LAST CHANCE TO SAVE 40% ON YOUR TRADINGWITHCODY.COM SUBSCRIPTION!

You know the service and the results we help you get for your portfolio and all the other features of TradingWithCody. For a limited time, you can take advantage of our Holiday Special and get TradingWithCody for up to 40% off.

That’s right! For a limited time you can buy an annual subscription to TradingWithCody for only $700! If you’d like to change your subscription from monthly to annual in order to take advantage of the Holiday Special offer, simply sign up for the annual subscription below and we’ll take care of the rest.

Email us at support@tradingwithcody.com or call us at (646) 397-7244 or visit Tradingwithcody.com/subscriber-holiday-special/ to take advantage of the Holiday Special before it ends.

I’ll send out My Latest Positions on Monday after I write it up over the weekend. I’m also going to put together some notes on each of our positions and will publish and send you all of those notes out over the course of the next week.

Meanwhile, here’s your Investor’s Deep Thought of the Day: Fundamentals really do matter over even just a few quarters and certainly as measured over years.

Remember these articles from me?

August 20, 2010 RIMM Is Dead; now what? – The Cody Word – MarketWatch

Apr 29, 2011 RIMM is truly dead – The Cody Word – MarketWatch

Nov 2, 2011 When a RIMM long says RIMM is doomed and other must-reads …

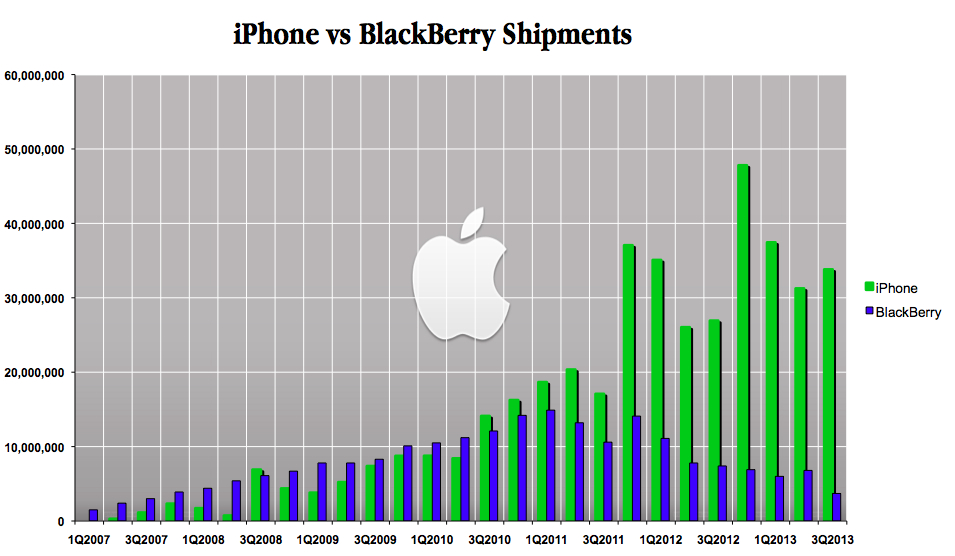

Did you know that RIMM’s sales have collapsed more than 90% since I called RIMM is Doomed the first time? And the stock is down 90% plus too since we first shorted it back above $100. (We covered a long time ago, way too soon.)

Here’s a summary of their quarterly report from mid 2011:

Research In Motion (RIMM) Reports Year-End Q4 2011 Big Short After Hours Trading Video Reports Q4 (Feb) earnings of $1.78 per share, $0.02 better than the Thomson Reuters consensus of $1.76; revenues rose 36.2% year/year to $5.56 bln vs the $5.64 bln consensus. RIMM reports Q4 gross margins of 44.2% vs 43.5% consensus; guidance was for GM to ‘be similar to Q3’ which was 43.6%. Reports Q4 shipments of 14.9 mln units vs. the 14.5-15.0 mln unit guidance… Co issues downside guidance for Q1, sees EPS of $1.47-1.55 vs. $1.65 Thomson Reuters consensus; sees Q1 revs of $5.2-5.6 bln vs. $5.64 bln Thomson Reuters consensus. Gross margin percentage for the first quarter is expected to be approximately 41.5%, vs. 42.7% consensus… Co issues upside guidance for FY12, sees EPS of $7.50- vs. $6.81 Thomson Reuters consensus.

Meanwhile, here’s an article from 2009 about Apple’s iPhone prospects and supposedly why “it’s a long way down from $200″:

…In October, 2009, Apple (Nasdaq:AAPL) delivered record fourth-quarter earnings, generating $1.67 billion in net income on revenues of $9.87 billion. These numbers are a big reason why its stock is trading at 31.8-times earnings and five-times sales. But are they warranted? Investors need to ask themselves whether the good news is enough to merit these lofty valuations. Anyone considering Apple stock should recognize there are a number of significant obstacles to it achieving projected iPhone unit sales. If it doesn’t meet the numbers above and its other products stumble, it’s a long way down from $200.

You guys know I’ve been long Apple for a decade plus now and that there was no bigger bull than me about the iPhone even back in 2004 and 2005 before it existed when I used to predict that Apple would someday sell a phone version of a “iMini MacBook Pro for Your Pocket”.

Here’s a chart of iPhone sales vs. Blackberry sales over the last six years. Note the divergence that starts back in 2010.

And a look at their stock prices over the same time frame:

Avoiding the BBRY’s and finding the AAPL’s of the world is in large part how we’ve had so much success over our career. Much more to come next year.

Bob & Doug McKenzie – Twist-off Tops

Also, a tip on how to help the economy by putting more alcohol in American beer

Follow us on social media: