Use Self-Reinforcing Cycles to your advantage

You know that the hype around a coming recession is high when even the random lady I sat next to at the airport who works at Microsoft in cloud sales immediately said to me when I told her what I do for a living:

“Let me ask you something. Are we heading into a recession?” The talk on the street, on Wall Street and on TV while I was in NYC last week for three days was often full of concern that we are headed into an imminent recession. Nobody wanted to talk about Revolutions like The Electric Vehicle Revolution, Artificial Intelligence and its developing positive impact on corporate margins (if nothing else) and how there might be trillion dollar companies in their infancy being built right now.

I talked about these very themes in a recent radio interview I did that you can consume in less than 10 minutes on SoundCloud. Why is everybody so focused on a recession? I suppose it’s mainly because the dreaded “inverted yield curve” hit a few weeks ago and the mainstream media decided it was really noteworthy since the last few times that happened it caused a recession. I myself am not so sure that I want to bet on a less-than-statistically-significant data point in an economy with billions of inputs is going to automatically foretell a recession this time. Be cautious, but not mainstreamed fretful.

And it’s not like just because main street and Wall Street decided to worry over a recession that we’ll automatically have one. Certainly there’s some reflexivity in the economy, as the stock market prices, earnings expectations and decision-making based on many self-reinforcing inputs feed on themselves. But then again, it just might take a real shock to the system in order for these factors to override the decade-old self-reinforcing inputs that are still in boom (not bust) mode.

