Trade Alert: What About Valuations

Let’s keep doing real homework and being disciplined about our approach here. That’s where the real edge is over the long term. And that’s why we keep following the playbook.

I came across this list of crashed big cap tech stocks on Twitter when I was hanging out feeding Amaris through her gtube while she was sleeping Saturday night:

I’ve analyzed every one of those stocks over the last year and many of them I have known well for years, and I was like, “Amaris, there might be some good bargains out there right now.” When thousands of stocks are down 70-80 or even 90%, there are going to be some good bargains out there.

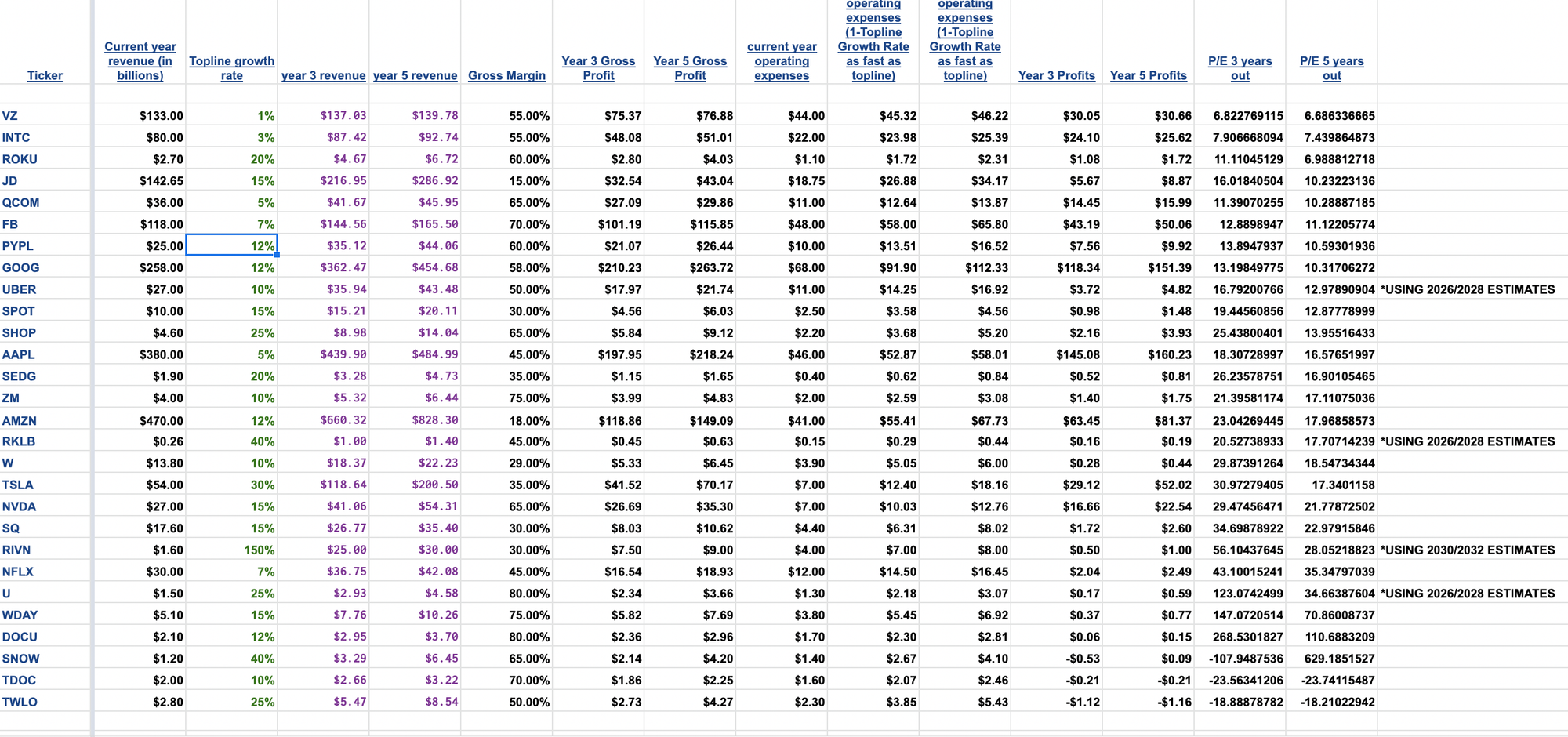

So I came into the office on Sunday and put together a list of stocks that I call my “Casket of Big Cap Crashes” (not basket, but casket, see?). Then I built a spreadsheet that uses their trailing twelve months revenues and gross margins and operating expenses. I took the average analyst growth estimates for the next two years and rounded them down on the assumption that their numbers are too high and that I want to use very conservative estimates. Then I drilled down to what each company’s net profits (basically GAAP profits) would be three years and five years out and divided each respective market cap with that number to find what the real P/E for most of these stocks might be in a few years.

