What Can We Learn From The Headlines: EV BKs, Central Bank Follies, Space Trillions(!)

Let’s run through some recent headlines and see if we learn anything:

We’ll start off with a headline that we’ve been (sadly, contrarian-ily) needing to see in hopes that the markets can eventually start putting in a real, long-term bottom:

Electric Last Mile Solutions Files For Chapter 7 Bankruptcy

Jun 17, 2022 — In the voluntary petition for Chapter 7 bankruptcy, ELMS disclosed its estimated assets range from $50 million to $100 million,

And then there’s this update now, three months later:

Struggling EV Startup Mullen Auto Bids for Bankrupt Electric Last Mile

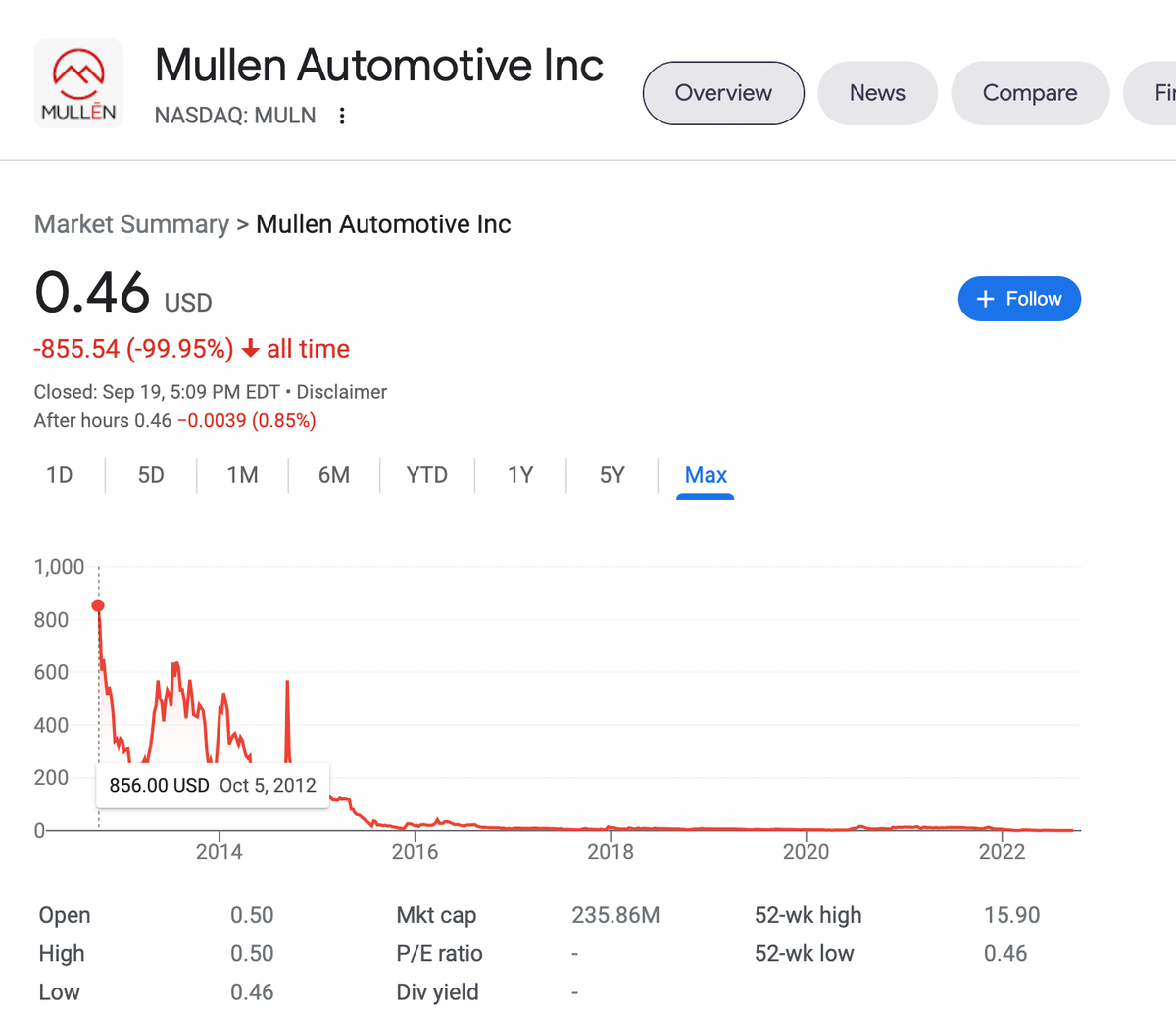

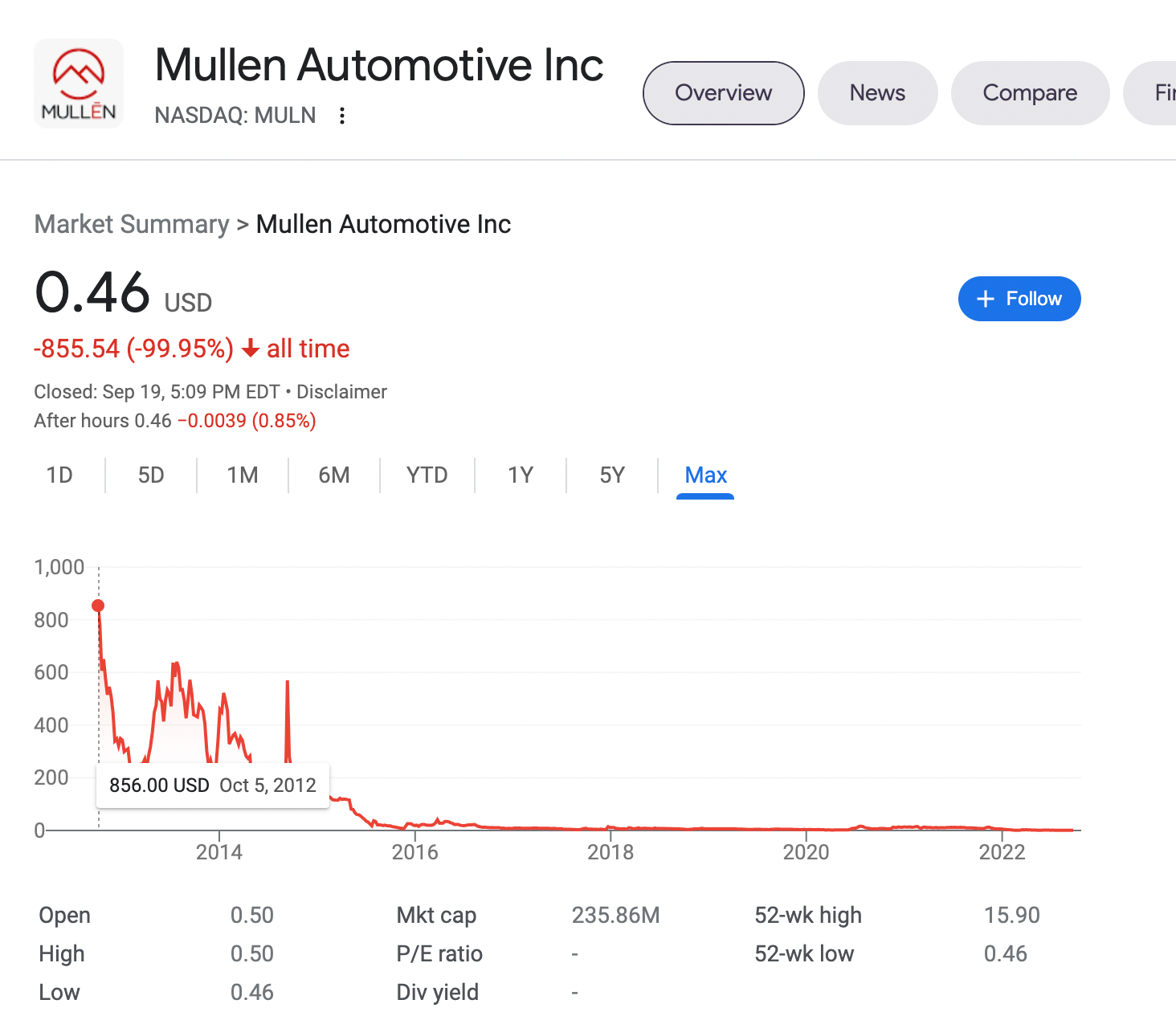

Oh my gosh, I just pulled up a long-term chart of the company, MULN, that’s trying to buy this bankrupt company, ELMS, and even the buyer’s stock truly loosk like a JDSU stock chart from 2000-2012. Look at this:

You see that right. MULN, which is down 99.95% over the last ten years and a company that should therefore at some point recapitalize itself with a form of bankruptcy, is trying to buy the nearly worthless assets of a recently bankrupt competitor. Let’s put 99.95% in perspective.

