Updated List Of The Prices Where I’d Want To Buy Our Stocks At Now

Growth or value? For years, 17 years according to some studies, the markets have been favoring growth over value. That’s because, as we’ve rightly analyzed for the last 20 years, when you can find a company growing 30-100% or more per year with nice gross margins and operating leverage, the “value” has actually been better in the “growth” names. That’s not going to change although as I think it’s clear that the economic/business model/sales cycle resets that have come along with The Coronavirus Crisis is going to help make “value” names more able to “grow” both topline and margins.

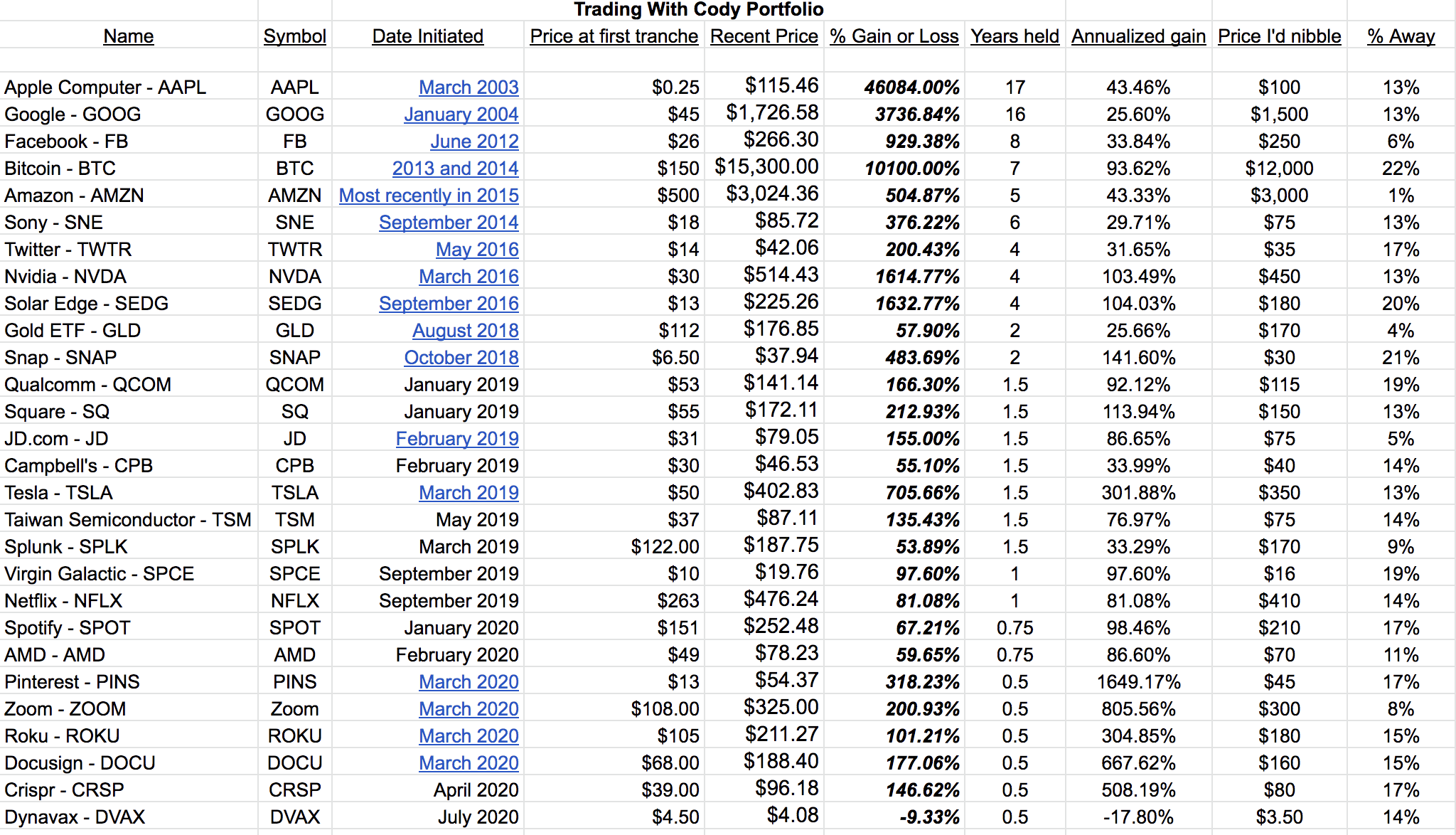

Anyway, with many stocks that I’ve been worried about valuation-wise having come down another big leg today, the entry points are becoming more compelling. With that and with the endless requests for this list whenever I go a couple months without updating it, here’s a list of most of our positions and where I’d nibble more:

| Trading With Cody Portfolio | ||||||||||

| Name | Symbol | Long or Short | Date Initiated | Price at first tranche | Recent Price | % Gain or Loss | Years held | Annualized gain | Price I’d nibble | % Away |

| Apple Computer – AAPL | AAPL | Long | March 2003 | $0.25 | $115.46 | 46084.00% | 17 | 43.46% | $100 | 13% |

