Where I’d buy more of each of our stocks

We have so many positions that are up 50%, 100% or 300% or even 1000% or more, as with the Bitcoins we sold recently. And as you know, I’ve been trimming our positions, reducing the number of longs we have and fond of having a nice cash cushion right now.

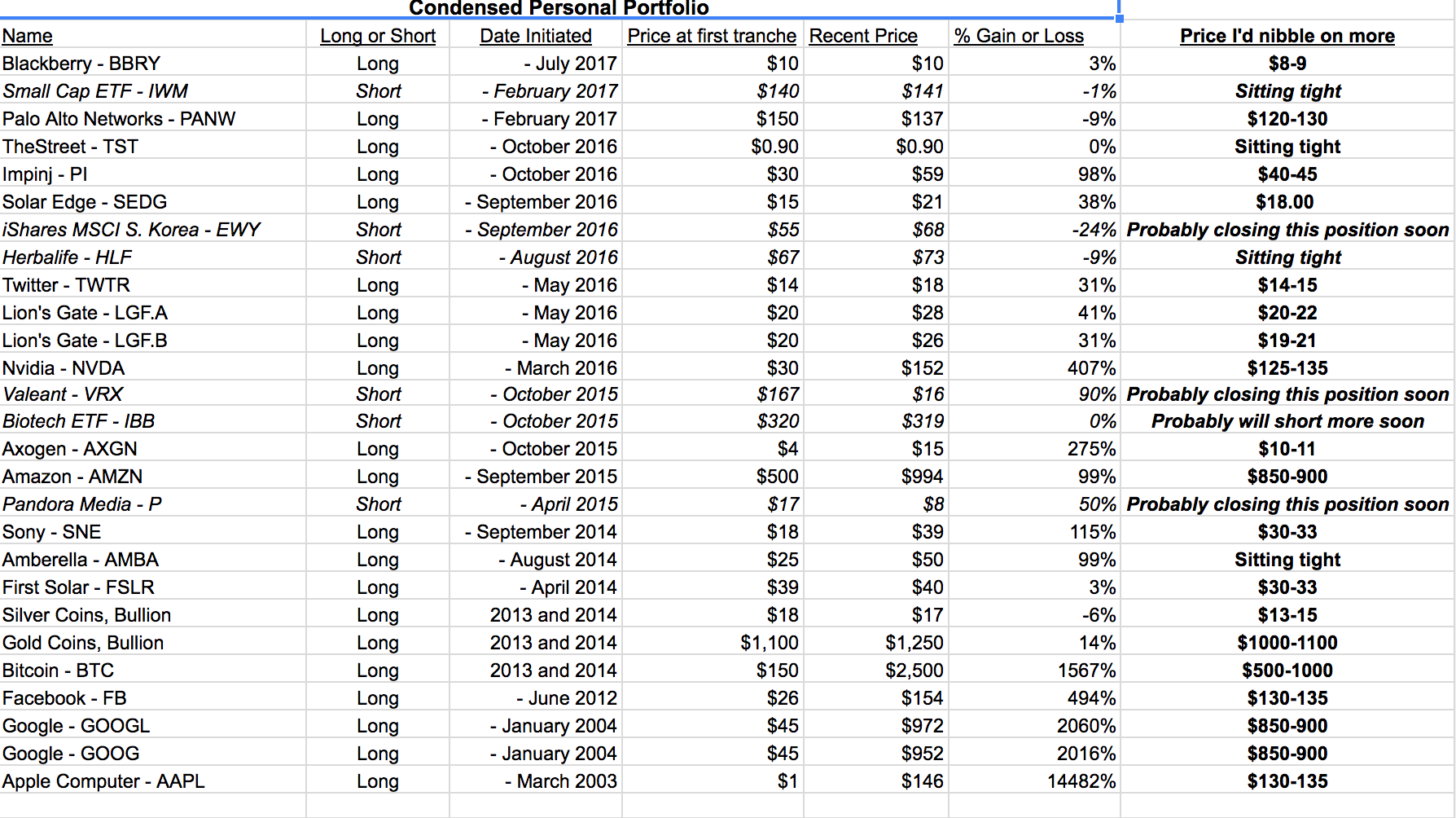

One of our members in the Trading With Cody Chat Room asked me run through our stocks and list the levels at which I might buy some of our shares back or otherwise be personally interested in nibbling on some of our longs. I’d probably do some buying if we got some major panicky selling and/or a crisis du jour that heats up in the EU or something. Here’s a look back at where I invested in most of our longs and shorts and where I’d probably look to nibble more more…

