TSLA Cybertruck Speculation, ADSK Discussion, GM’s Unlimited Capital, And Much More

Here’s the transcript from today’s live Q&A chat:

Q. When looking for bearish/bullish sentiment in the market, where do you go to look?

A. Hmm, usually I’m going off the hundreds of articles, comments, analyst reports, conversations, and so on that I consume about the markets each and every day. But sometimes I’ll also look up the Put/Call ratios or the II bull/bear survey or some other surveys on Google.

Q. When you decide to sell an entire position, do you try to scale out of it or just sell it all at market price?

A. I usually try to get out quickly when it’s time to bail, but sometimes, especially if the stock is way oversold or something, I might slow the selling process down a bit. But when it’s time to go, I want to move on and get ready for the next idea.

Q. Quick thoughts on iShares 20 Plus Year Treasury Bond ETF (TLT)?

A. I liked the long calls trade on TLT back when it was closer to $80. Now above $90, I’m not sure the risk/reward setup is favorable.

Q. Top five best buy now?

A. In alphabetical order: Autodesk (ADSK), Meta (META), Texas Instruments (TXN), maybe Globalstar (GSAT) and STMicroelectronics (STM) too. Trying to answer this question and finding that I’m not thrilled about a whole 5 names right now underscores my lack of bullishness at this moment.

Q. Going straight to feet to fire… lol… Cybertruck vs PCE… Tesla (TSLA) up or down tomorrow on Cybertruck announcement? Feels maybe a little like getting the sell the news out of the way this afternoon… (I know, who really knows, and doesn’t matter really but for fun).

A. I suppose the action in TSLA tomorrow after the Cybertruck event at 3 pm ET will partly depend upon whether Elon has any “One more thing” kind of moments or previously unveiled features for the Cybertruck. But feet-to-fire, I’d guess that TSLA is down 2% tomorrow.

Q. How far down the line are you to get your Cybertruck? Do you expect to get it relatively soon?

A. I think I’m about #30,000 out of 2 million in the Cybertruck backlog queue. That means maybe I’ll get my truck in the first half of next year unless Tesla surprises everybody with how quickly they can ramp up production.

Q. Slight pullback today in some big names, any trades you like?

A. I like Autodesk (ADSK) but it’s not pulling back today. The slight pullback in many of the megacap names isn’t enough to get me excited here given the huge run they’ve had recently and all year.

Q. How large of a position should we make Autodesk (ADSK)? What is the advantage of purchasing stock through exercising long call options? Wouldn’t it make more sense to exercise short puts so you can receive the stock at an even greater discount? Thank you.

A. I can’t tell you how large of a risk to take on any one position size. I can tell you that I am planning to make ADSK a Top 10 position and it’s currently about 2/3 the size I want it to be in the hedge fund. Yes, shorting puts on it would also help you get a good purchase price. We bought some calls as we started working on it after it reported earnings last week to get our toe in the water as we did more homework. The calls worked and we are holding them til expiration after we found how much we liked the ADSK setup here.

Q. What rating is Autodesk (ADSK) and would it be one of our main positions for the next few years?

A. I give it an 8/10 right now. I plan on making it a Top 10 position.

Q. Looks like Autodesk has managed to explode upwards just before I bought some! Dang. But I still bought some and a few calls dated out to April. Hope this move is just getting started.

A. I agree!

Q. Thank you for the write-up on Autodesk (ADSK). Certainly an interesting read. Two items with regard to this position. 1 – Do you think this is the right time to buy considering the broader NASDAQ rally? 2 – Does the AI hype feel overdone? Just thinking of ways that this trade could go against us and being cautious.

A. 1) There’s always market risk in any position we buy. I’m not terribly bullish on the overall tech market right now, but ADSK has been slammed before we started scaling into it here and I like that individual stock setup. 2) Not sure there’s anybody but us that is realizing just how good of a play Autodesk is on The AI Revolution at this point.

Q. How did we miss this move in Coinbase (COIN) and all other Crypto plays? Are you still looking into shorting these names?

A. I have had our long-time Trading With Cody subscribers in bitcoin since 2013 when it was at $100. We were pounding the table on ProShares Bitcoin Strategy ETF (BITO)/bitcoin back a few months and weeks ago before it popped big time. That said, I’m not a fan of Coinbase’s CEO and him coming out this week after the Binance company/CEO got fined and pleaded guilty and saying that the entire crypto community can turn the page on regulation risk WHILE the SEC is still very much suing his company for doing a lot of illegal stuff is insane to me. In the hedge fund we are long some puts on COIN and CleanSpark (CLSK) as hedges to our BITO/bitcoin long but I don’t have any puts on them in the personal account. We own some slightly in-the-money puts on both COIN and CSLK, dated out 3 weeks and 6 weeks respectively.

Q. What is your take on the move by General Motors (GM)? Don’t they need all this cash to develop EVs?

A. Seems like GM spends every month telling Wall Street all the ways GM is going to win by investing/spending/giving cash to shareholders. Does GM apparently have unlimited access to free capital? I don’t think so. We put some GM puts back in the hedge fund this morning, buying some puts dated out a few weeks that are slightly in the money.

Q. Ford (F) & General Motors (GM) will be lucky to be around in 10 years.

A. I think Ford F has a slightly better chance of being around in ten years than GM but both are in trouble, as I’ve been saying for the last four or five years as we’ve been so long/bullish on Tesla (TSLA).

Q. Any thoughts on the automobile companies complaining about President Biden’s policy/demand on ramping up EV production? A few companies specifically said that they have backed up EV inventory.

