Where I Might Start Nibbling More Of Each Of Our Longs

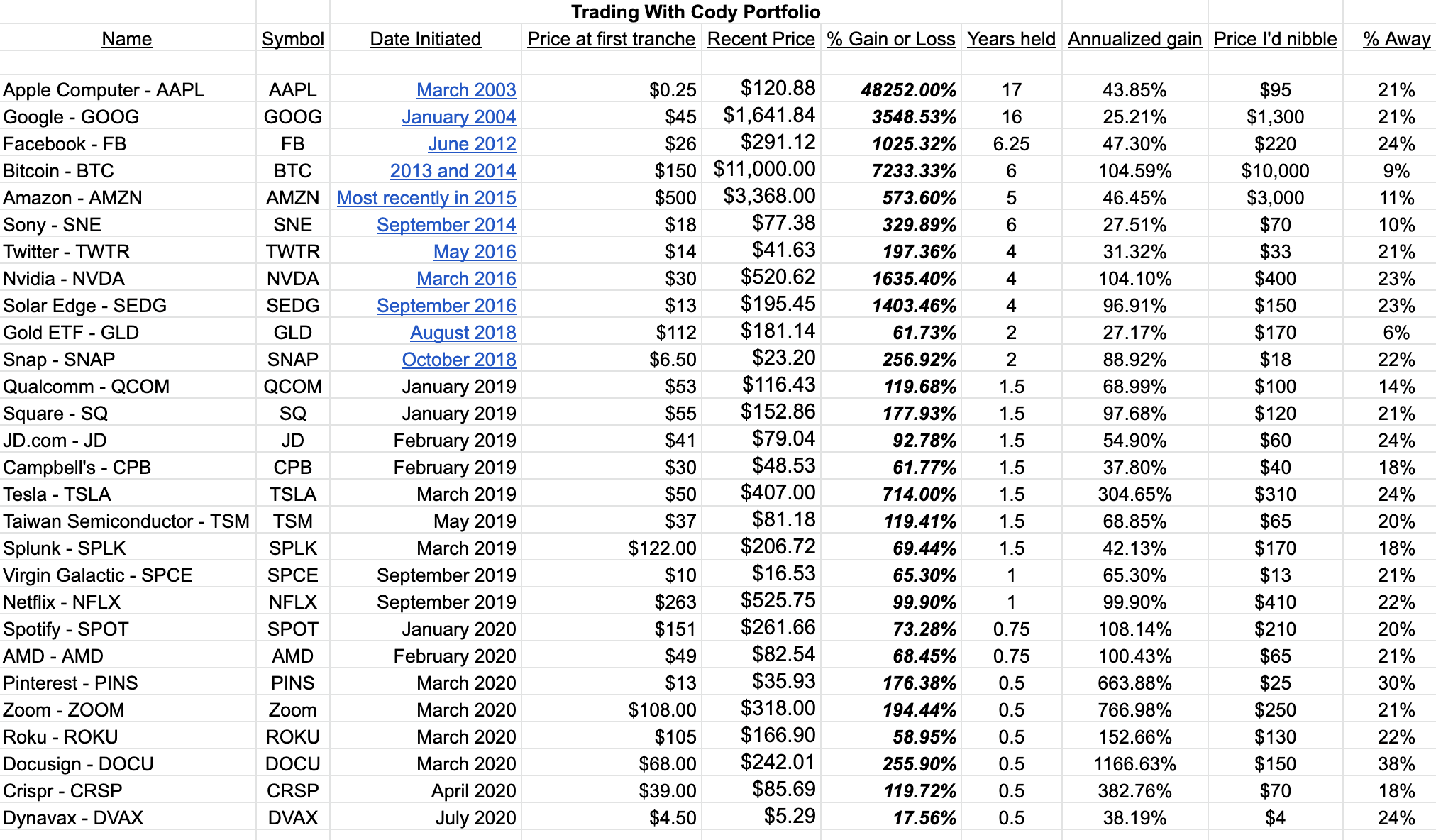

Here’s a list of most of our long positions including the dates and prices at which we started buying them and, by popular demand, the prices at which I’d consider nibbling more of each stock.

You’ll notice that most of the stock prices I’d look to nibble more at are 20-30% below current market valuations. Bitcoin, Amazon, Sony, Gold, Qualcomm are probably closest to the prices at which I might nibble more. Of courses, it’s been a helluva year of returns for us thus far, we’ve got a crazy amount of gains off off the lows in March and we don’t have a single name that’s down since we bought it. I’m okay with letting things settle down for a bit and letting valuations get more compelling before looking to get to active in buying more of our names for now.

| Trading With Cody Portfolio | ||||||||||

| Name | Symbol | Long or Short | Date Initiated | Price at first tranche | Recent Price | % Gain or Loss | Years held | Annualized gain | Price I’d nibble | % Away |

| Apple Computer – AAPL | AAPL | Long | March 2003 | $0.25 | $120.88 | 48252.00% | 17 | 43.85% | $95 | 21% |

| Google – GOOG | GOOG | Long | January 2004 | $45 | $1,641.84 | 3548.53% | 16 | 25.21% | $1,300 | 21% |

| Facebook – FB | FB | Long | June 2012 | $26 | $291.12 | 1025.32% | 6.25 | 47.30% | $220 | 24% |

| Bitcoin – BTC | BTC | Long | 2013 and 2014 | $150 | $11,000.00 | 7233.33% | 6 | 104.59% | $10,000 | 9% |

| Amazon – AMZN | AMZN | Long | Most recently in 2015 | $500 | $3,368.00 | 573.60% | 5 | 46.45% | $3,000 | 11% |

| Sony – SNE | SNE | Long | September 2014 | $18 | $77.38 | 329.89% | 6 | 27.51% | $70 | 10% |

| Twitter – TWTR | TWTR | Long | May 2016 | $14 | $41.63 | 197.36% | 4 | 31.32% | $33 | 21% |

| Nvidia – NVDA | NVDA | Long | March 2016 | $30 | $520.62 | 1635.40% | 4 | 104.10% | $400 | 23% |

| Solar Edge – SEDG | SEDG | Long | September 2016 | $13 | $195.45 | 1403.46% | 4 | 96.91% | $150 | 23% |

| Gold ETF – GLD | GLD | Long | August 2018 | $112 | $181.14 | 61.73% | 2 | 27.17% | $170 | 6% |

| Snap – SNAP | SNAP | Long | October 2018 | $6.50 | $23.20 | 256.92% | 2 | 88.92% | $18 | 22% |

| Qualcomm – QCOM | QCOM | Long | January 2019 | $53 | $116.43 | 119.68% | 1.5 | 68.99% | $100 | 14% |

| Square – SQ | SQ | Long | January 2019 | $55 | $152.86 | 177.93% | 1.5 | 97.68% | $120 | 21% |

| JD.com – JD | JD | Long | February 2019 | $41 | $79.04 | 92.78% | 1.5 | 54.90% | $60 | 24% |

| Campbell’s – CPB | CPB | Long | February 2019 | $30 | $48.53 | 61.77% | 1.5 | 37.80% | $40 | 18% |

| Tesla – TSLA | TSLA | Long | March 2019 | $50 | $407.00 | 714.00% | 1.5 | 304.65% | $310 | 24% |

| Taiwan Semiconductor – TSM | TSM | Long | May 2019 | $37 | $81.18 | 119.41% | 1.5 | 68.85% | $65 | 20% |

| Splunk – SPLK | SPLK | Long | March 2019 | $122.00 | $206.72 | 69.44% | 1.5 | 42.13% | $170 | 18% |

| Virgin Galactic – SPCE | SPCE | Long | September 2019 | $10 | $16.53 | 65.30% | 1 | 65.30% | $13 | 21% |

| Netflix – NFLX | NFLX | Long | September 2019 | $263 | $525.75 | 99.90% | 1 | 99.90% | $410 | 22% |

| Spotify – SPOT | SPOT | Long | January 2020 | $151 | $261.66 | 73.28% | 0.75 | 108.14% | $210 | 20% |

| AMD – AMD | AMD | Long | February 2020 | $49 | $82.54 | 68.45% | 0.75 | 100.43% | $65 | 21% |

| Pinterest – PINS | PINS | Long | March 2020 | $13 | $35.93 | 176.38% | 0.5 | 663.88% | $25 | 30% |

| Zoom – ZOOM | Zoom | Long | March 2020 | $108.00 | $318.00 | 194.44% | 0.5 | 766.98% | $250 | 21% |

| Roku – ROKU | ROKU | Long | March 2020 | $105 | $166.90 | 58.95% | 0.5 | 152.66% | $130 | 22% |

| Docusign – DOCU | DOCU | Long | March 2020 | $68.00 | $242.01 | 255.90% | 0.5 | 1166.63% | $150 | 38% |

| Crispr – CRSP | CRSP | Long | April 2020 | $39.00 | $85.69 | 119.72% | 0.5 | 382.76% | $70 | 18% |

| Dynavax – DVAX | DVAX | Long | July 2020 | $4.50 | $5.29 | 17.56% | 0.5 | 38.19% | $4 | 24% |

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

You can find an archive of Trade Alerts here.