Virtual Worlds, Virtual Reality and Real Money

Roblox, a Unity competitor, came public yesterday. My team and I did a bunch of analysis on it and the entire sector of VR platform development and here’s what we came up with.

Battle Royale, Or 3 Kings To Rule Them All?

We all know gaming platforms have taken on a different operational mode in the last decade. It’s not the same setup (blowing into game cartridges in order to get them to function properly) as it once was when I was a kid. In fact, 3D interactive social gaming is the future of more than just the future of gaming. The purpose of this article is to breakdown the differences, risk/reward and technology roadmaps for three of the biggest players in 3D augmented and virtual reality development platforms. We are on a mission to find the leader of 3D VR Kingdom. The battle between Roblox, Unity Software and Epic Games Unreal Engine is almost (but not quite) neck and neck.

The first company we’ll take a look at is Roblox, a global platform where millions of people gather together every day to imagine, create, and share experiences with each other in immersive, user-generated 3D worlds. Roblox has a $29.5 billion valuation after its last funding round and is scheduled to go public on Wednesday, March 10th. The company will be divvying out 199 million shares from existing shareholders. Today, the gaming platform has almost 33 million daily users, having doubled just last year during the pandemic and lockdowns.

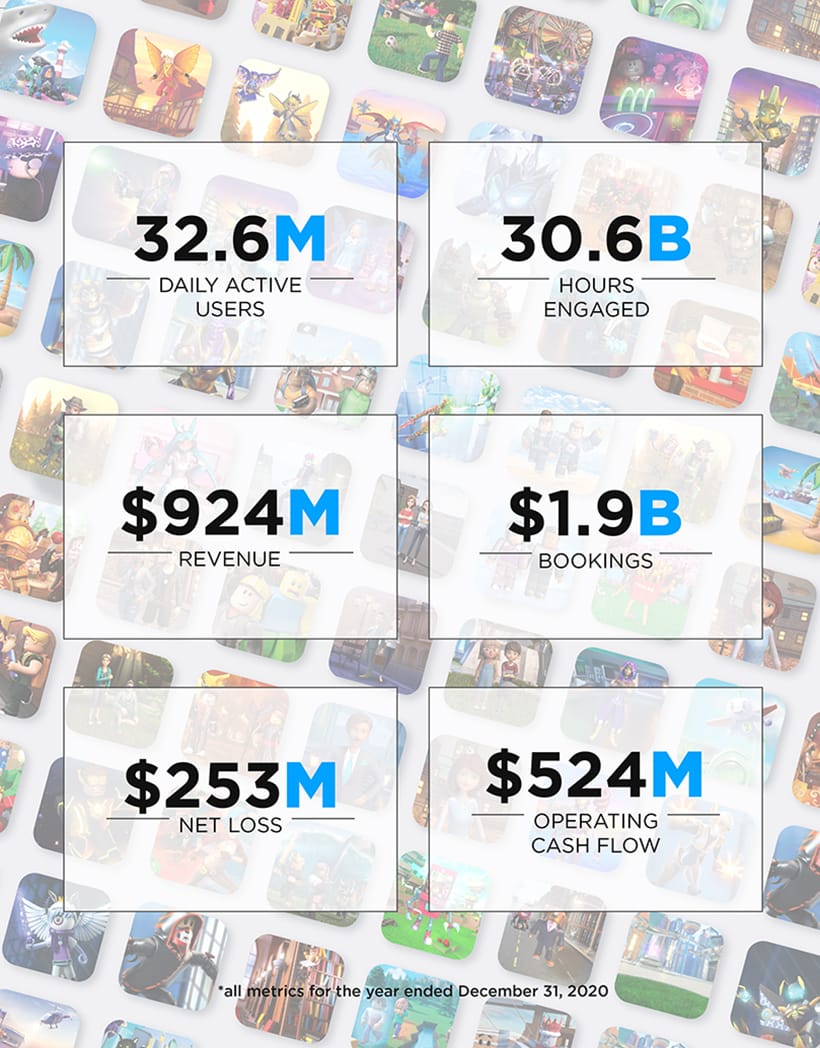

Roblox recently scrapped their IPO and opted for a direct listing. One probability for this is likely due to a shift in SEC regulations just last December. The U.S. Securities and Exchange Commission (SEC) changed the rules on direct listings, now allowing companies to raise cash by auctioning new shares in parallel with sales by current shareholders. It’s possible the direct listing is more likely a way to afford