What history says about the markets now

The Fed’s going to raise rates eventually, right? Maybe this week! And if you listen to the pundits and traders, a 0.25% interest rate hike from our central bank is A Very Big Deal.

Let’s cut through the noise with some more historical perspective.

This morning I sat down to write about why seeing the Fed raise rates from a fraction of 1% to slightly higher fraction of 1% is completely meaningless to the markets and the economy. But then I realized, I think I’ve written this exact analysis out before — several different times in the last few years. Because the Fed, the markets and the economy have been doing exactly what my analysis has said they would — staying Bubblicious. So let’s take a look back at some of that analysis from the last four years and you’ll be shocked at how I could have simply cut and paste the content from those years-old articles into a new one applicable to today’s Fed, market and economy.

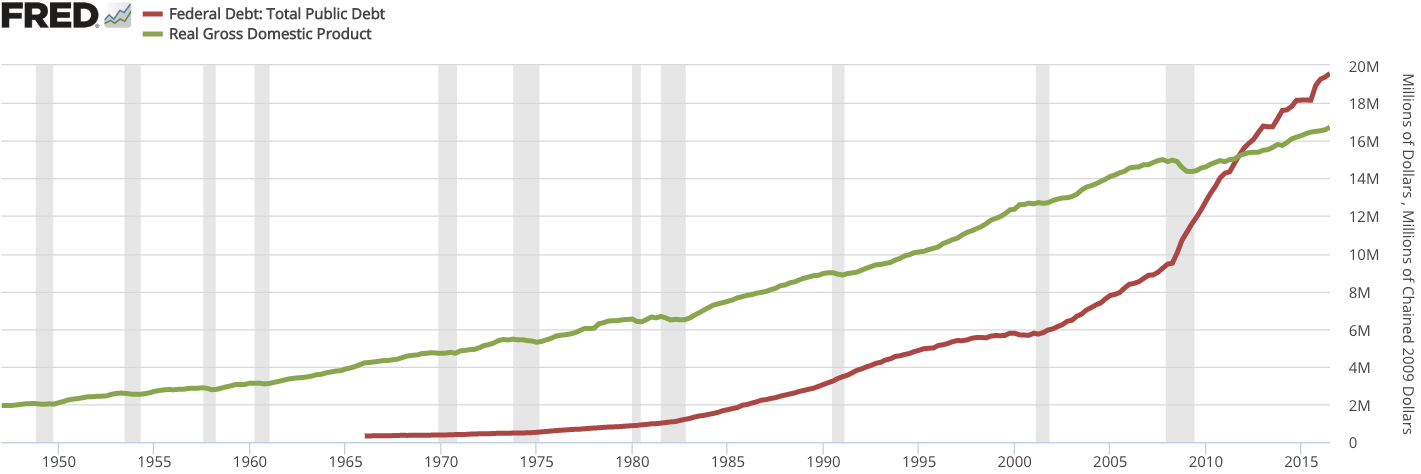

A couple things to note. Just as I’ve predicted for the last few years, the Republican Democrat Regime has been able to ram trillions of dollars of debt down the public’s throat basically for free since interest rates are so low. Those trillions of extra dollars borrowed from our grandchildren are pure Bubble-Inflators so long as interest rates stay near zero. In the article below, I have a chart that shows the US Debt going from $8 trillion to $14 trillion after the bailouts of 2008. It’s now nearly $20 trillion.

And yet, still today, interest rates remain at the same low levels they have since 2008, so what do you think will happen to the US Debt, to US GDP, to the stock market over the next two or three years as long as rates stay steadily low?

More Bubble Blowing Bull Market is most likely for the next couple years still.

A few quotes I pulled out and highlighted in bold italics in the article below:

2011: *”So what happens when the Fed continues to create unprecedented amounts of dollars and forces trillions of dollars of private capital into risky assets like corporate bonds and especially stocks? You tell me. I sure think we’re most likely headed into yet another unprecedented asset bubble.”

2011: *”Ultimately, $14TT of debt is no joke. But we are paying record low interest rates to borrow unprecedented amounts of money to pump into our system and enable the banks to continue looting the taxpayer with 0% loans and 3% Treasuries.”

