again… if the market is usually in the business of doling out the most pain to the most number of people (especially at turning points), I’m thinking we’re likely to walk in one morning and find the futures are limit down with the highest flying stocks down 5-20% across the board. The shorts are going to be like — “Wait, I was going to get short all this stuff and now it might be too late already?” And the greenhorn retail traders are going to be like — “What the hell just happened to my stimulus check?” And the long-term investors are going to be like — “I’m going to ride this out, but maybe I shouldn’t?”

I don’t know if this will actually happen, of course. Or when. It could happen this afternoon. It could happen next week. It could happen next month with the markets up another 5% from here. It could happen not at all. My feet-to-fire guess is that it’s more likely than not and it’s more likely than not going to happen relatively soon.

What to do with our portfolios? Not much. We’ve been well positioned in many of the best-performing names and have added some nice trades along the way this year as we’ve navigated this wildly volatile and emotional 2020. We’ve trimmed down and reduced our shorts and raised cash as the rally has gotten ever longer in the tooth. I do think it’s time to nibble on some puts, especially as premiums have dropped along with the rush to buy puts that we saw in March and April. I want to be clear that I don’t think most retail investors at home should try to mess with puts. Just raise cash, buy some bitcoin, buy a little gold, stick with your long-term Revolutionary names. But for those of you who want to try to hedge a little bit more with puts and shorts, now might be a good time to consider nibbling on some. I wouldn’t go net short. I wouldn’t try to make a huge gain off of these ideas. But maybe a tiny bit of capital in some puts while few people are buying puts isn’t a bad idea here.

Here are a few tickers worth considering buying puts on. As usual, I’d probably look out to June or July with strike prices 10-15% below the market. :

CAR

CONN

CTL

CWH

DKNG

GM

MTDR

RNG

T

TCOM

VIPS

VTIQ

Also, we will do this week’s Live Q&A chat at 2pm ET tomorrow (Friday), in the TWC Chat Room or just email us your question to support@tradingwithcody.com.