those current shareholders a liquidity opportunity. In their recent S-1 SEC filing, Roblox generated $924 million in revenue and $240 million in revenue costs, leaving the company with an approximate 74% gross margin for 2020. The company has a cash balance of $1.4 billion after their latest private funding round this January which valued the company at $29.5 billion.

Revenue for the company grew from $325 million in 2018 to $508 million in 2019 which is a 56% increase, and grew 82% to $924 million in 2020. During that time, the number of hours spent on the platform more than doubled to 30.6 billion. This user base number is expected to wane in 2021 because of the Covid bump experienced in 2020, yet it’s still important to remember that 50% of kids in the U.S. under age 16 play the game. And because of the gaming platform’s unique 3D VR world, complete with self designed avatars, buildings, landscapes, and even its own currency (Robux), those users are likely to continue using the platform for years to come. The flip side of that speculation would be that those users under the age of 16 grow up and find other interests, as kids transitioning from teens to young adults often do.

With that said, Roblox is constantly targeting older users and non-gamers. Usage among people age 13 and older more than doubled last year and that demographic now accounts for 44% of daily active users. The company plans on maintaining its older user base with virtual concerts, holiday parties, immersive education, 3D tours, movie making and so much more. They demonstrated early success in this area last December when hosting a concert for Lil Nas X, which attracted over 30 million views. Roblox has found, along with the other companies mentioned in this article, an incredible demand for 3D VR development platforms in architecture and infrastructure development, and a serious demand for its technology from so many other industries as well.

