Where’s all the supposed gains from the wonders of tech?

No trades for me today. I’ve done the trades and made the investments I want to make for now. I’m pouring over my short positions and considering covering some of the current long-held shorts like IBM and replacing it with other stocks that I think might give us more downside gains without tying up our capital. I’m looking at a few new long ideas too, as the big sell-off in high-beta has piqued my interest in a few Revolution Investment names I’ve been analyzing.

WHY AREN’T WE MORE PROSPEROUS FROM ALL THIS TECH-ENABLED PRODUCTIVITY?Anybody else ever wonder if the seemingly insanely huge advances in productivity our economy has gained from apps, smartphones, tablets, PCs, Internet, etc is what has enabled the Fed to play these games much longer and has likewise enabled the Republican Democrat Regime’s debt/low-rates addiction to grow much larger than they would have been able to in other times?

Which leads to the next question – does it HAVE to be a hard landing if/when all rates go up on all that debt upon which interest has to be paid? Could this version of a 1-3% slow growth GDP economy be a self-fulfilling dynamic whereupon destructive policies will always suck out anything above that but never more than that?

As LunaticTrader further explains: Exponential efficiency gains in tech sectors may mean that we are entering a period of inevitable and growing deflation. This keeps rates near zero and leaves a growing chunk of the world’s savings to be taxed/wasted/funned to corporate earnings and stock market bubbles.

The possibility exists that a gvmt addicted to zero rates + systemic large deficits has the effect of keeping the economy locked in a situation where growth and inflation stay so weak that rates stay near zero and most savings flow into funding the deficit.

Much more debate and discussion on this string of discussion I started when I pondered this outloud on Scutify. Read it all here, as I think it’s very value-add for every investor and trader to ponder the analysis debated on this topic.

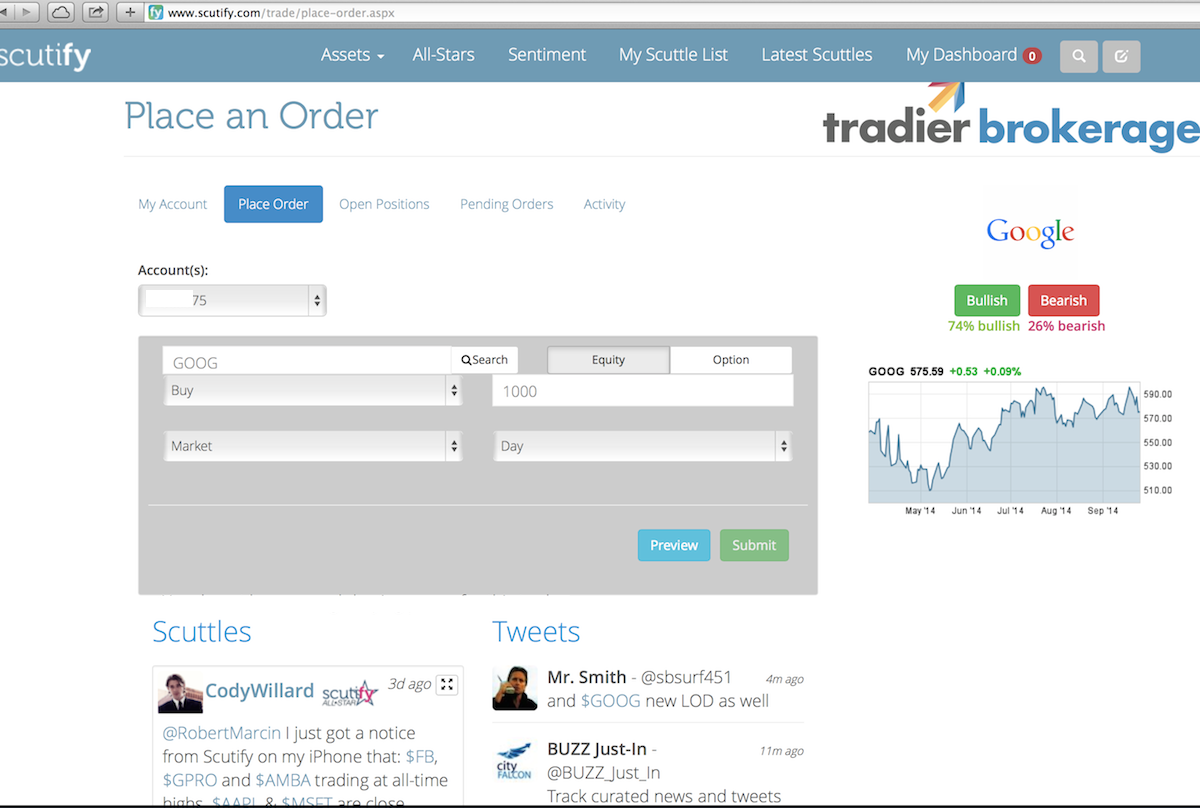

RANDOM THOUGHTSScutify is excited to announce that you can now trade stocks and options right on Scutify using our best-in-class financial resources and social network to aid you along.

I know several people including myself and my old TV co-anchor, Rebecca Diamond, who have placed trades on our new Scutify trading platform via Tradier. Have any of you guys on here reading tried it yet? You don’t ever have to leave the Scutify platform to buy or sell a stock or option. I’ve been using it today and I highly suggest you check it out, it’s pretty darn awesome. Go to http://www.scutify.com/trade.html and learn more. See pic for a sample of what it looks like when you’re logged in to place a trade.

Bill Gross leaving Pimco is pretty big news in the Wall Street world. First, thought is: Why doesn’t Bill just retire? He’s 70 years old and worth literally billions; isn’t there more to life? Second: I’m sure nobody will ever discuss it really, but I wonder if the investigation into his bond fund pricing mechanisms by the SEC made this decision easier for him.http://blogs.wsj.com/moneybeat…

Talk about a winning trade! @tomgentile: “Ok yesterday I posted I was taking the afternoon off to watch #derekjeter and that it better be worth it. Was that the understatement of the year! Thank you #Derek for the last 20 years. Couldn’t write a better ending. Ok back to work now for the rest of us.”

And finally an important link. “The downside to using margin is that if the stock price decreases, substantial losses can mount quickly. For example, let’s say the stock you bought for $50 falls to $25. If you fully paid for the stock, you’ll lose 50 percent of your money. But if you bought on margin, you’ll lose 100 percent, and you still must come up with the interest you owe on the loan.” http://go.usa.gov/WyCP