Uber Tesla Taxis, Bezos bitcoin, Gold standard, Technology vs jobs, and more

Here’s part 1 of the transcript from this week’s Live Q&A Chat.

Q. A lot going on domestically and abroad. Stocks went up as you anticipated and wondered if you have any intuition about where we go from here? Thanks.

A. I think stocks could gyrate around these levels with a slight upward bias for the near-term. Just a guess though. Be prepared for anything, as always!

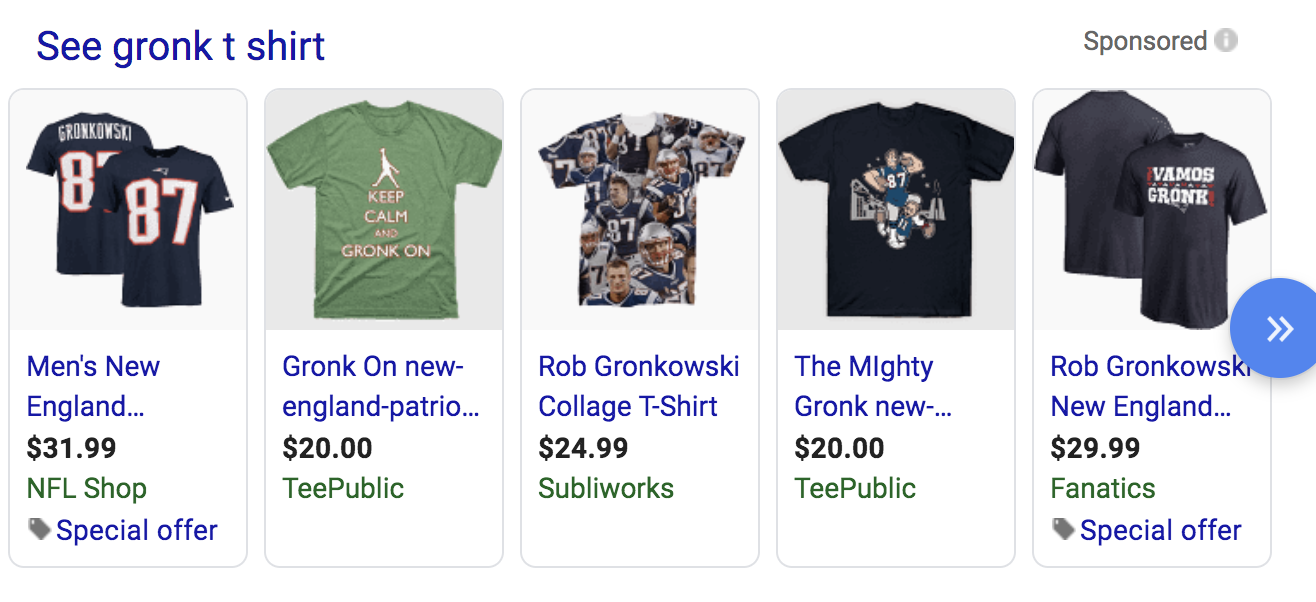

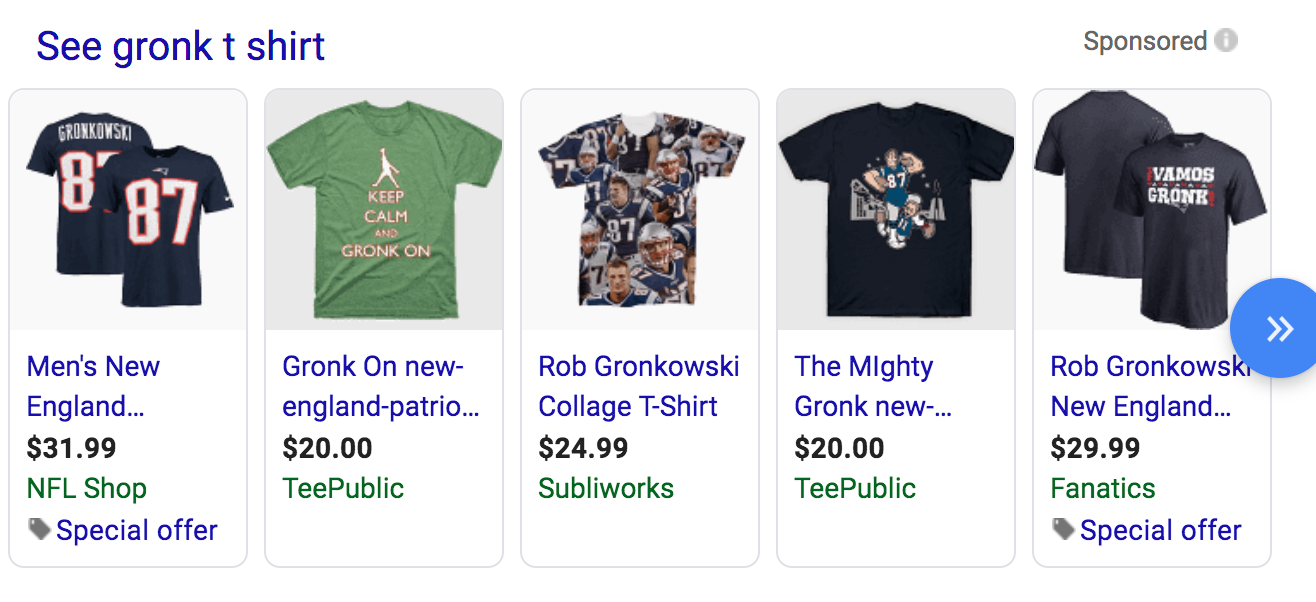

Q. Do you recommend any new shirts/buying puts?

A. Here’s a few shirts I’d recommend, particularly the very stylish third one:

What’s that? “Shorts?” Oh, would I recommend new shorts. I won’t bother pulling a screenshot of Gronkowski shorts, so to answer your question — no, not too much right now. I do think it’s good to have a few index shorts/puts on to help hedge the portfolio in case there’s a nutty grumpy Trump tweet or something each day, but not too terribly heavy in shorts/hedges/puts right now. (PS. This Gronk reference will be even funnier when you see part 2 of the transcript.)

Q. Are you hedging more given the attack on Aramco and the possible new round of tariffs on the EU?

A. Not really, but if you’re worried, you might want to raise a little more cash and/or do some hedging.

Q. I do not know what is really true on this, but have heard that 5G can cause some serious health problems, Any thoughts on this? Shall we see what it does to our kids?

A. I don’t think 5G will cause any more health issues than all the other signals and connections running through the air and our bodies and heads already do.

Q. Cody, what happens to BTC when Bezo’s says “We accept Bitcoin”?

A. “When” is a big word there, but “if” Bezos says Amazon takes bitcoin, bitcoin will go up 50% in a week, I suppose.

Q. Cody do we ever go back to the gold standard and if Trump declares such a thing does gold go up 10x?

A. No, the US will never go back to a gold standard. The decades of fiat currency for the US dollar plus Bitcoin have killed the gold standard concept.

Q. Are countries are dumping USD?

A. No, not really. With the US getting to be the only developed economy with positive interest rates, global monies are flooding the US.

Q. Technology, created by capitalism, will destroy the balance between job creation and job destruction. Many more jobs will be destroyed than created and this will destroy capitalism as we have known it. A BASIC INCOME will become a NECESSITY ! How Is this impacting your investing now and for the next 10,000 days ?