| Condensed Personal Portfolio | |||||||

| Name | Symbol | Long or Short | Date Initiated | Price at first tranche | Recent Price | % Gain or Loss | Price I’d nibble on more |

| Blackberry – BBRY | Long | – July 2017 | $10 | $10 | 3% | $8-9 | |

| Small Cap ETF – IWM | Short | – February 2017 | $140 | $141 | -1% | Sitting tight | |

| Palo Alto Networks – PANW | Long | – February 2017 | $150 | $137 | -9% | $120-130 | |

| TheStreet – TST | Long | – October 2016 | $0.90 | $0.90 | 0% | Sitting tight | |

| Impinj – PI | Long | – October 2016 | $30 | $59 | 98% | $40-45 | |

| Solar Edge – SEDG | Long | – September 2016 | $15 | $21 | 38% | $18.00 | |

| iShares MSCI S. Korea – EWY | Short | – September 2016 | $55 | $68 | -24% | Probably closing this position soon | |

| Herbalife – HLF | Short | – August 2016 | $67 | $73 | -9% | Sitting tight | |

| Twitter – TWTR | Long | – May 2016 | $14 | $18 | 31% | $14-15 | |

| Lion’s Gate – LGF.A | Long | – May 2016 | $20 | $28 | 41% | $20-22 | |

| Lion’s Gate – LGF.B | Long | – May 2016 | $20 | $26 | 31% | $19-21 | |

| Nvidia – NVDA | Long | – March 2016 | $30 | $152 | 407% | $125-135 | |

| Valeant – VRX | Short | – October 2015 | $167 | $16 | 90% | Probably closing this position soon | |

| Biotech ETF – IBB | Short | – October 2015 | $320 | $319 | 0% | Probably will short more soon | |

| Axogen – AXGN | Long | – October 2015 | $4 | $15 | 275% | $10-11 | |

| Amazon – AMZN | Long | – September 2015 | $500 | $994 | 99% | $850-900 | |

| Pandora Media – P | Short | – April 2015 | $17 | $8 | 50% | Probably closing this position soon | |

| Sony – SNE | SNE | Long | – September 2014 | $18 | $39 | 115% | $30-33 |

| Amberella – AMBA | AMBA | Long | – August 2014 | $25 | $50 | 99% | Sitting tight |

| First Solar – FSLR | Long | – April 2014 | $39 | $40 | 3% | $30-33 | |

| Silver Coins, Bullion | Long | 2013 and 2014 | $18 | $17 | -6% | $13-15 | |

| Gold Coins, Bullion | Long | 2013 and 2014 | $1,100 | $1,250 | 14% | $1000-1100 | |

| Bitcoin – BTC | Long | April 2013 | $150 | $2,500 | 1567% | $500-1000 | |

| Facebook – FB | FB | Long | – June 2012 | $26 | $154 | 494% | $130-135 |

| Google – GOOGL | GOOGL | Long | – January 2004 | $45 | $972 | 2060% | $850-900 |

| Google – GOOG | GOOG | Long | – January 2004 | $45 | $952 | 2016% | $850-900 |

| Apple Computer – AAPL | AAPL | Long | – March 2003 | $1 | $146 | 14482% | $130-135 |

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.

Scaling into a position using an approach of buying 1/3 or 1/5 tranches over time is how I build my personal portfolio positions, but there’s no scientific way to go about investing and trading. Sometimes you have to pay up for the latest tranche but I try to be patient and wait for a temporary sell-off to add to the existing position.

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 1% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

You can find an archive of Trade Alerts here.