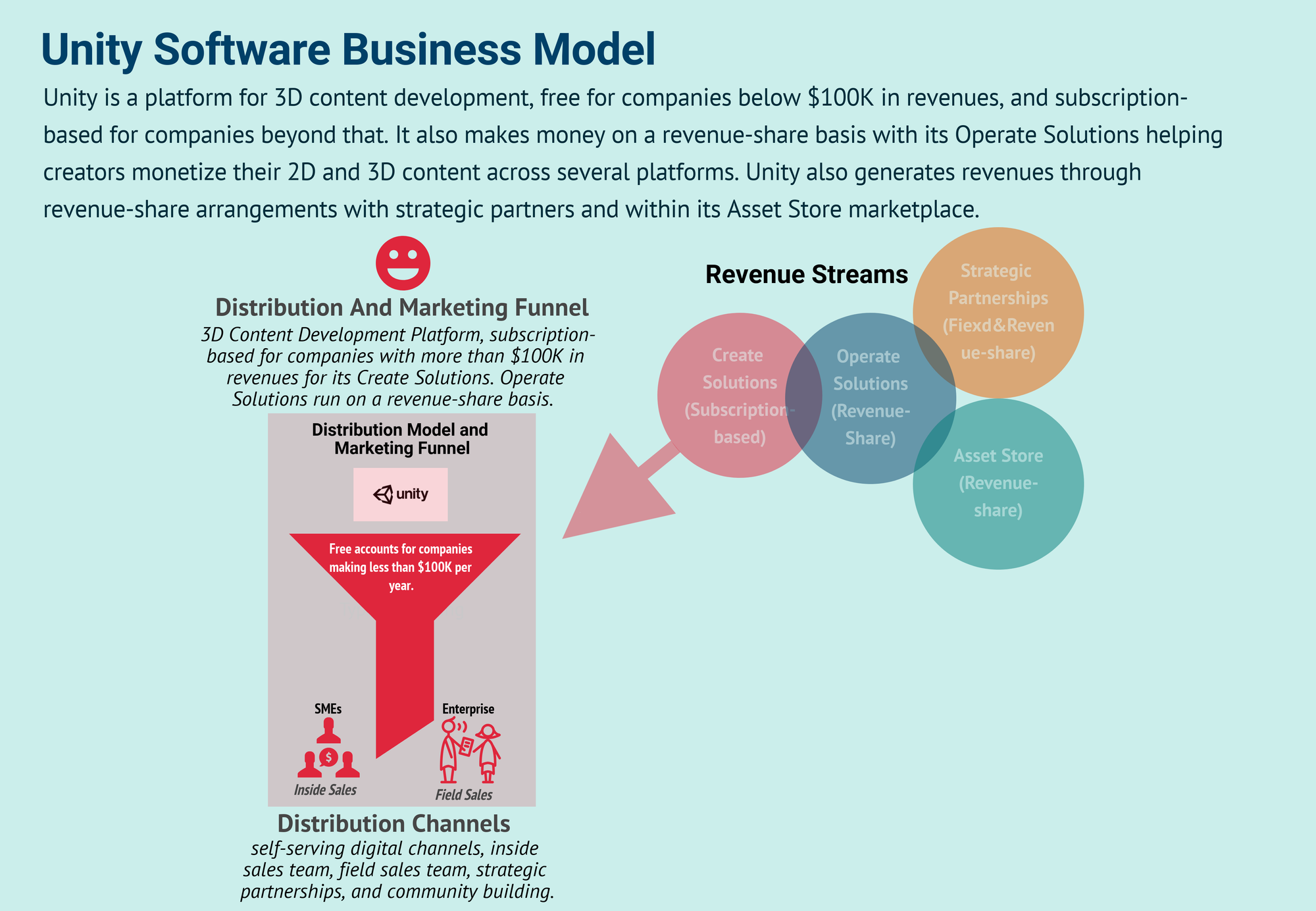

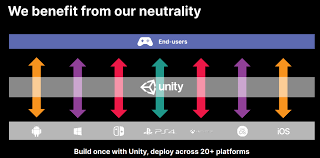

Moving on to Unity Software (NYSE: U), this company is already available in the public market and has a $25.53 billion market cap. Unity Software is a real-time 3D development platform as well, providing software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company has $1 billion in cash, only $20.5 million in debt and a quarterly gross margin of 77%. Sales growth percentages for this year and the next are 25.7% and 27.4%, respectively.

Revenue for the company in 2020 was $772 million up 42% from 2019 revenue of $541 million. The company said, “mobile games made with its tools comprised 71% of the most popular titles for that media during the fourth quarter of 2020, and the number of monthly active end users who played games made or operated with Unity hit an average of 2.7 billion; a robust 63% increase over the same period of 2019.” On the long-term, Unity’s executive management is aiming to deliver a 30% revenue growth. In preparation of this, Unity has been building out its platform of services to help developers advertise, deliver, and monetize content with new AI-based analytical tools and content distribution. Unlike Roblox, Unity Software does not use a proprietary digital currency on its platform.

Unity now has almost 800 customers spending over $100K in the last year. Thirteen percent of that user base are using the platform for non-video game development (like movies, TV, engineering, and manufacturing), which was only 8% just a couple of quarters ago. This is great progress, the company just ended 2020 with $1.75 billion in cash and equivalents, with zero debt.

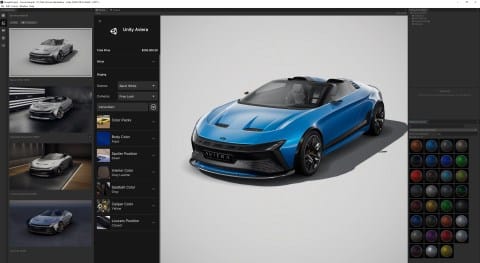

Volkswagen’s 3D virtual showroom powered by Unity.