2013: *”What will be the likely catalyst for this house of card political and economic reality we live in to come crashing down? Higher rates, I would expect. And not some measly 0.25% bump or two in overnight rates at the Fed.”

2013: *”When the Republican/Democrat Regime in power redistributes trillions of dollars from the renters and savers to the bankers, most bank stocks will go up. A lot.”

2013: *”That said, always bet on growth, bet on US innovation and bet on a bright future. Those who say that today’s developed economies are post-growth and unable to grow again are shortsighted and don’t have a vision for where technology can continue to help us prosper. The borrowing of trillions of dollars from the future generations of developed economies — and therefore from all children around the world — will certainly impact their ability to thrive, but thrive they will. We will.

Let’s review our playbook. We seek to own companies with very strong balance sheets that are revolutionizing and/or outright creating their industries. We try to buy those companies cheaply/early like we did with Apple in 2003, Google on its IPO, FB near $20 after its crashed IPO, First Solar after letting it crash in the alternative energy bubble pop, and many others such as those that we can hold onto them for many years. We start small and slowly in each position, recognizing that there will be many ups and downs in each stock in the years ahead. Since we believe in these companies ability to grow as they revolutionize their industries over many years, we scale into our long positions when the stocks are getting hit and we trim them when stocks rally hard. We get aggressively long after stock markets crash and we whittle down our long exposure when markets bubble.”

Read on for more historical perspective.

Bernanke says “Let’s inflate the biggest stock market bubble ever”

July 13, 2011

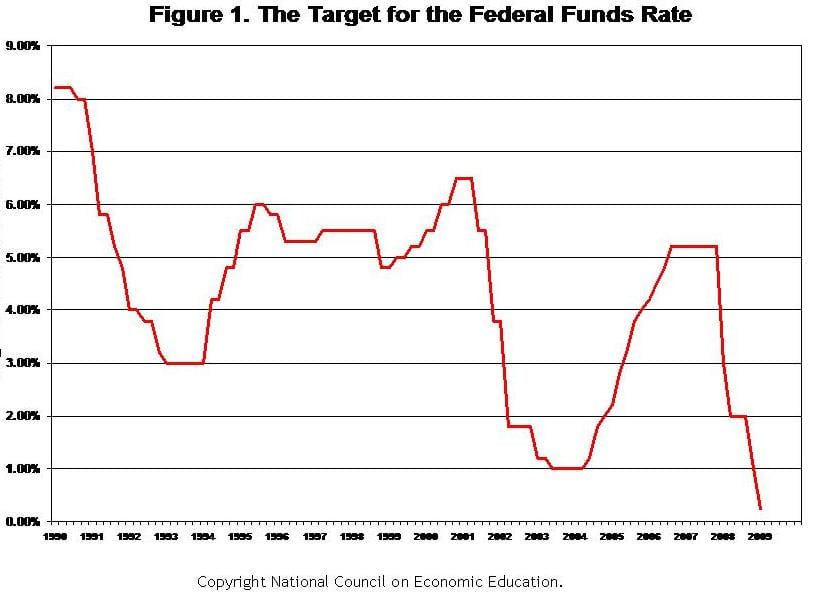

Do you remember how in the mid 1990s how the Fed kept rates at artificially low rates, eventually dropping them all the way to unprecedented levels in the midst of a market boom over stupid concerns about Y2K? Do you remember how that was a large part of what propelled us into a great tech/dot-com/telecom bubble?

Do you remember how the Fed kept rates at artificially low rates, especially starting in 2002 and on through to 2005 or so, eventually taking them to levels yet again unprecedented levels and leaving them there as the stock markets boomed and real estate went wild? Do you remember how that was a large part of what propelled us into a huge real estate and banking bubble?

Long-time readers know that I’ve been betting my time, money and reputation on the idea that we’ve been heading into the greatest bubble ever in large part because. Think about it…You know what I think I’ll be writing in five or ten years?

