Why we buy vs why we sell: Long and short analysis

Let’s update the analysis on two of our stocks in the portfolio. These two stocks have nothing to do with each other but the analysis underscores why we are long one of the stocks and short the other one.

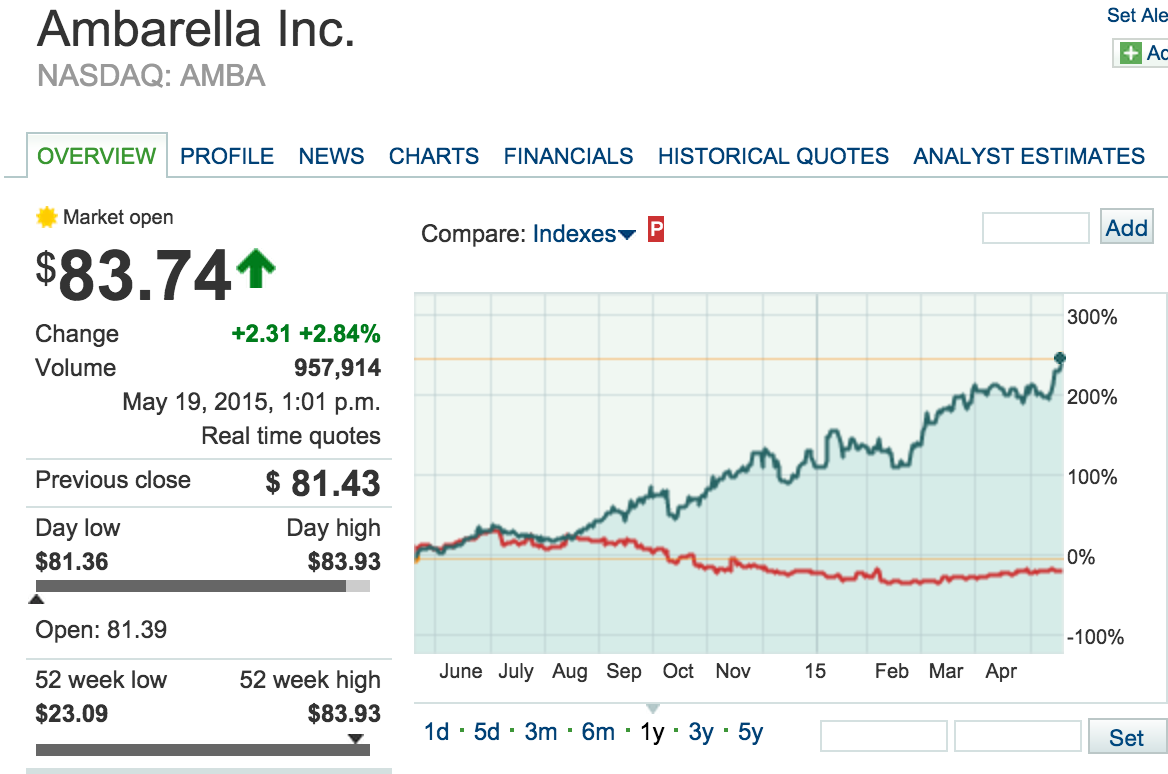

Ambarella – The stock is popping out to new all-time highs, now up about 200% from where we bought it last year. The chart is a technical analyst’s charting dream.

With Ambarella’s chipsets being sold into GoPro, its Chinese knock offs and other wearables, with Periscope and other HD streaming video apps going mainstream, with drones and robot camera demand taking off, we are talking about the HD Video Chipset business selling tens of millions of units this year to upwards of billions of units in the next five years.

Consensus analyst estimates are for this HD chipset company to grow its topline 30% to nearly $300 million this year with $2.25 or so in earnings per share. With the stock trading at a $2.6 billion valuation, we’re looking at rather expensive price-to-sales ratio of 8 and a P/E of 35. The flipside is that AMBA could triple sales in the next five years to more than a $1 billion per year which would likely kick off more than $8 per share in earnings.

I think such growth and earnings power would likely make this a $150-200 stock, which would still give Ambarella a market cap measured in single digit billions. Could Ambarella be a $10 billion market cap company in the next ten years? I would sell it right now if I didn’t think it had the ability to triple or more from here.

Pandora – The company just lost yet another court battle over how much (how little) they pay in royalties compared to how much the average radio station pays. Pandora has lost the ability to drive valuable partnerships like it did when it got the Pandora radio service apps onto most new cars sold in the country over the last couple or so years. The Android and iOS car dashboards are coming down the pike in the next year or two and Pandora’s place on the dashboard will diminish and take down its subscriber base with it. I still think this P is a single digit stock in the next couple years. Let’s use the same metrics as in our above Ambarella analysis for Pandora’s financials, valuation and fundamentals.

Pandora’s lost any “de facto standard” status as a streaming music standard it might have once had as Spotify and its model of letting users find, listen to, and download any song has destroyed Pandora’s old paradigm of radio algorithms frustrating and controlling the service’s users. Is there any growth for this company ahead? Where? Apple’s Beats, Amazon Prime and Google’s Music Play services have a better chance of competing against Spotify. Where does Pandora fit in when it loses its prime spot in the car dashboard?

Consensus analyst estimates are for this Internet and app radio company to grow its topline 30% to nearly $1.2 billion this year but those revenues will result in less than 20 cents earnings per share. With the stock trading at a $3.8 billion valuation, we’re looking at somewhat expensive price-to-sales ratio of 3 with a outrageously expensive P/E of 90. Pandora could more than double sales in the next five years to more than a $3 billion per year but that would likely kick off only a $1 or maybe upwards of $2 per share in earnings.

The Pandora business model’s inherent low margins coupled with a strong topline growth would likely make this a $20-25 stock, which would still give Pandora just a little bit bigger market cap than it has right now. Could Pandora be a $10 billion market cap company in the next ten years? I highly doubt that the company can deliver the 25% compound annual growth rate it would take to get its sales to $3 billion, much less $5 billion or more which is probably what it would take to make this a $10 billion company.Here’s the two stock charts compared against each other in one chart:

You can see we’ve been right to be long one and short the other over the last year or so. With the above analysis, you can see why I remain steady-as-she-goes with each of these positions going forward too.

PS. We’ve finally rolled out our first Trading With Cody app for Android, available right now in the Google Play Store. We’ll have the iOS TradingWithCody app released in the next week or two, so you iPhone/iPad users stay tuned for that. Click here to download the new TradingWithCody Android App.