Triumph and Desperation in Las Vegas

– “History is hard to know, because of all the hired bullshit, but even without being sure of ‘history’ it seems entirely reasonable to think that every now and then the energy of a whole generation comes to a head in a long fine flash, for reasons that nobody really understands at the time—and which never explain, in retrospect, what actually happened.”

– “Good people drink good beer.”

– “Beware of enthusiasm and of love, both are temporary and quick to sway.” I’ve never read the book or seen the movie, but these are three relevant quotes I found this morning from Fear & Loathing in Las Vegas by Hunter S. Thompson

I spent this week in Las Vegas networking at a conference for the hedge fund industry at the Bellagio and I spoke at the Money Show for the retail investor and trader at Caesar’s Palace too. The two conferences were connected by a walking bridge over Flaming Road, but they might as well have been on two different planets.

Walking more than 20 miles in two days, my business partner and I listened to former Federal Reserve Chairman Ben Bernanke speak at the hedge fund conference and one of the things he discussed if whether the Fed should actually be trying to try to stimulate inflation even higher than the “2% target” in order to catch up with past years that the inflation rate hasn’t been hitting the 2% target. Inflation, is of course, known as the hardest tax and inflation is a direct tax on the middle class and especially the poor and those dependent on a fixed income. I don’t think we should have a 2% inflation tax at all, much less try to aim higher than that. Ask middle class and poor people who lived through the 1970’s what can happen when you let the inflation genie out of the bottle.

I listened to penny stock companies promoting their stock to desperate retail investors and traders at the Money Show.

I listened to billionaire money managers at the hedge fund Conference who had lots of opinions about how China and globalization and banking policies and “de-regulation” would really continue to fuel the stock market.

I listened to a desperate elderly guy with a bad dye job try to sell me a $350/month newsletter that’s sent out by email and by snail mail once a month for a $299/month special offer.

I mingled with Sultans, bullish hedge fund managers, wealthy investors and family office heirs and the people who cover/facilitate/create that eco-system as steaks and lobster were served.

I chatted with the slow security guard who drank five free cokes in the “VIP Section” (a couple couches behind a panel in the back of the MoneyShow booth area) who told me he had six more cokes stored in his bag outside. He was planning to take a greyhound bus to meet the movers at the apartment he and his wife are moving to in Missouri next week because he thinks he might be able to live cheaper and be a security guard there.

You get the idea of the contrast between the two conferences. One had a vibe of confidence and even a sense of triumph. The other had a sense of desperation.

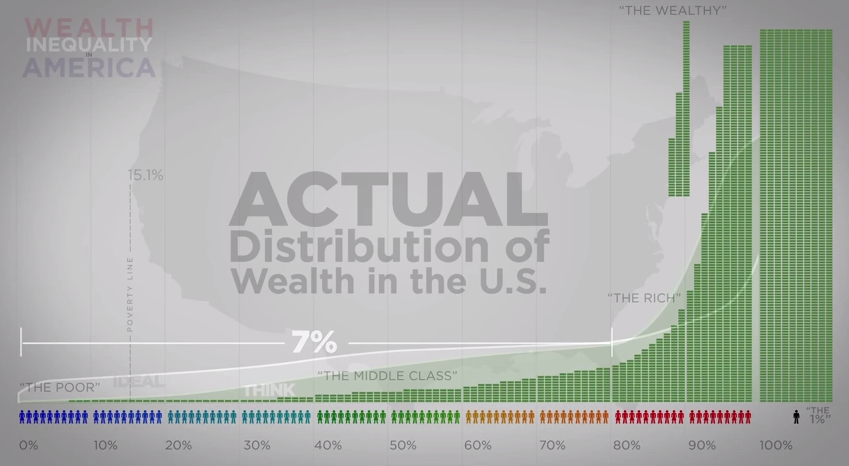

Real-life example of the growing wealth disparity, rich-get-richer dynamic we read so much about, I suppose?

Any change in sight for this? Probably not anytime soon, as I’ve explained many times that the policies of our Republican-Democrat Regime and its entire system perpetuates this dynamic. Economically-speaking, we can expect more of the same of this growth in wealth-disparity. And that means, we can likely expect continued profit growth and Bubble-Blowing Bull Markets.

I’m not sure I can apply any meaningful takeaway about the near-term stock market action from these events. The bullishness and sense of triumph at titans conference was palpable back the last couple years too. And there were plenty of cautious words and hedge fund managers who were bearish about stocks too. Meanwhile, the crowds at the MoneyShow were good. Most of the money managers and speakers were more about selling people products that would supposedly make this mostly novice and mostly not-wealthy crowd better traders.

It’s not like there was rampant bullishness everywhere which might have been a great indicator that the markets are finally due for that big 10% pullback that they haven’t had in many months.

I’ve got some shorts I’m probably going to cover soon, but I’m just not in a rush to cover them as I do think the markets seem exhausted on the upside and I want to have some short hedges on to counter our overall long positioning in the portfolio.

I’ve got some interesting individual names I’m working on, mostly on the long side, but a couple potential new shorts. So stay tuned, as I’ll be sending out those names and I’ll send out Trade Alerts if I do make any trades on the new or old names next week.