This company is not only the world’s leading platform for creating and operating real-time 3D (RT3D) content, its Object Pose Estimation and corresponding demonstration is aimed at supporting Robot Operating Systems (ROS), aka a flexible framework for writing robot software. Unity tools in combination with other company’s software is opening the door for roboticists to quickly explore, test, develop, and deploy solutions in a cost effective manner. This will eventually save time and money for the many industries positioned for this transformation to robotics combined with AI and Machine Learning.

Last of the 3 kings, but not the least is Epic Games Unreal Engine. This is a software development firm that produces tools for game creators. The Unreal Editor is a fully integrated suite of tools for building every aspect of your project. Advanced features include physically-based rendering, UI, level building, animation, visual effects, physics, networking, and asset management. Adding to thought, the Unreal Engine platform already works hand-in-hand with the HoloLens 2.

Epic games carries a $17.3 billion valuation with $3.4 billion in total funding. The game makers last funding round raised $1.7 billion approximately 7 months ago. Investors in Epic Games include Lightspeed Venture Partners, BlackRock, T. Rowe Price, Fidelity, Vulcan Capital, Altimeter Capital, Iconiq Capital, Tencent Holdings, Sony, DreamWorks, and Smash Ventures to name a few. With $4.2 billion in total revenue for 2019 (of which its flagship game, Fortnite, contributed $1.8 billion), the company expected 2020 revenues to be around $5 billion. Revenues ended up flat however, due to the fact the new 52 million users the Epic Store attracted in 2020 amounted to only $20 million in revenue, or just $14 million for third-party games.

Unreal Engine is also working on reshaping the 3D VR world with its next-gen Unreal Engine 5. This new platform is designed to achieve photorealism on par with movie CG (the building blocks for CGI) and real life via highly productive tools and content libraries.

One such development is Nanite, a virtualized geometry in which film-quality source art can be imported directly into Unreal Engine. As mentioned in Epic Games first look at Unreal Engine 5, “Nanite geometry is streamed and scaled in real time so there are no more polygon count budgets, polygon memory budgets, or draw count budgets; there is no need to bake details to normal maps or manually author LODs.” Basically speaking, there’s no compromise in the quality.

“The cave system in the “Lumen in the Land of Nanite” Unreal Engine 5 demo was generated using real-world photogrammetry assets imported into the Nanite engine rather than detailed by hand.”

The other new and exciting plus one in the Unreal Engine stable is Lumen, an illumination solution that reacts to scene and light changes. In 3D VR development this is a huge time saver, and in virtual reality time is everything.

Having said that, let’s take a look at the future of Unreal Engine beyond the video gaming industry. Epic Games Unreal Engine 5, like Roblox and Unity Software, is using its new funding to develop the so-called “Metaverse.” A Metaverse is the expansion of gaming into platforms for experiences, social interactivity, virtual concerts and so much more. It’s a whole new digital world where users and developers can build, interact and seek various forms of entertainment. This Metaverse will be home to architects and engineers, centers of education, and entertainment mediums; from social environments to parks, and so on.

With all of this exciting, revolutionary, ‘world’ changing software development going on it’s hard to pick a favorite. I suppose it’s somehow nice to know we can rule out Unreal Engine (Epic Games) since it’s private and most traders and investors don’t have access to it. I suppose if one wanted to invest in Epic Games today, they could buy shares of Tencent, the games largest investor. Tencent’s investment in Epic equates to 40% of total Epic in 2012 as part of an agreement focused on moving Epic Company towards a games as a service model (GaaS). Even though this makes Tencent the largest outside investor, I still don’t think it will move the needle on Tencent being that they are a company with an $828B market cap when Epic Games is only valued at $17.3B.

With all of the tens of thousands of new VR applications still to be developed and experienced by users all across the globe and in all industries, there might plenty of room for everybody. Then again, market share and technology roadmaps for each of these companies are different and we’ll need to stay on top of the trends to see which stock(s) in this sector we should own. I already own and am holding Unity steady for now and am interested in buying some Roblox (RBLX) if it will come down in price a little bit from here. Virtual reality is going to make this reality a lot of money in future years.