I have run through dozens of names (25 are names I like and 5 are names I’m short) so far. Here are some of them

You can see that several names, including FB are trading at very low P/E rates. Here’s a closer look at the featured names (bold are names I own):

| Ticker | P/E 3 years out | P/E 5 years out | |

| VZ | 6.822769115 | 6.686336665 | |

| INTC | 7.906668094 | 7.439864873 | |

| ROKU | 11.11045129 | 6.988812718 | |

| JD | 16.01840504 | 10.23223136 | |

| QCOM | 11.39070255 | 10.28887185 | |

| FB | 12.8898947 | 11.12205774 | |

| PYPL | 13.8947937 | 10.59301936 | |

| GOOG | 13.19849775 | 10.31706272 | |

| UBER | 16.79200766 | 12.97890904 | *USING 2026/2028 ESTIMATES |

| SPOT | 19.44560856 | 12.87778999 | |

| SHOP | 25.43800401 | 13.95516433 | |

| AAPL | 18.30728997 | 16.57651997 | |

| SEDG | 26.23578751 | 16.90105465 | |

| ZM | 21.39581174 | 17.11075036 | |

| AMZN | 23.04269445 | 17.96858573 | |

| RKLB | 20.52738933 | 17.70714239 | *USING 2026/2028 ESTIMATES |

| W | 29.87391264 | 18.54734344 | |

| TSLA | 30.97279405 | 17.3401158 | |

| NVDA | 29.47456471 | 21.77872502 | |

| SQ | 34.69878922 | 22.97915846 | |

| RIVN | 56.10437645 | 28.05218823 | *USING 2030/2032 ESTIMATES |

| NFLX | 43.10015241 | 35.34797039 | |

| U | 123.0742499 | 34.66387604 | *USING 2026/2028 ESTIMATES |

| WDAY | 147.0720514 | 70.86008737 | |

| DOCU | 268.5301827 | 110.6883209 | |

| SNOW | -107.9487536 | 629.1851527 | |

| TDOC | -23.56341206 | -23.74115487 | |

| TWLO | -18.88878782 | -18.21022942 |

The good news is that a lot of stocks are not terribly expensive if they come anywhere near delivering on their business plans for the next three to five years. The bad news is that many of them are still expensive. I think Unity and others are probably going to grow faster than the assumptions I put into these spreadsheets so I am holding onto that name for now.

You might notice that I bolded ROKU there. Indeed, I have started building a new ROKU again. I plan on giving myself plenty of room to buy more if it continues to crash with the broader speculative tech market but looking at those relatively conservative estimates for Roku’s profitability and valuation have me starting to build a position in this name.

SNOW and TWLO are great companies and I would like to buy them at some point, but as you can see in the chart above, they are very expensive stocks and will probably still be so in another five years unless they grow much faster than my conservative estimates. Netflix is probably still too expensive here, but as the company is still the de facto leader of The Streaming Revolution, I’m willing to give it some more room. I’d be a strong buyer of NFLX near $150.

I have also been buying some puts on NVDA (and AMD) as prices for some of their mining chipsets have been falling quickly.

On that note, I’ve also sold all my Ether from my hedge fund (I still own a little bit personally that I’ve owned for years). I think the price of ETH has to come down at some point as the economics of “gas fees” are too high for most businesses and is creating all kinds of competition for Ethereum’s smart contract platform. Everybody, including Ethereum’s founders know this and they are supposed to do a fork to address this at some point, but they keep putting it off, perhaps to try to keep ETH as high as possible for as long as possible even if its going to hurt ETH’s long-term prospects.

We’ll do this week’s Live Q&A Chat tomorrow morning at 10am ET.