Why The Sexy 6 (And The Mag 7) Are The Most Important Stocks On The Planet

There are seven US-based companies that have been worth a trillion dollars and we have been in six of them for many years, long before they were called the “Magnificent 7” (we also had you all in bitcoin back in 2013 at $120 too!).

This is Part I of a series of articles breaking down and ranking the AI strategies of the Magnificent 7.

I often talk about how our job as “Revolution Investors” is to find companies that are changing the world and creating trillion-dollar economies as they do so before they go mainstream.

There are seven US-based companies that have been worth a trillion dollars, and we have been in six of them for many years, long before they were called the “Magnificent 7” (we also had you all in bitcoin back in 2013 at $120 too!).

Anyway, the “Magnificent 7” — Microsoft (MSFT), Apple (AAPL), NVIDIA (NVDA), Google (GOOG), Amazon (AMZN), Meta (META), and Tesla (TSLA) — are now, by far, the most important stocks on the planet.

The markets themselves are now largely a reflection of what’s going on with the Mag 7, not the economy. Of course, nothing happens in a vacuum, and the Mag 7 are affected by what’s happening in the economy, but if 2023 taught us anything, it is that the revenue and profits of the seven largest tech companies in the world matter a whole lot more than people realized.

Our biggest stock market winners over the years, which include six of the seven greats (AAPL, NVDA, META, GOOG, and TSLA), are now the biggest and most valuable companies on the planet, but they did not start out that way.