Most likely it’ll be something like this:

Do you remember how that the Fed kept rates at artificially low rates, especially starting in late 2008 and 2009, eventually dropping them all the way to a truly unprecedented 0% rate and then going on to create trillions in brand new quantitative easing methods, even as the stock market and commodities have been in big-time boom mode? Do you remember how that was a large part of what propelled us into the greatest asset bubble that the world had ever seen?

And then today comes news that Bernanke’s more likely to figure out ways to take the existing unprecedented easy monetary policies and make them yet even more unprecedentedly easy monetary policies. Holy cow.

These Fed idiots are forcing everybody who has any money at all to risk it in desperation for some sort of return. My parents, my old hedge fund partners and even my own money, are desperate for any kind of return on the capital. 0.4% in the money market and 0.2% in the savings account ain’t gonna cut it.

So what happens when the Fed continues to create unprecedented amounts of dollars and forces trillions of dollars of private capital into risky assets like corporate bonds and especially stocks?

You tell me.

I sure think we’re most likely headed into yet another unprecedented asset bubble.

Time to panic over the debt crisis yet?

July 25, 2011

Remember the original TARP bill? It was for less than $700 billion or so. The outcry was over the top from the public who rightly saw that the Republican/Democrat Regime and the Federal Reserve it allows to monopolize all currency and monetary actions were about to upwardly transfer unprecedented wealth to a bunch of insolvent and crooked bankers.

At the time, I was on TV, interviewing Republican and Democrat Senators and Congressman, all of who confirmed that the public was against the TARP bill by about 9 to 1. Several congressman told me that they’d never seen such a strong consensus from their constituents.

So the bill failed.

And Wall Street tanked for a day by a couple, few percent.

So the Republican/Democrat Regime added another $150 billion or so of pure pork to the TARP bailout. I’m still talking about summer 2008, when it was a Republican Administration (you know those guys who say they are “conservative” and “capitalists”) and a Democrat Congress (you know those guys who say they are “liberal” and for “level playing fields”). These same people, including Obama, McConnell, Boehner, and Reid, somehow were able to find the budget for $150 billion in pork in one day. That’s about 1/6 of a trillion dollars of bribes pork that these guys somehow were able to find in the midst of the “worst financial crisis” in history so that the bankers who backed them and who needed the $700 billion outright welfare infusion to keep from having their own businesses liquidated and purchased by a smarter, more conservative businessmen and bankers.

Guess what happened when these same guys who say we are facing a budge crisis now revoted on that expanded $800 billion TARP bill that included an extra $150 billion or so of outright pork — yup, it passed with all that targeted pork that came out of the US debt. Heck remember the special break on Medicaid for Nebraska citizens that they included as part of the great TARP bailout package that no other state’s citizens deserved apparently?

And don’t believe any of that propaganda about TARP having been paid back. The banks and the Federal Reserve have created upwards of ten trillion dollars of other welfare and bailout programs since the original TARP passed. I mean, do you guys even remember that the entire US government debt was only $8 trillion when we started the bailouts in 2008?

With all those stealth bailouts and the tanked economy it helped create, the Republican/Democrat Regime under both Bush and Obama, added six trillion dollars to the on-balance sheet debt that your children and grandkids will pay back.

Six trillion dollars in three years was added to the recognized US debt since the bailouts started, in large part to fund the trillions of dollars that the Republican/Democrat Regime has hoisted onto the banking system which then donates that money back to them for elections and propaganda to get more welfare money even as they sit up in Washington right now pretending that they’ve got to cut a two or three trillion dollars from the budget in the next ten years.

$6 trillion in recognized debt that’s been added to the US debt in the last three years. $3 trillion that they say they need to cut from social services and health care for the poor and elderly over the next ten years.

Let’s wrap up this up with what all this means to our trading.

This entire debate about the US debt ceiling is a calculated distraction and political maneuvering by the two parties who are clearly working on the same side except when they want to pretend there’s a debate over a pretend crisis. That doesn’t mean it won’t hit stocks on occasion. And if we do get into mid August with these idiot politicians continuing to debate over this debt ceiling, the markets will likely get hit for 5% or so. More likely after a few more days of posturing, these guys will suddenly figure out some timing/pricing/social services cutting compromises (don’t worry the welfare for the banks will continue unabated) and we’ll forget about this “US debt ceiling crisis” just like we did the last twenty US debt ceiling crises.