A. Most of the EVs from Ford and GM and Volkswagen and the other legacy automakers absolutely suck. Remember this article from a few months ago after we tested a bunch of them? Those same companies used to love the EV subsidies, ridiculous giveaways to people rich enough to be able to buy a new car that they are, but since they now realize that they can’t hardly give away their crappy EV cars, they want the subsidies to be reduced?? Bunch of crybabies. I’m always against the government giving welfare/subsidies to wealthy people and corporations, and I do think our country would be better off with a LOT less of these targeted welfare/tax/loophole tricks.

Q. Still like the Pfizer (PFE) calls and Microsoft (MSFT) puts? I have a few of each, nothing huge.

A. I like the small premiums on the longer-dated Pfizer (PFE) calls still. If it drops below $29 on tax loss selling into year-end, I’ll probably buy some PFE calls for the hedge fund. The MSFT puts haven’t been great but like you’re saying, it’s nothing huge for the hedge fund. Just a smallish hedge against our other megacap longs.

Q. What are the main insights you’re looking for when meeting with DallasNews (DALN)?

A. We want to meet management and look them in the eye and learn about how they plan to create value for shareholders. We have some good ideas, including about integrating local news and AI, to help generate more sales and traffic for them, and want to share those ideas with them. We’ll be open and interested in learning anything when we go next week.

Q. Current thoughts on jettisoned names IONQ Inc (IONQ) & DocuSign (DOCU)?

A. Ioniq’s management has made me question if they can pull off their quantum computing goals. I’ve lost faith in them. Docusign is cheap and not a bad company but we just see so many other ways to digitally sign documents these days and Docusign spends so much on operations/salespeople that I just can’t get bullish enough on it to buy it again.

Q. Any update on the Immersed SPAC?

A. I spoke to the CEO a few weeks ago and they are trying to plug along. No big updates or insights for you on it right now though.

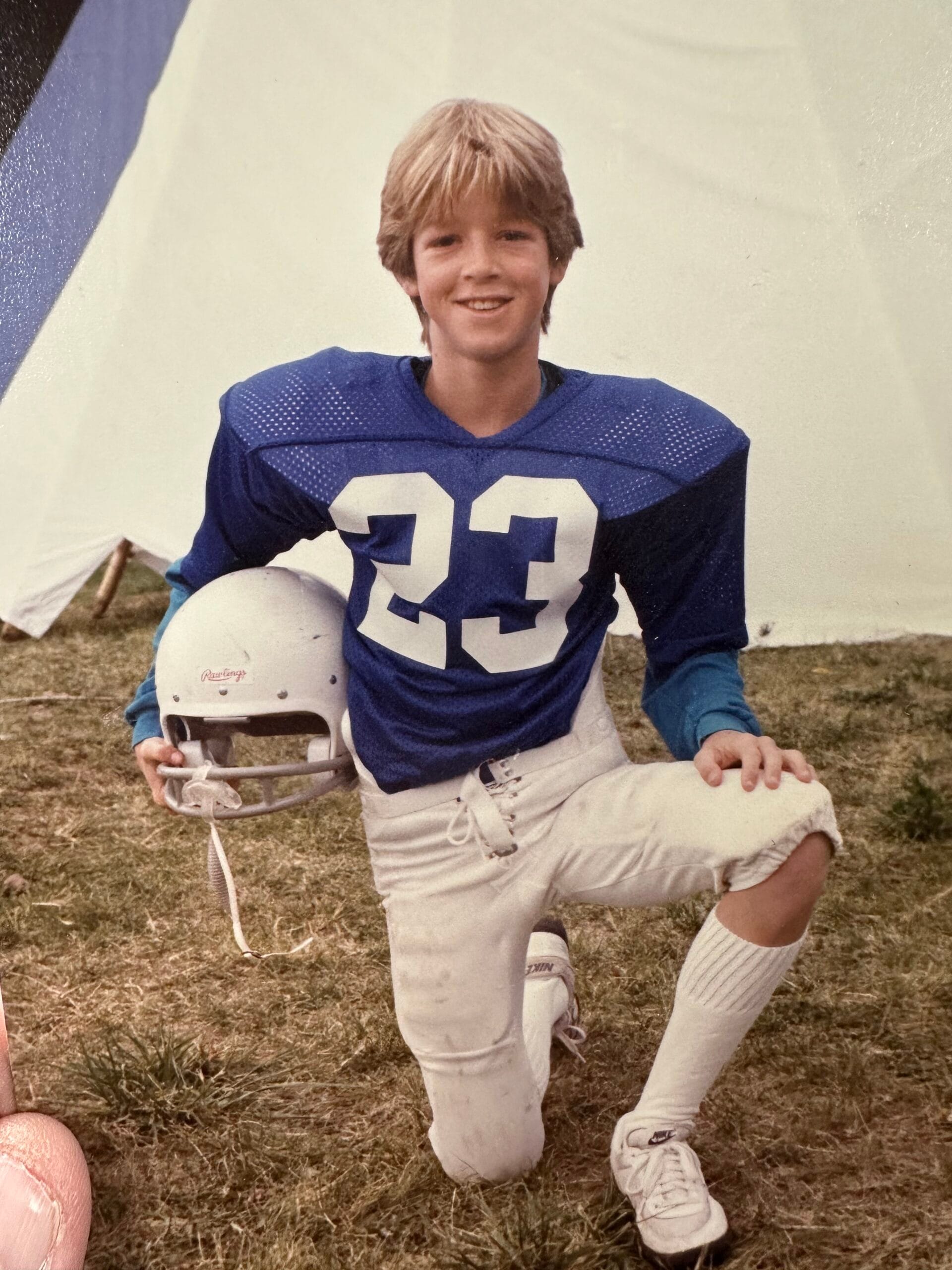

I leave you all with a shot from when I was a 7th grade Little League football player. I was #23 because even though I loved football, Jordan was my idol. I found this photo in a box I was cleaning out the other day.