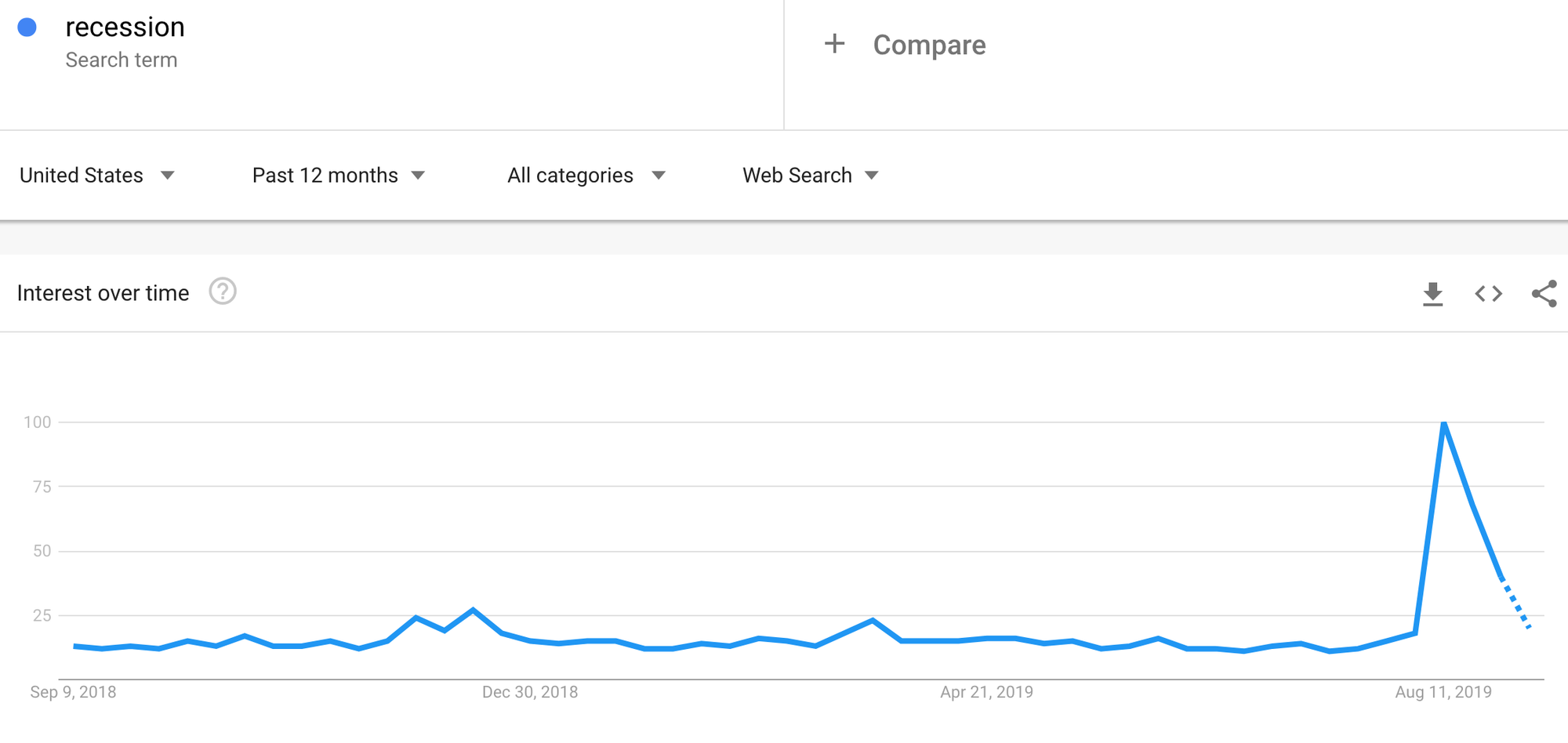

Take a look at this updated chart of people googling “Recession” over the last 12 months, which clearly shows that a strong downward trend, for what it’s worth:

I’d bet that most of the people who wanted to sell stocks because of recession concerns did already in the last few weeks. That might mean stocks are in more confident, longer-term hands.

So if recession worries and/or inverted yield curves aren’t likely to impact the economy and stock markets more than they already have, let’s rank a few other important themes out there in order of importance:

- Tens of trillions of dollars worth of money is now sitting in negative interest rate bonds. It’s pensions, funds, tax-deferred accounts and so on that are basically forced to lend $1 to governments in order to get back 99 cents at the end of the year that are the only money that would do such a thing. That means two things — most of the governments around the world are so insolvent that the only way they can keep the lights on is to force their people to lend them money at negative interest rates. And it means that every dollar in EU or Japan or other places that can flee those areas is fleeing to find some sort of positive interest rate for taking on the risk of investing in and/or lending a company/government their money. This is probably a net positive for the US for the next few years — at least until some exogenous shock or something causes some of these governments currently selling negative interest rate bonds to lose their ability to fund themselves. That last part is probably at least two to five years out, I’d guess.

- Corporate earnings growth continues its steady pace. Will it turn down? Is a corporate earnings recession imminent? There are definitely some companies throughout the economy that are faltering, losing ground, trying to fund failing businesses. Then again, isn’t that always the case. The Trade Wars could accelerate some failures, which could of course feed off into the broader economy…and corporate earnings are really what drive the stock market long-term anyway, so…wait, I’m walking us right back in another potential self-reinforcing cycle.

- Tariffs/Trade Wars are sucking $100 billions of dollars of extra costs out of the corporate system of earnings. Perhaps more importantly, perhaps another trillion dollars worth of supply chain decisions are being changed/paused because of corporate concern over tariffs/trade wars. This is definitely not bullish if it lasts for another year or two, but if/when Trump decides to declare victory in the Trade War, the markets are likely to re-price most corporate earnings upward (meaning likely higher stock prices).

The takeaway from all of this — I’d like get increasingly bullish if markets/stocks go down as long as earnings growth continues. Meanwhile, I see some stocks that I think are wildly bubbled up at ridiculous valuations. And other stocks that I think are creating trillion dollar Revolutions that we should get in front of. Here are two. You pick which stock you’d rather own:

Company A:

Revenue estimate for 2020: $30 billion

Revenue growth estimate for 2020: 20%

Gross margins: 20-25%

Years old: 16

Company B:

Revenue estimate for 2020: $1.5 billion

Revenue growth: 35%

Gross margins: 35-45%

Years old: 17

Knowing nothing else…What kind of valuation would you put on each company?

What if I told you that company A was valued at $40 billion? And company B is being valued at $20 billion? Which one would you rather own then?

I give you Company A, Tesla and Company B, Roku.

I have been doing some more work on some of our largest positions and some new ideas that I’m trying to get comfortable with. I want to make sure that these companies have things like, well, self-reinforcing cycles in their business models before I pull the trigger on them.

Finally, I’ll be doing a MoneyShow appearance while I’m in Dallas. October 13, 2019, 5:00 pm – 5:45 pm: Don’t Make Another Trade or Investment Without Using the WiNR Ratio! Why will the trade work? What can go wrong? Timeframe? Best way to play it? Downside risk? Potential upside? Sign up by clicking here.