Ultimately, $14TT of debt is no joke. But we are paying record low interest rates to borrow unprecedented amounts of money to pump into our system and enable the banks to continue looting the taxpayer with 0% loans and 3% Treasuries.

Bernanke and the boys in the bubble

September 19, 2013

Remember the stock market bubble that the Federal Reserve helped drive back in the late 1990s when the cut rates out of Y2K fears? Remember the stock market bubble that we got when the Fed drove rates artificially below market rates in the mid 2000s? Imagine what 0% interest rates, relaxed accounting rules and trillions of dollars worth of mortgage backed security purchases at inflated prices dictated to the Fed by the selling banks is going to end up doing in the bubble-blowing arena.

We are partially through the bubble-blowing process. I think it could get even crazier before the reset/crash comes, as I have been saying since 2010. When will it end? Stay tuned, I’ll help you figure that out.

I would guess that there’s at least one more leg up in the Bubble-Blowing Bull Market. I would expect a couple of serious selloffs over the course of this spring and into middle summer, but I wouldn’t want to try to game them other than to own some great stocks but have plenty of cash ready to put to work buying great Revolutionary companies with a focus on technology stocks in coming months.

We don’t have to be all in or all out at any given time. Jim Cramer once gave me a book by Andrew Byer called, believe it or not, “Picking Winners: A Horseplayer’s Guide.” Cramer told me that there were a lot of lessons about how to manage risk-vs.-reward scenarios in your portfolio that you can learn from Byer’s work on horse-race handicapping.

In essence, it’s that you want to bet big when the odds are terrifically in your favor, bet smaller when the odds are just somewhat in your favor, and to walk away entirely when the odds are against you. Right now, the odds are just okay in the stock market as I don’t expect a big crash near-term but I also don’t expect stocks to bubble to new heights in the near-term either. So we bet smaller for now, but we remain in the markets overall.

I don’t plan on being as aggressively long stocks as I was in 2011 and 2012 until we’ve actually had another stock market crash. On the flipside, when I think the timing for the next major stock-market crash/financial crisis/Black Swan event to hit looks closer, I plan on having more shorts, even more cash and fewer longs on the sheets than I do right now.

Speaking of stock market crashes, financial crises and Black Swan events, let’s move to the long-term outlook for stocks and the economy. The fact is we have huge imbalances, central planning and out-of-control redistribution of wealth in the U.S. and global societies. And when I say redistribution of wealth, I mean the use of taxes and other governmental policies that are redistributing wealth upward. Imbalances, central planning and redistribution of wealth to a select few — these are not the things that long-term prosperity is built upon, and we all know it.

The reason that wealth disparity in this country has gotten to third-world levels is because every central-bank policy, almost every law passed by the Republican/Democrat Regime on a national level and many on a state and local level, every bailout — even the Obama/RomneyCare health-care system and wars themselves — are all done in the name of creating more profits for giant banks and giant corporations. Zero-percent interest rates, QE, bank bailouts … these things hurt everybody reading this because you and your children are the ones who have to pay for them. I’ll bet that the businesses that you all work for paid 30% or more in taxes last year, while Goldman, Apple and Wal-Mart paid less than one-third that effective tax rate. And that’s another example of how wealth disparities can grow from unlevel playing fields created by big government.

It’s the small town, hard-working, local communities that are truly being drained dry by these policies that take your wealth and funnel it through the government to giant banks and corporations in big cities. And every time another trillion of dollars of debt is added to the taxpayer’s balance sheet, it’s another trillion dollars of prosperity that the current generations are stealing from our children.

This is all very real, and it’s tragic, and it will cause even more hardships, death and wealth disparity unless all of us as citizens of this country and this community stop the cycle.

What will be the likely catalyst for this house of card political and economic reality we live in to come crashing down? Higher rates, I would expect. And not some measly 0.25% bump or two in overnight rates at the Fed. Rather, if and when you finally see interest rates across the board, from mortgage rates to corporate rates to long-term Treasury rates, start to rise sustainably, that will probably the time to really get cautious, as the hundreds of trillions of dollars of sovereign and corporate and bank debt around the world won’t be able to be rolled over any more.

In the meantime, enjoy the good times and slowly but surely prepare for the bad.

You can’t flood the corporate economy and force savers into risky assets like stocks for years on end and then contain the effects of those policies by cutting back on your pumping. Jawboning the end of excessive, emergency liquidity measures isn’t going to change anything, though it will likely give you a small-term market correction if and when the Fed finally ends all forms of qualitative easing.

As Joshua Brown said he learned from me as he quoted me in an article he called Things I Learned in 2009: “Cody Willard (Fox Business Network’s Happy Hour) taught me that when the Republican/Democrat Regime in power redistributes trillions of dollars from the renters and savers to the bankers, most bank stocks will go up. A lot.”

Ultimately the Fed’s recent moves are just window dressing and they have little choice but to cut rates to negative levels and/or create trillions in new QE. Yet more welfare programs for giant banks and global corporations would be a shame and waste and will at best create new asset bubbles, but probably will simply redistribute wealth.

As for investing in banks themselves? Maybe for a trade I could see it. However, in the end, I think the banking industry is so dependent upon near 0% rates and other subsidies and welfare from the government that it’s a busted model and, as a result, I don’t want to own any large bank like JP Morgan or Goldman for the long-term. See also, my comments above about how we are likely to have to reset our financial system one way or another at some point in my lifetime.

That said, always bet on growth, bet on US innovation and bet on a bright future. Those who say that today’s developed economies are post-growth and unable to grow again are shortsighted and don’t have a vision for where technology can continue to help us prosper. The borrowing of trillions of dollars from the future generations of developed economies — and therefore from all children around the world — will certainly impact their ability to thrive, but thrive they will. We will.

Let’s review our playbook. We seek to own companies with very strong balance sheets that are revolutionizing and/or outright creating their industries. We try to buy those companies cheaply/early like we did with Apple in 2003, Google on its IPO, FB near $20 after its crashed IPO, First Solar after letting it crash in the alternative energy bubble pop, and many others such as those that we can hold onto them for many years. We start small and slowly in each position, recognizing that there will be many ups and downs in each stock in the years ahead. Since we believe in these companies ability to grow as they revolutionize their industries over many years, we scale into our long positions when the stocks are getting hit and we trim them when stocks rally hard. We get aggressively long after stock markets crash and we whittle down our long exposure when markets bubble.

Long-term followers of mine know that we’ve trimmed our remaining longs and outright reduced the total number of longs in the portfolio and added shorts throughout 2015 after having been aggressively long since I’d left TV and started trading again in 2011.

All that said, I don’t think we’ve seen the last of this Bubble Blowing Bull Market even as there are more potential crash catalysts these days then there has been in years.

Setting up for the biggest stock market bubble of all time

October 23, 2013

Bubbles don’t stop blowing just because the permabears give up and turn bullish. Especially when the primary driver of this stock market bubbles in particular is the radical free money policies like QE and 0% interest rates for TBTF banks and lax enforcement of bank fraud. Think about how many trillions of dollars worth of mortgage-backed and other securities that the banks have traded to the FED for cash and which they then go buy and trade stocks with and lend to people who then go buy stocks with it. With these radical monetary policies of the 21st century, it’s not like grandma’s got any place to safely put her money and get some interest income, huh?

I think the Biggest Stock Market Bubble of All TimeTM will keep going at least into next year and perhaps start to pop in 2015. I remain invested in many of the same stocks I was highlighting for my readers back in 2010, including Google, Sandisk, and Ciena. But I’m sure not as aggressive since the bubble’s gotten bigger and the valuations gotten somewhat ridiculous already.

I plan on being as vocal and aggressive about calling the coming top of this ongoing Biggest Stock Market Bubble of All Time as I was about calling for its coming back in 2010 and 2011.