Why you shouldn’t panic (yet)

Over the weekend, a Trading With Cody subscriber posted this in the Trading With Cody Chat Room:

“Cody, I’m feeling slightly panicked. After becoming TWC subscriber, I learned to ignore the noise outside about correction or big risk. But as you have started mentioning about corporate debt risk, I feel the need to rush out of positions soon (within next few months).”

Let’s not panic here and let’s talk about the set up.

First off, if you’re feeling panicky at all, I think you might have too much long exposure. There’s always a chance the markets get hit and we need to be prepared for that possibility at any time, but we perhaps a bit more prepared right now more than we were in say 2011. If you’re reading this and have been feeling panicky at the end of last week after the DJIA was down 600 points on Thursday and Friday, maybe you should consider trimming down some/most of your positions 10-20% to put your mind at ease.

As for the stock markets, well, stocks are up a little bit today. I wouldn’t be surprised that we get those 600 points back by the end of the year, over the next six or seven trading days. But more to the point, it’s not the technology sector that’s going to feel the brunt of the corporate debt bubble popping and it’s not necessarily about to pop outside of energy anytime soon.

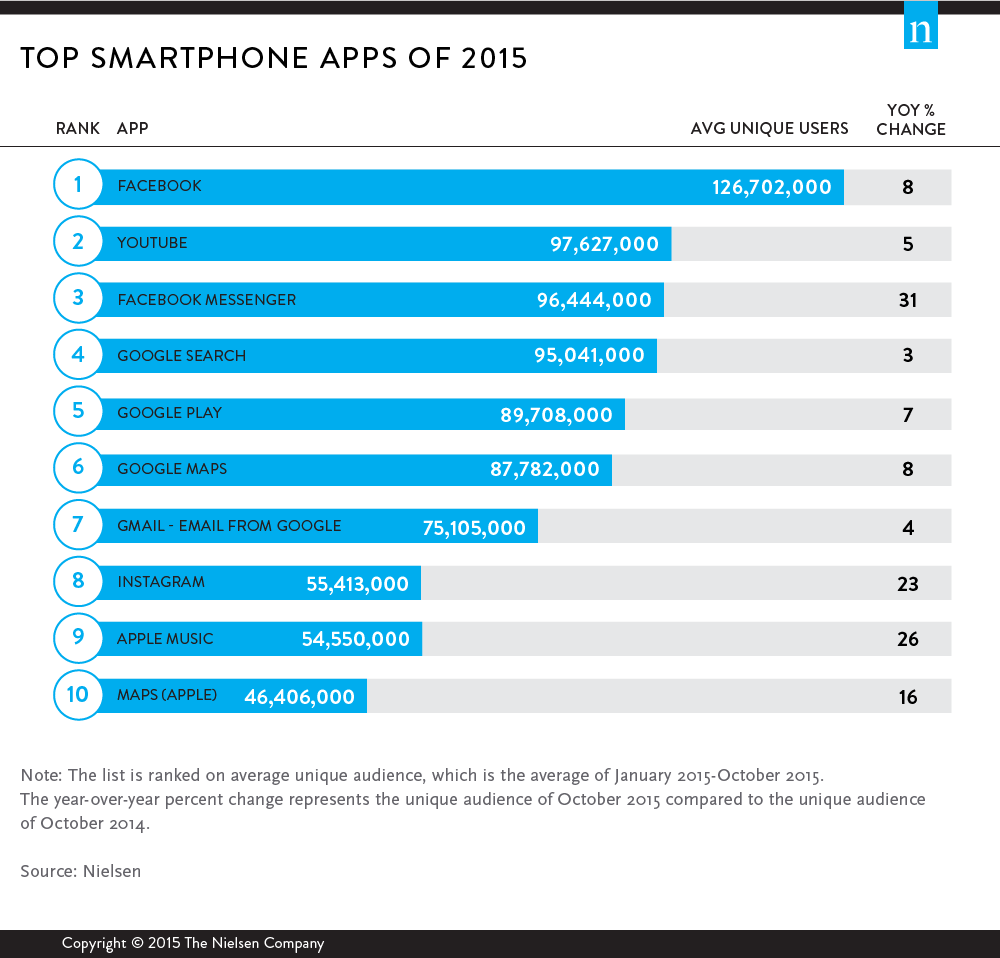

Think about it this way – it’s not a coincidence that my largest three positions for the last five years make up the three companies that dominate the Top 10 Most Installed Apps in the world and that all three have tens of billions of net cash on their balance sheets and that all of our stocks have strong balance sheets with lots of net cash.

So it time to sell because the Great Corporate Debt Bubble has started popping in 2015? Maybe, but I don’t think the ending of the App Bubble with the popping of the Great Tech Bubble of 2000 or the more recent stock market crash and financial crisis on 2008-2009.

For one, the Fed cut rates from 2000-2002 as tech stocks crashed and the Fed’s now going through the early stages of a rising rates cycle. For the last couple decades, despite the old saw of “Don’t Fight the Fed”, stocks have continued to bubble up during rate hike cycles and to crash as the Fed chases the stock market lower with rate cuts.

Go back to the App Revolution stocks we’ve owned and continue to focus on. More than a billion smartphones are sold every year and by the end of 2016, more than a quarter of the world’s population will be on a smartphone up from just a hundred million back in 2009. Trillions of apps are used hundreds of trillions of times per day right now. And there’s still a few billion more people to get online in the next five years. And there’s still all kinds of innovation in the smartphone/tablets/wearables and the other form-factors that are going to drive the App Revolution through its next cycle.

Some stocks in the app sector have and will continue to crash, but there’s not nearly as many wacky app stocks that came public and are now collapsing. You’ve got a few Yelps and Twitters, and even those companies are much better positioned to create long-term value for shareholders than say a Pets.com and Webvan were back in 2000.

It’s still quite early in the value creation that the biggest App Revolution stocks will have. That doesn’t mean they won’t go down ever again or that they’ll head straight up forever. But it does mean we want to continue to invest in the most Revolutionary Stocks we can find, including Apple, Google, Facebook, Amazon and Netflix, all of which I still own a core position in and plan to for many years to come.

Meanwhile, stop me if you’ve heard this before —

The oil and broader energy complex remains in crash mode. Oil’s down nearly 70% in the last two years and many energy stocks are down much more than that. How many money managers, pundits and analysts have tried to call the bottom? How many more bankruptcies will have to hit the sector before supply finally gets curtailed? Why would we want to try to game it with our hard-earned capital? One of the few energy stocks that has had a good last year is First Solar, and that’s the one we own and are still sticking with.

We don’t have to be all in long or all out short at any given time. Let’s be careful out there, but let’s be vigilant and contrarian too. Let’s focus on great stocks and taking advantage of the euphoria and panic that the stock markets always go through over time. Rock on.

No trades for me today and I’ll have a “Latest Positions” run-through with updated analysis and Revolution Investing Ratings for each of our positions coming out later today or tomorrow.