A. I happen to be one of the few who don’t see the world this way. Technology will just create new jobs for us, just as it always has.

Q. My prediction is in the future, all vehicles will be required to have a 5G transponder. No need for lidar, or expensive Auto Pilot to avoid collisions. All roadway will be geofenced .

A. I don’t think so. The car needs to be smart enough without being connected to a central system to drive itself or the whole system won’t be safe enough.

Q. Regarding TSLA, I’ll say this: in the Los Angeles area, existing inventory is very low and while I ordered a Model 3 over a week ago, still no word on the delivery date. In fact, I’ve been told it could take 2-4 weeks from the original order date (I was originally told it could take 2 weeks). What I’m trying to say is that, based on my limited yet significant experience buying a Tesla, Tesla car demand appears very strong in Los Angeles. Sub #2: $TSLA. Porsche taycan is supposed to be a ” Tesla killer.” It could be reversed, Tesla Plaid Powertrain could possibly killed taycan before it’s even begun. Sub #3: Tesla Model 3’s seem like by far the most popular new car on the road in So. Cal. Used to see new BMW 3 Series everywhere – now Teslas are the go to new car.

A. The only thing these electric vehicles from Porsche, Audi and the other gas engine companies have done is prove that Tesla is at least five years ahead of everybody. And the gas companies are selling their EVs with negative gross margins vs Tesla at around 20% gross margins. Good points about the popularity of the Model 3 growing…it’s growing everywhere in the US, as every single Tesla is a mobile commercial and just about every owner a passionate salesperson.

Q. Cody – with higher oil prices, would that finally get TSLA rolling and upwards ?

A. Won’t be a direct correlation, but over time, higher oil prices = higher gas prices = EV’s ever more competitive.

Q. Any thoughts on Tesla insurance and new battery technology they mentioned in a recent white paper?

A. Tesla insurance would be a huge cash cow for the company if it can go nationwide. Tesla’s batteries are amazing.

Q. My MBA Investment Banker friend says Tesla runs out of money and will need massive infusion – potential dilution or equity holders being hurt by cash raise or whatever. Do you see Tesla having this weak link?