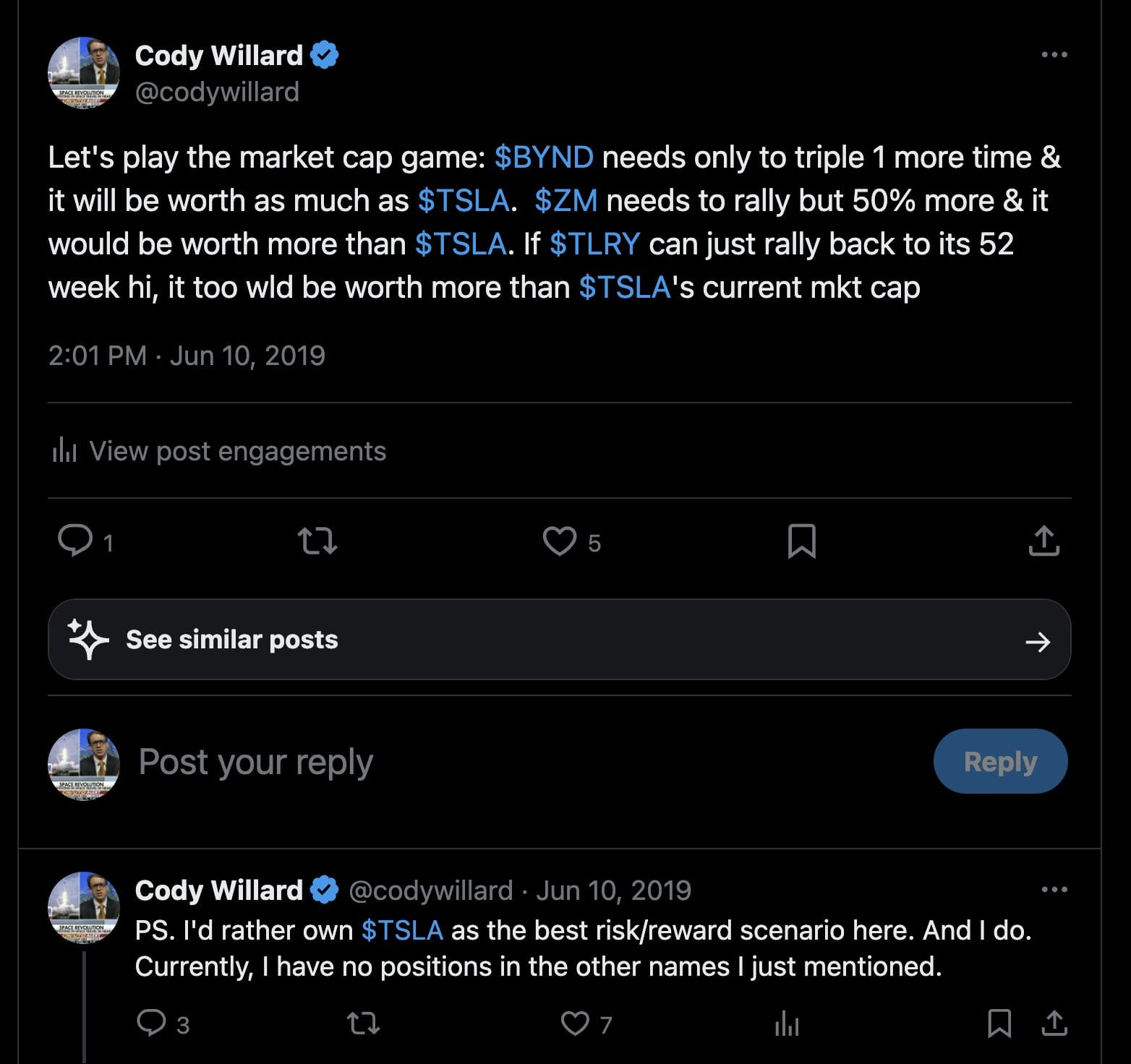

For example, when Cody bought Apple, it had a market cap of just over $1 billion. When Cody bought Tesla at a split-adjusted price of $17/share, it had a market cap of about $35 billion. Cody posted a tweet back then comparing Tesla to some of the high-flyers of the day, like Beyond Meat (BYND), Zoom (ZM), and Tilray Brands (TLRY).

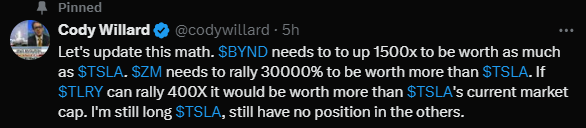

And it’s amazing to look back and see how those relative market caps have changed, as Cody showed us in the updated tweet yesterday:

The Magnificent 7 have grown in scale to absolutely dominate the rest of the American stock market.

These seven stocks make up about 50% of the weighting in the Nasdaq 100 (QQQ) and about 35% of the S&P 500 (SPY). Today, the combined market cap of the Mag 7 is $13.2 trillion, which is greater than the market cap of the entire Chinese stock market, about 2x greater than that of Japan, and about 4x that of the UK. These seven companies will generate about $2 trillion in revenue in 2024 (which is 8% of US GDP) and about $420 billion in profits.

We invested early in each of these companies (excluding Microsoft), and it is downright astonishing that they have grown to become this large.

As the Mag 7 have now become such an outsized portion of the market, it’s difficult for most investors (including us) to comprehend just how much bigger and more important they are than the rest of the market.

Although these seven companies are not currently the top seven most valuable companies on the planet right now — Saudi Aramco, Berkshire Hathaway (BRK.A), Eli Lilly (LLY), TSMC (TSM), and Broadcom (AVGO) are also in the top twelve — their collective importance matters more than the others for one key reason. Why? Because the Mag 7 are the companies that are building what perhaps will be the most important technology the world has ever seen: Artificial General Intelligence (AGI).

AI is so important because it has the potential to expand the productivity of humans by orders of magnitude. The goal of nearly every AI company is to build artificial “general” intelligence (AGI). While definitions vary, AGI simply means computers that have generalized human cognitive abilities. For example, humanoid robots and self-driving cars with AGI will be able to do a lot of the mundane, repetitive, and mundane tasks that humans don’t need to do. Moreover, AGI may one day produce full-length feature films that are better than anything coming out of Hollywood. Perhaps one day AGI will even be able to solve some of the most difficult science, physics, and math questions, discover new drugs that cure diseases, and build new advanced materials/compounds that enable all kinds new products and applications. The obvious commercial success of any of these types of endeavors is what is driving many companies to try and figure out AGI as quickly as possible.