Next headline…

Ford warns investors of an extra $1 billion in supply chain costs during the third quarter “Ford said based on recent negotiations, inflation-related supplier costs during the third quarter will run about $1 billion higher than originally expected.”

I can not figure out how GM and Ford are supposed to manage their stocks, their cash flows and their buy backs and their dividends in the midst of all the headwinds they face, including trying to migrate from IC to EV, managing supply chains (especially trying to get chips for their vehicles)…and next, most likely a deflationary cycle in the prices of used vehicles leading to lower prices for these new vehicles if and when they ever get these new vehicles built to completion while facing an inflationary cycle in their supply chains as they compete with every other IC-to-EV wannabe.

And then there’s the ever-hyped and ever-fretted interest rates… and the Fed….

10-year Treasury yield jumps to 3.51%, the highest level since 2011

Treasury Yields Hit Decade High

The yield on the benchmark 10-year Treasury note notched its highest close in a decade, ending at 3.489% ahead of this week’s rate-setting Fed meeting. Two-year yields also rose, finishing at 3.946%—a 15-year high.

Investors Betting on 0.75-Point Increase

Dollar’s Rise Spells Trouble for Economies

Heard on the Street: How to Survive the Next Market Crash

Jerome Powell’s Inflation Whisperer: Paul Volcker

“Aiming to reduce inflation even at the risk of recession, the Fed Chairman draws on a 1980s playbook.”

When I picture JPow’s psychology, I’m like: He totally wants to go down in history like Paul Volcker did and he’s willing to risk anything to make sure he doesn’t go down in history as the Neville Chamberlin of the inflation threat becoming a full-blown global tragedy. But I’m not sure he can ever fix his posterity. The best thing Biden could do for our economy and the threat of a long-term inflationary cycle would be to get rid of Powell and replace him with someone completely new who hasn’t been on the Fed for decades. I’m sure Biden realizes the threat that long-term inflation is to our country and economy…oh, wait:

President Biden on inflation | 60 Minutes

Can you imagine when people look back in history some day and they’re like, “You mean EVERY country had a central bank that jacked around with inflation and interest rates and propped up giant global institutions? You mean, the US central bank, by far the most important and powerful in the world, was literally owned by the very banks the central bank was supposed to also regulate?”

I’ve never understood how people accept that fallible, weak bureaucrats with endless conflicts of interest and revolving door careers should control anything, much less our currency.

Which leads us to cryptocurrency, of course…oh wait…

Bitcoin, Ethereum crash continues as US 10-year Treasury yield surpasses June high

I continue to think that most cryptos have lots of downside both near-term and long-term and that 99% of the current batch of cryptocurrency tokens are headed to $0 like the aforementioned ELMs stock. Many already have gone down 99.95% and most of the rest of them will end up with charts that look like the aforementioned MULN stock if they trade at all in five years.

That said, I am finally starting to get excited that The Space Revolution, the single biggest economic engine of all-time, is getting ever closer to accelerating (and I’m still slowly but surely accumulating more SKTL Space-Debris-Cleaning Cryptocurrency Tokens most every week). A very smart space investor and friend of mine helped me make a chart that shows how we expect The Space Revolution to play out over the next decade or two. I’ll write up a full article with that chart and analysis later this week. It helps show how we are still in the top half of the first inning and how the cycle will likely play out from startups growing into Bubbled Stocks which leads to a washout and consolidation… and finally, The Trillion Dollar Revolution is taken for granted.

Also, I’ve found two new non-Space names that I’m quite intrigued with as long-term Revolutionary investments that I’m working hard on. I work on new names most every day. I know you all want new names that can make you wealthy. It doesn’t happen willy-nilly. It takes long hours and creativity and flexibility and…timing. There’s a time and place for everything…and there will be a time and place to load up on the next trillion dollar opportunities and I plan to be there pounding the table for us when we get there. I can’t force it though.

Tomorrow, I’ll be in Albuquerque meeting a bunch of space start ups and NASA/AFRL/SpaceForce people. Very excited to build on my Space Networking and to, most importantly, listen, learn and look for new Revolutions.

We’ll do this week’s Live Q&A Chat Thursday at 10am ET.