| Google – GOOG | GOOG | Long | January 2004 | $45 | $1,726.58 | 3736.84% | 16 | 25.60% | $1,500 | 13% |

| Facebook – FB | FB | Long | June 2012 | $26 | $266.30 | 929.38% | 8 | 33.84% | $250 | 6% |

| Bitcoin – BTC | BTC | Long | 2013 and 2014 | $150 | $15,300.00 | 10100.00% | 7 | 93.62% | $12,000 | 22% |

| Amazon – AMZN | AMZN | Long | Most recently in 2015 | $500 | $3,024.36 | 504.87% | 5 | 43.33% | $3,000 | 1% |

| Sony – SNE | SNE | Long | September 2014 | $18 | $85.72 | 376.22% | 6 | 29.71% | $75 | 13% |

| Twitter – TWTR | TWTR | Long | May 2016 | $14 | $42.06 | 200.43% | 4 | 31.65% | $35 | 17% |

| Nvidia – NVDA | NVDA | Long | March 2016 | $30 | $514.43 | 1614.77% | 4 | 103.49% | $450 | 13% |

| Solar Edge – SEDG | SEDG | Long | September 2016 | $13 | $225.26 | 1632.77% | 4 | 104.03% | $180 | 20% |

| Gold ETF – GLD | GLD | Long | August 2018 | $112 | $176.85 | 57.90% | 2 | 25.66% | $170 | 4% |

| Snap – SNAP | SNAP | Long | October 2018 | $6.50 | $37.94 | 483.69% | 2 | 141.60% | $30 | 21% |

| Qualcomm – QCOM | QCOM | Long | January 2019 | $53 | $141.14 | 166.30% | 1.5 | 92.12% | $115 | 19% |

| Square – SQ | SQ | Long | January 2019 | $55 | $172.11 | 212.93% | 1.5 | 113.94% | $150 | 13% |

| JD.com – JD | JD | Long | February 2019 | $31 | $79.05 | 155.00% | 1.5 | 86.65% | $75 | 5% |

| Campbell’s – CPB | CPB | Long | February 2019 | $30 | $46.53 | 55.10% | 1.5 | 33.99% | $40 | 14% |

| Tesla – TSLA | TSLA | Long | March 2019 | $50 | $402.83 | 705.66% | 1.5 | 301.88% | $350 | 13% |

| Taiwan Semiconductor – TSM | TSM | Long | May 2019 | $37 | $87.11 | 135.43% | 1.5 | 76.97% | $75 | 14% |

| Splunk – SPLK | SPLK | Long | March 2019 | $122.00 | $187.75 | 53.89% | 1.5 | 33.29% | $170 | 9% |

| Virgin Galactic – SPCE | SPCE | Long | September 2019 | $10 | $19.76 | 97.60% | 1 | 97.60% | $16 | 19% |

| Netflix – NFLX | NFLX | Long | September 2019 | $263 | $476.24 | 81.08% | 1 | 81.08% | $410 | 14% |

| Spotify – SPOT | SPOT | Long | January 2020 | $151 | $252.48 | 67.21% | 0.75 | 98.46% | $210 | 17% |

| AMD – AMD | AMD | Long | February 2020 | $49 | $78.23 | 59.65% | 0.75 | 86.60% | $70 | 11% |

| Pinterest – PINS | PINS | Long | March 2020 | $13 | $54.37 | 318.23% | 0.5 | 1649.17% | $45 | 17% |

| Zoom – ZOOM | Zoom | Long | March 2020 | $108.00 | $325.00 | 200.93% | 0.5 | 805.56% | $300 | 8% |

| Roku – ROKU | ROKU | Long | March 2020 | $105 | $211.27 | 101.21% | 0.5 | 304.85% | $180 | 15% |

| Docusign – DOCU | DOCU | Long | March 2020 | $68.00 | $188.40 | 177.06% | 0.5 | 667.62% | $160 | 15% |

| Crispr – CRSP | CRSP | Long | April 2020 | $39.00 | $96.18 | 146.62% | 0.5 | 508.19% | $80 | 17% |

| Dynavax – DVAX | DVAX | Long | July 2020 | $4.50 | $4.08 | -9.33% | 0.5 | -17.80% | $3.50 | 14% |

Here’s a screen shot of the above chart that you can click on in case this form makes it easier for you:

I’m not doing anything today in the personal portfolio, although in the hedge fund I am nibbling a few shares of common stock and/or a few call options in SPOT, FB, AMZN, AMD, PINS, DOCU and putting in a few limit orders to nibble a little bit of some call options and/or some common stock in other names from our portfolio too. Easy does it though, as I do small moves here with a tiny bit of capital. If and when the prices of the stocks get closer to my target nibble prices, I’ll do some more serious buying of some common stock in those names in both my personal portfolio and the hedge fund. But for now, easy does it.

We’ll do this week’s Live Q&A Chat at 10:30am ET tomorrow (Wednesday).