Wild Market Moves Underscore Why We Trust The Playbook And Long-Term Analysis

Here’s something I started writing at the near-term bottom that the markets put in on Friday when I was working instead of even pretending to be on staycation as was the plan for last week. When the markets crashed on Wednesday, I basically called off my break although I did sneak in a round of golf on Thursday. As you read this below, realize that the markets are up about 3-5% since Friday at 2pm ET when I was writing these two paragraphs:

“The markets are now fully in bear market territory, as even the S&P 500 is now down 20% on the year. Most hedge funds — even most of the giant hedge funds with decades-long outperformance — and tech-centric mutual funds are down 50%, 70% or more year-to-date. While we are clearly outperforming those kind of dreadful numbers because we have been been positioned defensively and preaching caution, I’m terribly disappointed in myself for not having done better and avoided even any relatively small-ish drawdown even in this historically ugly market action this year.

On the other hand, it is sell-offs like these that give us the opportunities to find stocks that can go up 10x, 100x or more — and to buy them with a much larger margin of safety as valuations are finally getting reasonable here. I am preparing to start being a bit more aggressive about buying some names in the portfolio already along with adding several new names as the opportunities arise. That is, it’s looking like we will have the opportunity to really move back towards the long side in several different Revolutionary sectors for a big move higher into year end and on into the future cycles here after this crash-like action cycles itself out. My fund’s largest positions at the time of this writing include FB, Intel, Paypal, Tesla (I’ve had our TSLA quite hedged and am now slowly opening up some more long side exposure on TSLA once again) and Uber. And we continue to short some of the fundamentally broken businesses that remain, even now, at what are likely insane valuations. Perhaps the question now is whether or not the markets are going to overshoot to the downside. After all, markets moves in either direction usually last longer and go further than most anybody’s expects.

So the idea here, as usual, is to stick with the playbook and do some nibbling during panicky-sell-offs like this but be slow and steady. To trust the long term analysis…”

What a move since I wrote that and thought I was in the middle of a handholding piece as the markets were panicking themselves out. Then suddenly, I looked up and the markets took off on Friday. And then I thought maybe I’d use that today if the markets were tanking again and I could finish writing up a handholding piece for your dear subscribers.

As I’ve said all along, we should try to nibble some of our favorites when the markets get really ugly and we can clean up the portfolio along the way too. I did a little bit of that last week in the hedge fund in the usual suspects, including those aforementioned stocks above but I am not drawing any lines in the sand. We don’t have to catch the exact bottom although I do expect that if the markets put in another big whoosh down or two, I will indeed start getting more aggressive and looking for a potential bottom. As for my personal account, I’ve been holding onto the cash we raised all last year and into this year and am going to start deploying a little bit of it if we get another whoosh down or two soon. In hedge fund, I tend to short and nibble puts when the markets put on big rallies. I’m doing a little bit of that as the markets have moved to their day’s highs here as I write on Monday at 10:46pm MT.