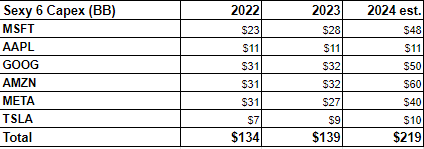

When we exclude NVIDIA (NVDA) (which sells to the other members of the Mag 7), the “Sexy 6,” as we call them, have nearly unlimited capital and are spending more money building AI than nearly all other companies on the planet combined. Collectively, Microsoft (MSFT), Google (GOOG), Amazon (AMZN), and Tesla (TSLA) will spend over $200 billion on AI-related capital expenditures (capex) in 2024. That’s a 56% increase from the $128 billion they spent in 2023. For context, that level of spending is roughly equivalent to the entire market caps of Adobe (ADBE), Disney (DIS), or McDonald’s (MCD). In fact, that $200 billion+ number of AI-related capex is more than the $137 billion that the “Bipartisan Infrastructure Bill” spends annually. And that $200 billion+ figure does not include the major investment in personnel that these companies will make attempting to hire the leading AI talent, who can essentially name their price at this point.

NVIDIA is its own beast and we will discuss it more in its own article, but its important to note at the outset that the Big Question (stated below) is not facing NVIDIA because NVIDIA it is not a consumer-facing platform for the most part. Rather, NVIDIA is the key enabler of the AI Revolution and makes money selling graphics processing units (GPUs) and other chips and software to the Sexy 6. It is already “monetizing” AI because it is selling billions of chips to the Sexy 6 at the highest gross margins in the company’s history. Other valuable chip-related companies like Broadcom and TSMC also help enable the AI Revolution, but we now know that it is truly NVIDIA, with its advanced chip design (which is still years ahead of its competitors like AMD and Intel) and software ecosystem that has enabled the most-recent leg of the AI Revolution and the “ChatGPT moment.”

So here is the big question facing the markets and the Mag 7: can the Sexy 6 actually monetize AI so that it justifies their massive investment in AI Infrastructure? If the AI Revolution is to live up to its promise, it has to actually produce something that has utility to consumers and/or businesses. If all AI is able to do is provide human-like responses in a chat, or paint pretty pictures, or tell (somewhat) funny jokes, then its usefulness to society is severely limited. At the end of the day, AI must help consumers and businesses become more efficient, creative, productive, and so on if it is to live up to its hype.

While there are thousands of companies working in AI right now, in terms of dollars and technology, only the Sexy 6 matter right now for the markets. To be clear, there are a plethora of AI startups and other publicly traded companies that are building standalone AI tools and applications and integrating AI into their existing products. However, most of these smaller companies do not have enough of their own capital to build the compute necessary to truly advance AI to something closer to AGI. These smaller companies, which will probably eventually be very successful and profitable companies to come out of the AI Revolution, are depending on the Sexy 6 to develop the capital- and talent-intensive part of the AI tech stack that will enable their apps/tools/products. We’ve seen dozens of Large Language Models built by various companies around the world but they all depend upon suppliers from the Sexy 6 companies to build and run those LLMs.

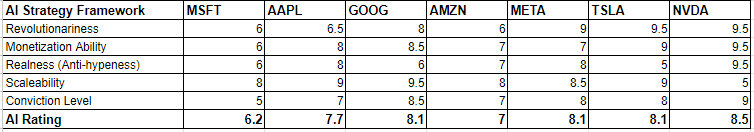

So let’s break down how each of the Sexy 6 companies are currently building and planning to implement AI, starting with Microsoft since it is currently the most valuable of the lot. We rank each company’s AI strategy on a scale of 1 to 10 and discuss our reasoning at the conclusion of the article. Here’s our ratings for the entire Mag 7:

Part 1: Microsoft (MSFT) — Innovative, but not quite Revolutionary (Plus They’re Dependent On A Third-Party Startup) (AI Ranking: 6.2/10)

Microsoft is currently the most valuable company on the planet thanks in large part to the massive gains in its stock price because of its big bet on OpenAI. OpenAI is the maker of ChatGPT, which opened the world’s eyes to the potential power of AI when it released GPT-3 in November 2022. Microsoft has reportedly invested around $13 billion in OpenAI in exchange for roughly half of the company’s future profits (as OpenAI is technically a non-profit, Microsoft does not “own” any portion of OpenAI).

Microsoft is essentially running a three-pronged AI strategy, one of which is consumer-facing and the other is enterprise-facing. First, Microsoft is building OpenAI’s products into its massive installed base of Windows devices using its product called Copilot. Copilot is essentially a ChatGPT app built right into the operating system. The free version of CoPilot is now built into all Windows devices and includes the basic chat function, image generation, etc. For $20/month, you can subscribe to Copilot Pro which gets you AI in the web version of Microsoft apps like Word, Excel, and PowerPoint. To actually get the AI-integrated apps on your computer, you have to subscribe to Copilot for Microsoft 365. This version of Copilot is supposed to be able to build whole PowerPoint presentations, analyze data in spreadsheets, and draft full documents with simple text prompts. Thus far, standalone Copilot subscriptions have not dramatically moved the needle for Microsoft, with commercial office revenue growing 13% year over year in the first quarter and consumer revenue growing only 4% year over year.

Next, Microsoft has built ChatGPT’s impressive coding abilities into Github. In case you are not familiar, GitHub is a cloud-based platform where software developers store and collaborate on their code. It’s like a shared workspace for building software projects. Microsoft acquired Github in 2018 for $7.5 billion.

Perhaps more than anything else, ChatGPT is very, very good at writing code. In fact, some early AI startups are using LLMs to build entire websites based on a simple text prompt like “make a website for my locally-owned Mexican restaurant which allows for online ordering.” ChatGPT can also write code for algorithmic trading platforms, drug development, etc. It’s not perfect, but it has dramatically increased the productivity of software engineers by allowing AI to do most of the heavy lifting, with the human simply fine-tuning and correcting bugs. GitHub Copilot is $19.25 per user per month. Nearly all of corporate America (90% of the Fortune 100) are using GitHub copilot and revenue accelerated 45% year over year in the first quarter.

Lastly, Microsoft (MSFT) is spending tons of money building AI into its cloud offering, Azure, including buying thousands of NVIDIA H100 (NVDA) chips. Big companies keep their data in the cloud and license Azure compute power to run their software, analyze data, store files, etc. Azure has been growing rapidly, and this growth has been accelerated by big companies looking to build AI into all parts of their enterprise. Just last week, Coca-Cola (KO) announced that it signed a $1.1 billion, five-year deal to use advanced AI on Azure to help improve productivity across everything from marketing to manufacturing and the company’s supply chain. 65% of the Fortune 500 are using and/or experimenting with Azure OpenAI. Microsoft’s cloud revenue grew 23% year over year to over $35 billion in the first quarter.

Overall, Microsoft has done a great job of building AI into Azure (as evidenced by the big cloud deals it has signed thus far), and a so/so job of incorporating Copilot into Windows. Further, GitHub Copilot has the potential to increase the productivity of developers by orders of magnitude, but it is still a relatively small percentage of Softy’s revenue. Moreover, Microsoft is dependent on a non-profit (OpenAI) for nearly all of its Large Language Model edge and probably wouldn’t be able to compete with Google and the other Sexy 6 if it didn’t have exclusive access to ChatGPT. Microsoft is not explicitly focused on building AGI (like Tesla and Meta) or some new product that will propel growth, and it is more focused on making its existing lineup of Office products and Cloud services incrementally better using AI. We think AI probably will continue to be a driver of revenue growth for Microsoft for the next year or so, but we somewhat doubt that Softy has the plans to really take AI to the next level that it needs to get to really be valuable to corporate America. Altogether, we give Microsoft a 6.2 out of 10 for its AI Rating.