A. Did your MBAIB friend travel back in time such that he can tell us how many Model 3s Tesla will sell over the next year? LOL. Because that’s what it all hinges on for now. And then it will hinge on how many Model Ys and how many semi’s and how many trucks and so on Tesla sells. It’s certainly possible Tesla needs another cash infusion in the next year or two if they don’t sell enough cars.

Q. Some analysts say Uber has low barrier to entry and business model that can’t ever make money.. Also robo taxis could make Uber obsolete, blah blah… Thoughts?

A. Huge barrier to entry to master the logistics, the consumer side and the costs of building a taxi fleet. The robo taxi, if from Tesla, will likely kill Uber’s business.

Q. Or Uber can purchase Teslas and compete..win win for both companies and Uber solves its contractor issues.. sorry Cali!

A. Nice call!

Q. Cody- do you see a 26% slide of AAPL as a result of accounting method for Apple TV+?

A. No, not really, I foresee a 24.826% drop because of it. Just kidding. Why 26% exactly, anyway? I’d assume there was a sellside report that predicted at 26% decline and that’s probably where that number came from. All in all, Apple TV+ won’t move the needle for Apple by itself, but it will help Apple become even more eco-system-y.

Q. Cody – the 26% AAPL slide in this article.

A. Thanks. I knew it’d be a sellsider who put out a 26% risk report. And boy does this ever sound like someone stuck in the weeds and losing the forest for some accounting trees: ‘“Effectively, Apple’s method of accounting moves revenue from hardware to Services even though customers do not perceive themselves to be paying for TV+,” he wrote. “Though this might appear convenient for Apple’s services revenue line it is equally inconvenient” for hardware average selling prices, gross profits, and earnings per share in “high sales quarters” such as the first quarter of fiscal 2020, which ends in December.’

Q. Cody you were contemplating BA as one of your stock picks that you might consider letting go of can you address that in the next q & a given the constant unforeseen delays in the 737 max as well as transports potentially being affected with the current environment. Thanks.

A. I think the market is looking past the 737 Max issues and assuming that it will all work out over the next few months and that the huge backlog of orders will eventually be filled. It might be a better set-up near-term if the markets didn’t think the 737 Max issue was going to work out — that’s probably the case when BA gets close to $330 on panicky sell-offs on bad 737 Max headlines. That said, long-term, over the next 10-30 years, I think BA is probably a core holding for its duopoly airplane business and its potential to be a Space Revolution play.

Q. Hi, Cody, Wondering what you thought of Teladoc ($TDOC) as a possible member of the “Revolutionary” club? Recently saw it recommended (again?) by Motley Fool, and they make a pretty convincing case for it largely owning the category of direct-to-your-doctor online visits — and am I wrong in thinking that as 5G reaches a fuller distribution, the capabilities of such doc-visit “calls” will increase? Thoughts?. Thanks.

A. It’s another expensive stock, not profitable with nice 30% topline growth. I like your thesis that 5G could help its business boom though.

Q. Seems like SQ, WORK, PANW, SPLK, etc. are mostly due to rotation out of high multiple software?

A. Yes, the whole sector got smashed the last few weeks, especially the highflyers. Some of their guidance was a bit soft and that might have contributed to it too.

Q. Cody, SQ a buy under $60. Thanks.

A. Yes, I bought some last week, sent out a Trade Alert.

Q. I got rid of my square. I was afraid it was turning into another MO. Good move?

A. I have been buying more SQ below $60.

Q. Question for Cody – 10am chat: Slack is down 36% since its IPO in June and management guidance for revenues is 50% down from 100% a year ago. What do you find attractive in Slack (WORK)? Sub #2: GM C.W., SLACK SLACK SLACK, Please tell us more.

A. Slack has become an essential tool for corporations to run their business. I think Slack will become a household word in the next five years.

Q. You said WORK is 9 or 10 below $25. Is it really that good in your view? Please explain a bit…

A. Do you think I was kidding? LOL. I think Slack is the best of breed of this year’s IPOs.

Q. Any updated thoughts on AXGN here? Seems a continued downward trend.

A. I’m sitting tight, fundamentals seem fine.

Q. Can you please comment on expiring TLT puts? Thanks.

A. Probably time to trim some more of them. Consider this a Trade Alert, I’m selling more TLT puts and I’ll be out of all of the September TLT puts by the end of the week, win or lose, trimming 1/3 per day for each of the next 3 days.

Q. Cody – QCOM flirting with 80s….does it look its ready for next leg up ? thnx

A. No idea, really. Might be time to trim.

Q. Hi Cody, how are you? have you taken a look at AMBA after their recent earnings? Has your opinion changed?

A. AMBA’s revenue growth is going to be flattish to down this year and expected to grow 10% next year. But the stock is trading at 100x next year’s earnings estimates and 8x next year’s sales estimates. It’s not a bad company, but I’m not likely to buy it back here.