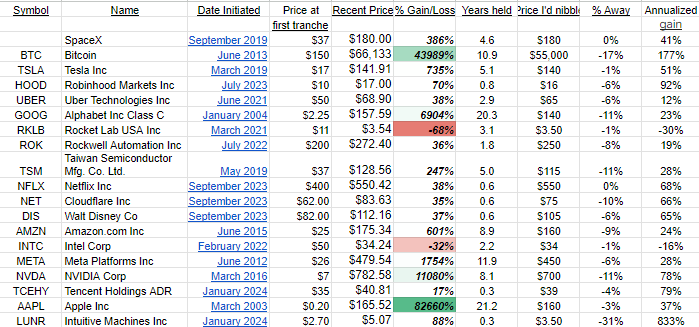

Where We’d Buy More Of Each Of Our Positions

To be clear, much of the remaining premium that is still baked into Tesla (even though it is down 43% YTD) is because of the multiple trillion dollar kickers the company has like Robotaxi/FSD, Model 2, Optimus Robot, Dojo AI, Energy Storage, etc.

Also, Cody will be doing a live Twitter Spaces with @Wolf_Financial tomorrow at 11:00 am ET to discuss the upcoming MoneyShow. If you’re going to be in the San Francisco area, be sure and register for the MoneyShow’s Investment Masters Symposium where Cody will be speaking on May 7-9th in San Francisco.

Markets got uuuuggglllyy on Friday. The Nasdaq had its worst week since 2022. We’ve been saying that the markets were a little too frothy for most of the year, and Cody turned outright bearish in March as he often noted at the time. We had been steadily building up cash and we started putting a little bit of that cash to work last week as mentioned.

Tesla continues to be painful, and to be frank, we are sick of looking at it on our screens, which usually means that is a good time to buy (as we did with another tranche today, forcing ourselves to remain unemotional). We’ll hear from Elon and the rest of the team at Tesla tomorrow on the earnings call, and there will be lots of questions about Robotaxi, the future of the Model 2, full self-driving (FSD) penetration, and demand in China, among other things. To be clear, much of the remaining premium that is still baked into Tesla (even though it is down 43% YTD) is because of the multiple trillion dollar kickers the company has like Robotaxi/FSD, Model 2, Optimus Robot, Dojo AI, Energy Storage, etc. However, these are still a ways out, and if the fundamentals for the S3XY car business keep deteriorating, we could see further downside in the stock.

| Symbol | Name | Date Initiated | Price at | Recent Price | % Gain/Loss | Years held | Years held | Price I’d nibble | % Away | Annualized |

| first tranche | gain | |||||||||

| SpaceX | September 2019 | $37 | $180.00 | 386% | 5 | 4.6 | $180 | 0% | 41% | |

| BTC | Bitcoin | June 2013 | $150 | $66,133 | 43989% | 10 | 10.9 | $55,000 | -17% | 177% |

| TSLA | Tesla Inc | March 2019 | $17 | $141.91 | 735% | 4 | 5.1 | $140 | -1% | 51% |

| HOOD | Robinhood Markets Inc | July 2023 | $10 | $17.00 | 70% | 0.5 | 0.8 | $16 | -6% | 92% |

| UBER | Uber Technologies Inc | June 2021 | $50 | $68.90 | 38% | 2 | 2.9 | $65 | -6% | 12% |

| GOOG | Alphabet Inc Class C | January 2004 | $2.25 | $157.59 | 6904% | 19 | 20.3 | $140 | -11% | 23% |

| RKLB | Rocket Lab USA Inc | March 2021 | $11 | $3.54 | -68% | 2 | 3.1 | $3.50 | -1% | -30% |

| ROK | Rockwell Automation Inc | July 2022 | $200 | $272.40 | 36% | 1 | 1.8 | $250 | -8% | 19% |

| TSM | Taiwan Semiconductor Mfg. Co. Ltd. | May 2019 | $37 | $128.56 | 247% | 4 | 5.0 | $115 | -11% | 28% |

| NFLX | Netflix Inc | September 2023 | $400 | $550.42 | 38% | 0.5 | 0.6 | $550 | 0% | 68% |

| NET | Cloudflare Inc | September 2023 | $62.00 | $83.63 | 35% | 0.1 | 0.6 | $75 | -10% | 66% |

| DIS | Walt Disney Co | September 2023 | $82.00 | $112.16 | 37% | 0.5 | 0.6 | $105 | -6% | 65% |

| AMZN | Amazon.com Inc | June 2015 | $25 | $175.34 | 601% | 8 | 8.9 | $160 | -9% | 24% |

| INTC | Intel Corp | February 2022 | $50 | $34.24 | -32% | 1.5 | 2.2 | $34 | -1% | -16% |

| META | Meta Platforms Inc | June 2012 | $26 | $479.54 | 1754% | 11 | 11.9 | $450 | -6% | 28% |

| NVDA | NVIDIA Corp | March 2016 | $7 | $782.58 | 11080% | 7 | 8.1 | $700 | -11% | 78% |

| TCEHY | Tencent Holdings ADR | January 2024 | $35 | $40.81 | 17% | 3 | 0.3 | $39 | -4% | 79% |

| AAPL | Apple Inc | March 2003 | $0.20 | $165.52 | 82660% | 20 | 21.2 | $160 | -3% | 37% |

| LUNR | Intuitive Machines Inc | January 2024 | $2.70 | $5.07 | 88% | 20 | 0.3 | $3.50 | -31% | 833% |

Here’s the same list in the form of a picture in case that’s easier for you to read. Click on the image below to magnify.