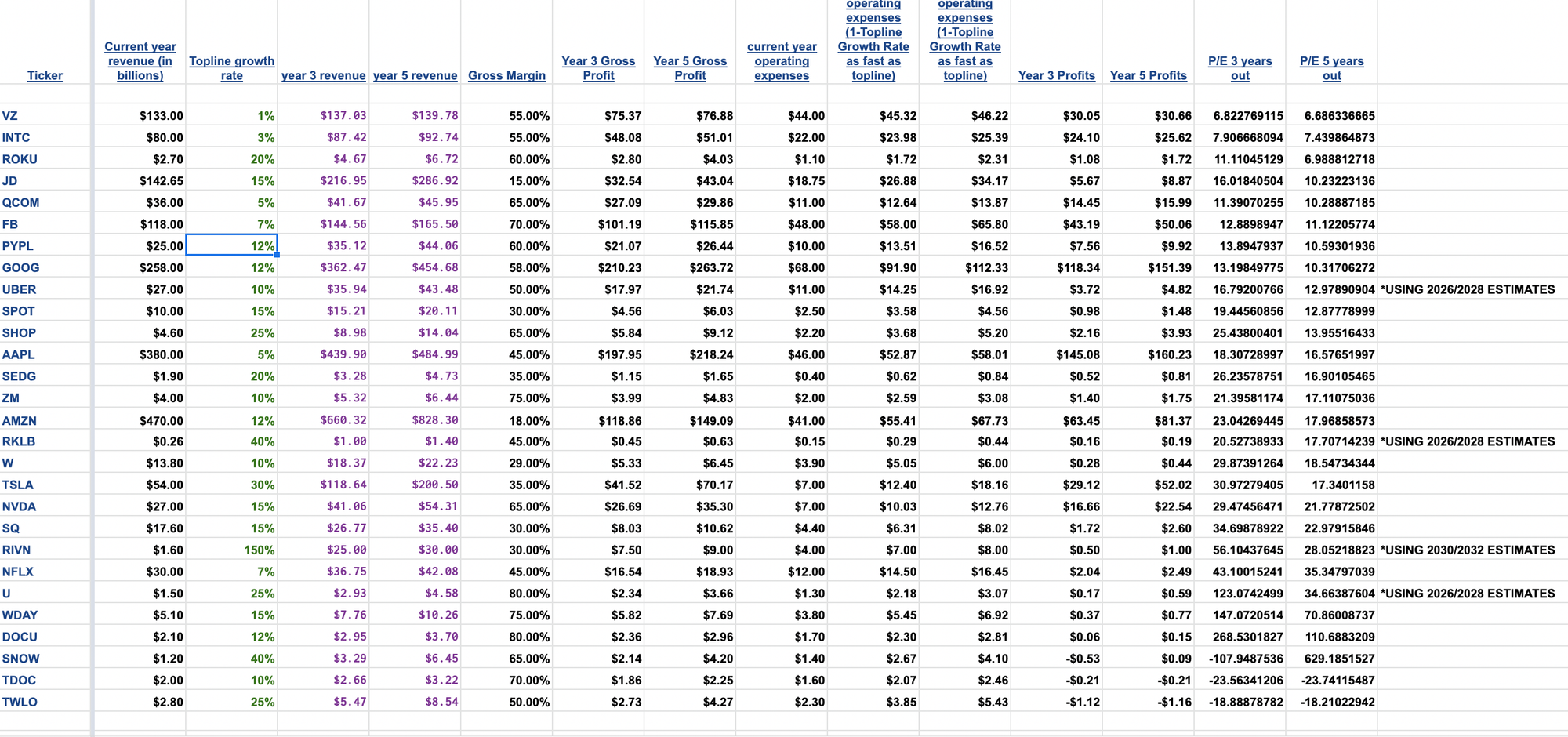

So let’s step back and look at valuations again and see what we learn. Here’s the list I published for you guys back on April 28, about four weeks ago:

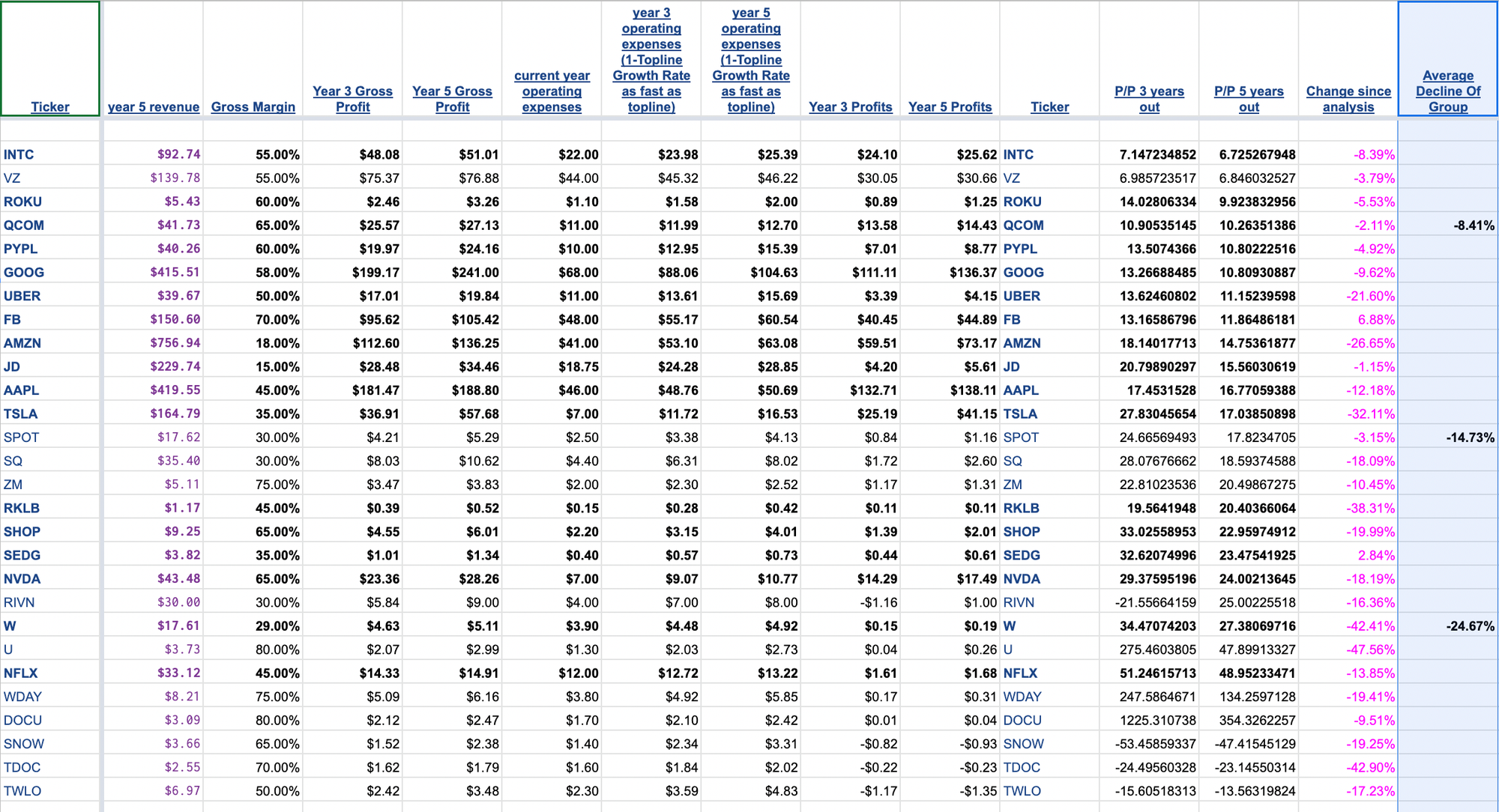

Here is the list sorted by the change in the respective stock prices since April 28, and you’ll notice I broke the list into thirds and averaged out the performance of each group. I went through and took another 3-10% off the topline growth of each of the companies to account for a potential recession and to just be even more conservative with my numbers. Clearly the stocks that had the lowest valuations looking out at profits five years from now have outperformed those that are more expensive. The group with the wildest valuations have lost 25% of their value since April 28:

This has been a no BS market and even as they’ve also been sold off by single digits in this market that formally marked its bear market status of a 20% decline most of which came in the last four weeks — it’s only stocks with reasonable valuations that have real earnings and cash flows and profits that have had much margin of safety. Which is how the markets are sort of supposed to work over the long run, right?

The reason I keep my longs and keep scaling into more of them slowly here is because I trust my long-term analysis and stock picking and Revolution spotting. And as I always like to ask in times like these when the markets have been horrible and war is in the headlines and inflation is worrisome and everything looks bad:

What if things work out? Things usually do work out for the US!

On that note, have you noticed that Treasuries are back to being a risk-off trade, meaning that the Treasury prices now go down when the tech stocks go up and vice versa, which is opposite of what it was doing for the last few months as tech stocks would tend to tank whenever rates would go up (remember that rates move in the opposite direction of the Treasury price). If rates can stabilize and/or even head a bit lower here for the next few months, it could help the US avoid the kind of horrible outcomes that are currently trying to be priced in.

Remember again — we don’t have to catch the exact bottom. We can find individual stocks that go up 10x or 100x without nailing the exact bottom. Of course, I love it when we do like we have several times over the years, but we’ve also made big money over the years by being patient while markets bottom too.

We can scale in on weakness in our favorite names, slowly scale into a few new names in Revolutionary sectors. Including, yes, The Space Revolution, The AI Revolution and The Biotech Revolution (notice that I didn’t include EVs, Cloud, Apps, and other Revolutions that we got ourselves in front of years ago and that are now probably still a bit crowded with the Wannabe Revolution Investors). We’ll need to make sure each stock looks compelling valuation-wise and not just buy because it’s in a great sector.

But that’s what I do all day every day. Search for those opportunities and figure out how to get our buckets in front of those trillion dollar trends as safely as possible over the next ten thousand days or so.

This has been a terribly hard market to navigate, but we have tried to prepare for this action and now that it’s already here, let’s use the sell-offs to nibble as we have been but don’t go crazy on the long side. Steady as she goes. I leave you with this — keep your hands on the wheel like Macaroni does when he rides around our ranch with me in my old truck: